Why Fortinet Could Be the Hidden Gem Ready to Explode Your Portfolio—Don’t Miss This Opportunity!

A month ago, the cybersecurity stocks parade was far from a victory lap—names like Palo Alto, Crowdstrike, Checkpoint, Zscaler, and Fortinet were all treading water with weak share prices. Fast forward to today, and while some still linger in the doldrums, Fortinet stands out as the resilient contender, holding a quality that begs a closer look. But here’s the kicker—what happens when the market’s high expectations collide headfirst with reality? Fortinet’s recent price tumble hints at a story of anticipation, execution doubts, and the ever-so-tricky hardware refresh cycle. Are we witnessing a mere hiccup in a longer-term growth saga, or is there a deeper signal here? Dive in as we unravel Fortinet’s role in the evolving cybersecurity arms race and why this seeming setback might just be the golden ticket for savvy investors ready to seize opportunity amidst volatility. LEARN MORE

img#mv-trellis-img-1::before{padding-top:52.5390625%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:30.17578125%; }img#mv-trellis-img-2{display:block;}

A month ago, the share prices of a few cybersecurity stocks such as Palo Alto(PANW), Crowdstrike (CRWD), Checkpoint (CHKP), Zscaler (ZS), Fortinet (FTNT) was pretty weak.

Since then, CHKP, FTNT are still languishing. ZS is… semi-languishing.

Out of all, the one with maybe the highest quality among them is Fortinet.

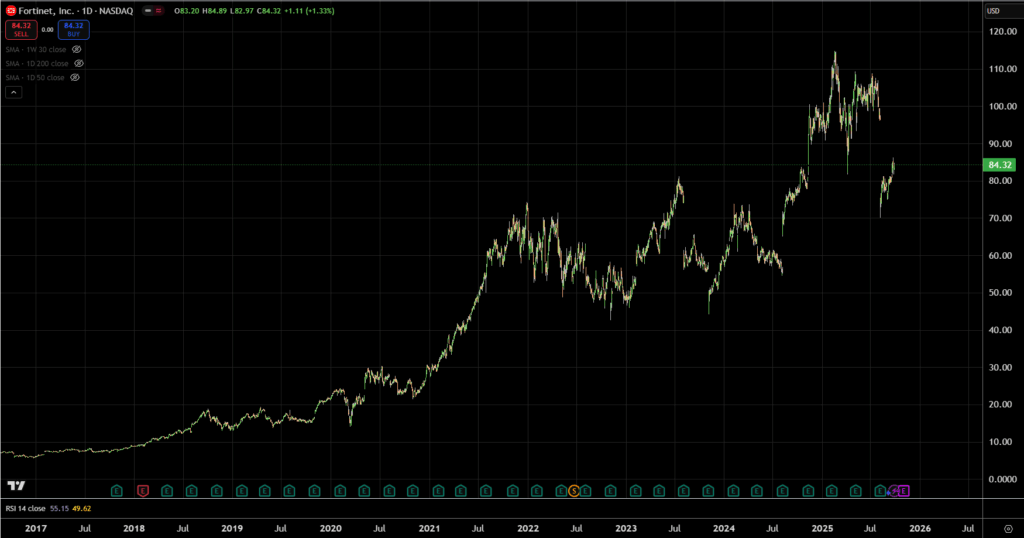

Here is a chart of Fortinet’s latest price trend:

What Caused the Big Gap Down?

The big gap down can be due to a lot of reasons but mainly that the market was expecting quite a lot from the results and guidance of FTNT but unfortunately it disappointed.

If you keep beating guidance, the market prices in greater expectations, I feel one day you are going to disappoint the market.

There were also concerns over where FTNT is with their firewall refresh cycle. During the earnings call, management updated that they may already be 40-50% through with their clients hardware upgrade. The market was expecting the pipeline to be longer than anticipated so there are concerns there. They were expecting the revenues or billings to accelerate more and thus it raises doubts in their execution.

The market may also view that FTNT Q3 guidance was below expectations.

What Fortinet Does

Fortinet is a U.S.-based cybersecurity company best known for its FortiGate firewalls, which sit at the heart of its business model. A firewall is essentially the first line of defense in corporate networks, monitoring and filtering traffic to prevent malicious attacks. What differentiates Fortinet from many peers is that it designs its own security processors (ASICs), which give its hardware an edge in speed and efficiency. Over the years, this positioning has made Fortinet one of the largest network security vendors globally, competing with Palo Alto Networks, Cisco, and Check Point.

While firewalls remain its anchor product, Fortinet has broadened its offering into what it calls the Security Fabric — an integrated suite of security solutions that covers not only network perimeter defense but also cloud security, endpoint protection, and secure networking (such as SD-WAN). This integration is designed to give customers a single platform with consistent visibility and control, rather than a patchwork of point solutions. Importantly, this strategy ties Fortinet’s customers into longer-term relationships and drives recurring revenue from subscriptions and support services layered on top of hardware sales.

The company has also been riding the structural tailwind of enterprises shifting to cloud and hybrid environments. These trends have created new attack surfaces, pushing IT teams to invest in unified security platforms. Fortinet has been expanding aggressively into secure access service edge (SASE), zero trust network access (ZTNA), and cloud security offerings to capture this demand. At the same time, its focus on cost-efficient hardware has allowed it to penetrate not just large enterprises but also the mid-market and service provider segments, giving it a broad base of customers across industries and geographies.

This Drawdown May Present an Opportunity for Investors

If a stock is beaten down because the market values poorer cash flows over a different timeframe than you, or it is a fixable problem, the this may present an opportunity for you.

FTNT currently trades at 33 times PE which looks high on an absolute basis. But 33 times PE is one of the cheapest it has been if you take a look at its historical PE at Macrotrends. On average, the PE is around 40 times.

FTNT’s PE reflects about three things:

- Technology companies typically trades at high price earnings.

- FTNT’s ability to grow its revenue and cash flow over time.

- The underlying quality of the company.

My question is whether any of these are affected with any new information that we know, or generally any recent challenges we can see.

Generally I don’t think so.

A tech company that sells hardware is going to be affected by hardware refresh cycles, which may be part and parcel of normal business cycle. Earnings near term might be affected but if you are buying a company for its longer term quality, this might present an opportunity if Mr Market values FTNT as a company that is unaffected by normal business cycle.

Secondly, Fortinet is ranked by Gartner as a leader in both:

- 2025 Magic Quadrant for SASE (Secure access Service Edge) platforms.

- 2025 Magic Quadrant for Enterprise Wired and Wireless LAN Infrastructure.

FTNT is broadly recognize for its security hardware and software offerings across zero trust network access, endpoint protection, SASE, LAN/WLAN. FTNT also has pretty strong peer reviews and if we check what is said in Subreddits, you can find that FTNT is appreciated for its ease-of-deployment to establish a multi-layer security strategy. If you need more granular tuning, then people generally prefer the firewalls from Palo Alto.

FTNT, unlike most of its peers, is profitable and still growing. Most of its peers may be growing free cash flow but they just turned profitable or started generating free cash flow not too long ago. Some are even still in the stage where they are not so focus on being cash flow positive.

Cybersecurity has evolved so much (just like many software-as-a-service) that each brand goes into so many verticals, trying to cover different areas of security.

I don’t profess to know enough although in my old job, I used to manage & maintain cybersecurity products such as firewall, endpoint protections, SIEM.

Managing them operationally is very different from being the one that establishing the security strategy so you can just take what I know like a janitor in a tech company.

FTNT grew its operating cash flow at 26% p.a. for the past 20 years. It grew its free cash flow at 26% p.a. for the past 20 years and 25% p.a. over the past 10 years. It grew its free cash flow by 20% p.a. over the past 5 years.

You can work out a PEG of about 1.3 to 1.6 times.

I would say such a PEG puts FTNT at a pretty fair value (even though the valuation is at its cheapest) by traditional metrics.

What many investors like about FTNT is that they are a a company focus on shareholder returns. In probably their second slide in their presentation slide deck, they will talk about their share buyback program. Many companies have buyback programs but not many presents it in a slide that is so high up.

From Fireside Chat’s with the management, we can see that they are not buying back their shares at anytime but when their share price dips and stop buying back when their share price is appreciating. The last time they bought back was probably at the dip April 2025, which may be at the price of $84.

This means they are likely buying back shares at this current level of $76 to $84.

In August 2025, the board approved an increase of US$1 billion to its existing share repurchase program.

One of the reasons companies do a lot of buyback is because they issue a lot of shares or options to their employees. If they do not buyback their shares, their shares will be more and more diluted.

But as you can see from the table in the chart, FTNT has the lowest share-based compensation (SBC) among the cybersecurity players:

Not just that FTNT, also has the lowest percentage of revenue spent on research and development for a cybersecurity company.

Not spending on R&D can be a sign of red flag in such an ultra competitive and fast evolving industry but FTNT has explained that they prefer to develop their solutions inhouse instead of grow by acquisitions. There are growing pains that a company have to deal with growing by acquisitions.

We can take them being ranked still as a leader to be a sign that R&D work still keeps them competitive.

FTNT says they have over 550 AI-related patents, which may be more than most cybersecurity companies.

Cybersecurity can be seen as a sub-area that indirectly benefits if this A.I. wave actually materializes over the long term.

FTNT is still lead by founder Ken Xie. Ken owns 7% of FTNT’s outstanding shares, amounting to $5.9 billion. His brother Michael owns another 7% of the company so they have plenty of skin in the game.

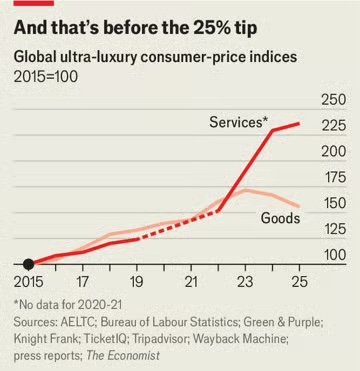

I have not known cybersecurity firms to be good investments until Covid happens. Apparently, cybersecurity is something that IT managers don’t save money on.

But they will optimize their limited IT spend.

I think this pie will expand and it is not as if FTNT is a weakling here so they will benefit if they are able to to compete.

And it seems FTNT’s management feels the same way.

I will end off with what they shared about how they look at their guidance, which may be a reason for their share price decline recently:

“The reason we gave above 12% in revenue growth guidance (13%) is that if the market grow 12% (a number from Gartner), we do believe we are gaining market share.

We are very confident we’ll grow above market in the next three to five years above 12% with the market growth. If the market grow faster, we feel we can also grow faster.

If the market is slow, we do believe we’ll continue gaining market share because we feel we are much better than any other competitor in each of these 3 segments”

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment