Why Ethereum’s Next Big Move Could Catch Investors Completely Off Guard—Don’t Miss This Rally Signal

Ever wondered why Ethereum’s shining star took a little stumble recently? Well, it turns out that partial profit-taking and some serious selling pressure from Binance caused ETH to shed about 4% in just a day. It’s like a seasoned athlete catching its breath mid-race—but here’s the kicker: this dip might just be the setup for a breakout. Picture this: if Ethereum manages to scoop up liquidity nestled between $3,600 and $3,800, it could well eye a sprint past the $4,000 mark, possibly soaring all the way to $4,800. Intrigued by what’s behind the scenes—whales cashing in, strategic moves by major exchanges, and those elusive liquidity clusters that dictate market moves? Stick with me—there’s more to unpack about whether this downturn is just a pit stop before the next big leap. LEARN MORE

Key Takeaways

What’s influencing ETH’s current downturn?

Partial profit-taking and Binance’s selling pressure caused Ethereum’s 4% decline on the day.

Will the price of ETH reverse?

Upon taking liquidity between $3,600 and $3,800, the price of Ethereum could target the clusters above $4,000, extending to $4,800.

Ethereum [ETH] declined by about 4% in the past 24 hours as some whales partially took profits. However, the altcoin was still trading around a key zone that could lead to a bounce back into bullish action.

These partial profits led to declining prices.

Whale take partial profits

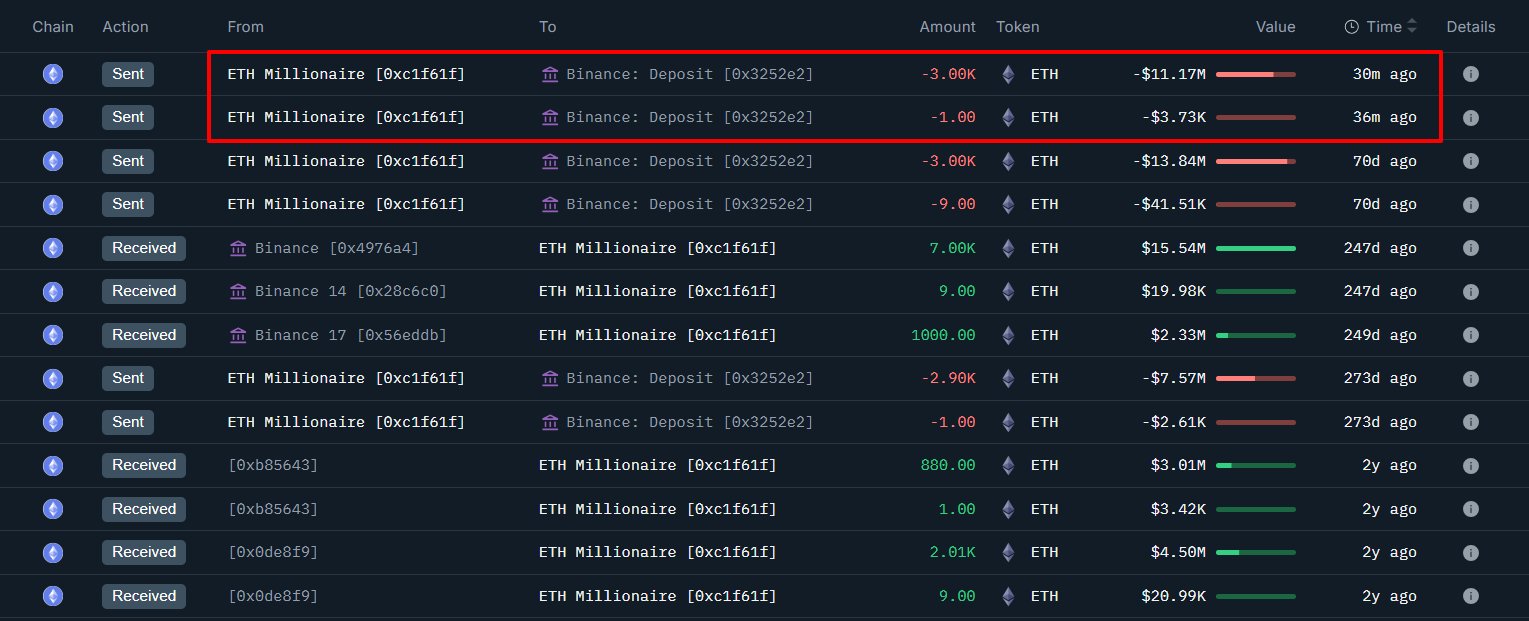

Per OnChain Lens data, a whale pocketed about $14.76 million in gains after selling 3,000 ETH on Binance. The whale had earlier bought 8,009 ETH for $18.25 million about two and a half months ago.

This trader, referred to as “ETH Millionaire,” still held about 2,002 tokens, indicating confidence in further price appreciation.

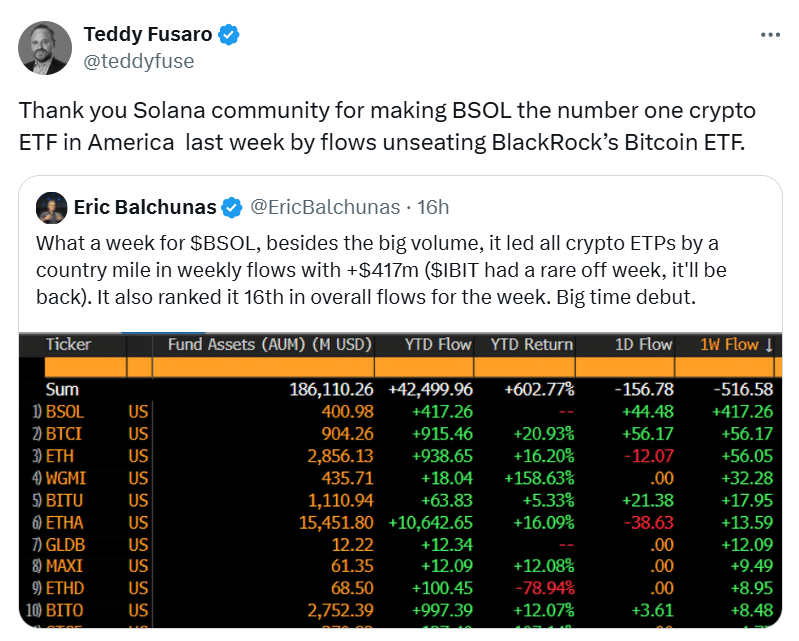

Moreover, Binance was moving ETH and Bitcoin [BTC] from its hot wallet. On average, between $1.50 million and $1.80 million worth of ETH was moved to Wintermute.

The biggest ETH position moved by Binance was worth $6.11 million, transferred to Bitget’s deposit address.

However, the analysis of liquidity and the behavior of investors indicated that the selling pressure may change.

Impact of liquidity clusters on Ethereum

On the charts, most of ETH liquidity was stacked to the upside after most of the longs below $3,800 were wiped out.

However, there was still liquidity between $3,600 and $3,800, which needed to be swept to ignite a reversal.

The liquidity just above $3,600 suggested a move to the downside could happen first. This would scare away weak hands, a common practice before price rallies.

Consequently, ETH price could rise toward levels above $3,900, with the uppermost level in this short-term outlook at $4,800.

On the other hand, the dynamic nature of these liquidity clusters could continue forming below $3,800. This would lead to price extending its stay between the $3,600 and $3,800 price levels.

Fear and greed in balance

In the meantime, Ethereum’s MVRV was at 1.5, suggesting traders were in profit as the price stayed above the realized value of $2,560. The price of ETH has been consolidating between $2,560 and $5,760 levels.

As price stagnates between these two levels, it depicts balance between fear and greed. This is the silence that precedes price rallies, as ETH had been filled with the latter behavior when the altcoin season was in play.

Altogether, Ethereum was still in a downward trend, with the fall accelerated by the recent partial profit-taking.

A price reversal to the upside, however, might be triggered by the liquidity clusters above the current price levels and the continuous accumulation.

Post Comment