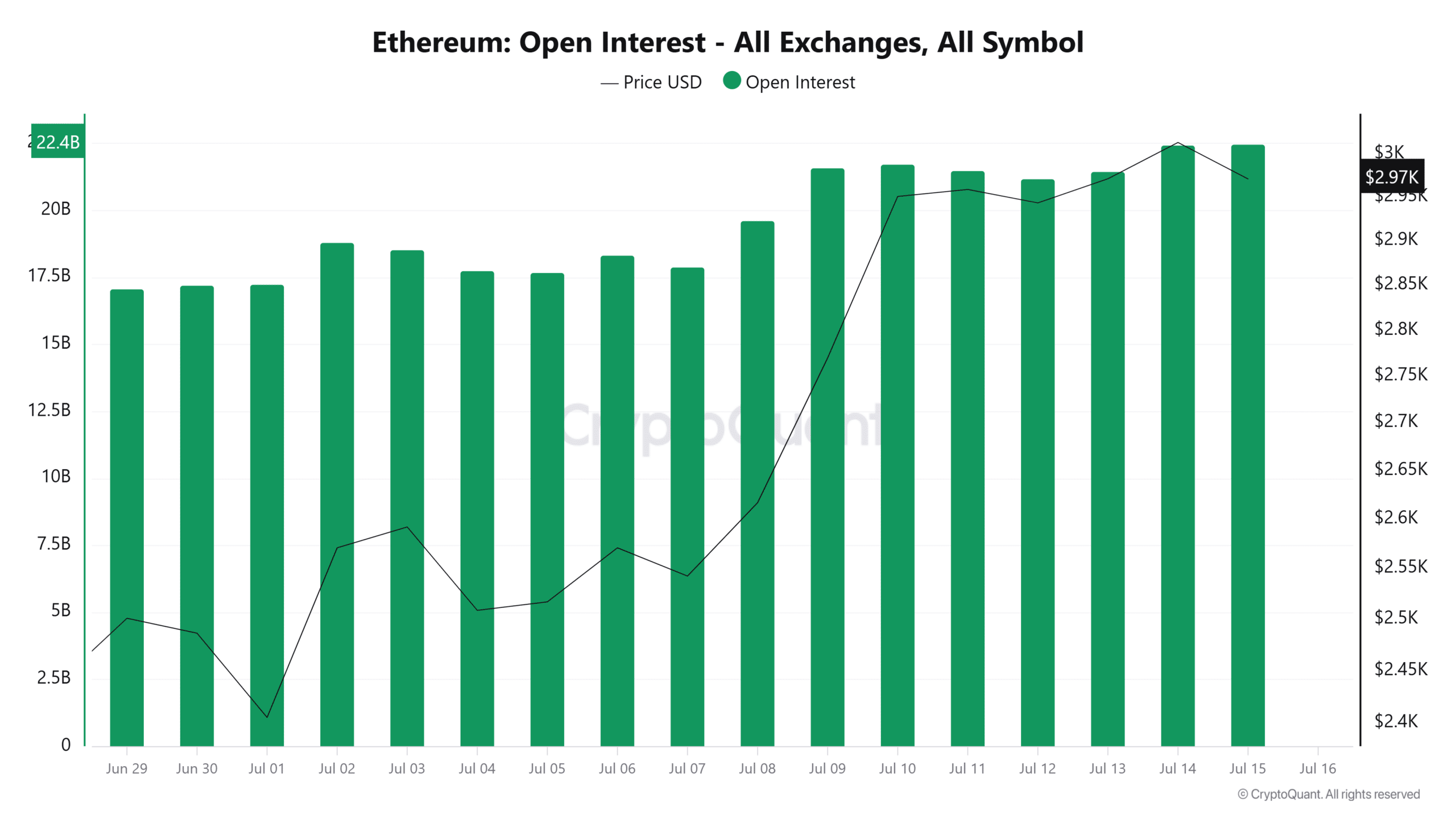

Typically, you’d expect a deeper flush in Open Interest (OI) after that kind of leverage reset. But interestingly, OI has barely budged, down just 0.55% from its record $43.94 billion the day before.

Zoom out a bit, and the setup feels familiar.

Back then, Ethereum’s OI held steady through a tight consolidation zone between $2,640 and $2,450. The result? A breakout rally that pushed ETH up 20% in under two weeks, alongside a fresh OI peak.

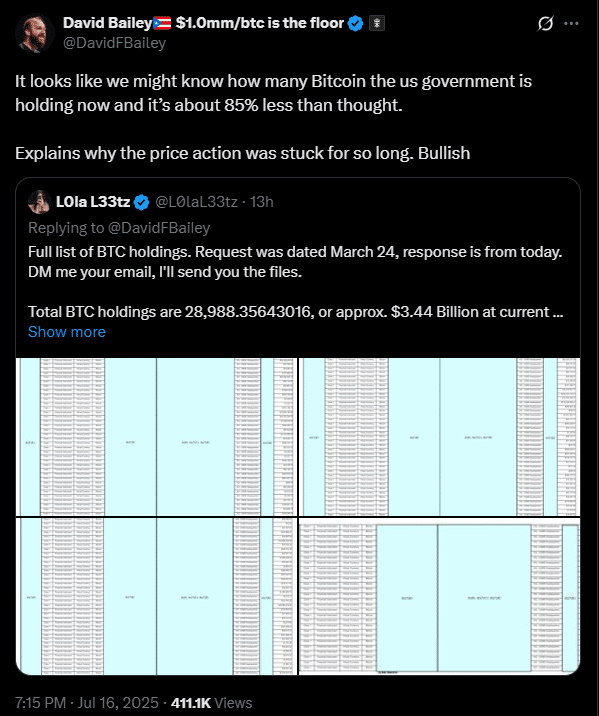

Now, throw in another $260 million into spot ETH ETFs, bringing the total to nearly $1.1 billion over just four trading days, marking the strongest run since their launch last July.

Post Comment