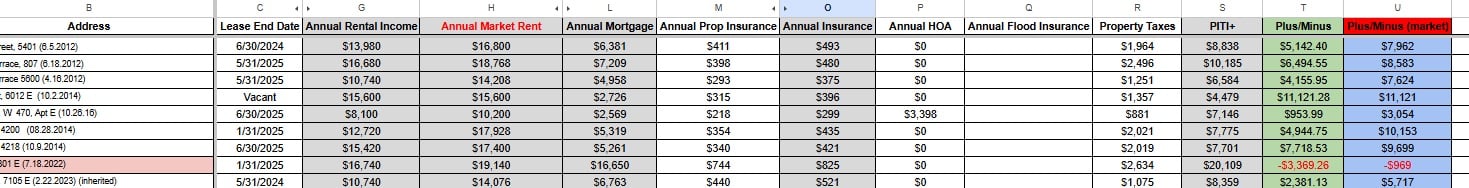

The sheet goes on to make estimates for maintenance, turnover, and vacancy costs based on the age and size of the property. But just here, you can see one property was negative without even including those costs.

This condo was hurt by the tax increase and an HOA fee increase in the same year. By far, we found the ones that don’t cash flow are large houses (particularly older ones) and condos (because of the HOA fee). So one by one, we’ve been putting those on the chopping block.

We also decided to sell properties that were over a 30-minute drive from our office, as they stressed our property management resources, as well as houses that still had a private loan on them (as we didn’t have a chance to reach the refinance stage of the BRRRR method before interest rates increased).

Post Comment