Why Litecoin Could Quietly Outsmart Bitcoin—and What That Means for Your Q4 Portfolio Gains

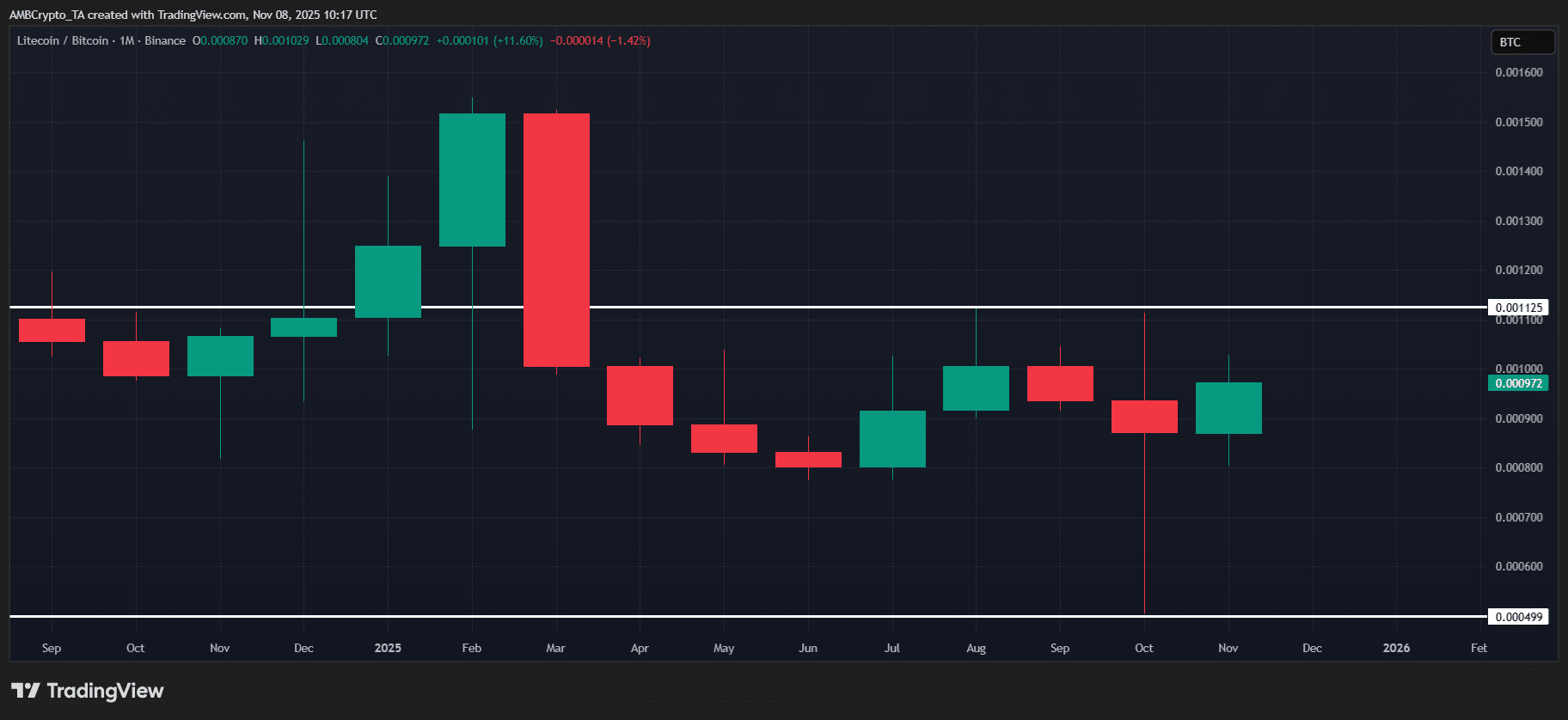

Ever wonder why Litecoin seems to be punching way above its weight this cycle, while most altcoins are just twiddling their thumbs? Here’s the kicker — LTC isn’t just riding the usual market waves; it’s carving its own path with an impressive 11.83% gain against Bitcoin. That’s no small feat, especially when Ethereum is wobbling with a 10% dip this November. What’s driving this unexpected surge? Whale accumulation and savvy risk-off hedging are stacking the deck in Litecoin’s favor. But before we crown LTC as the next big thing, the real question lingers — is this rally backed by solid on-chain fundamentals or just smoke and mirrors? Well, with a 12% jump in DeFi’s Total Value Locked, daily transaction volumes hitting a jaw-dropping $15.1 billion, and a noticeable uptick in high-value wallets, it looks like there’s some serious muscle behind the move. Could Litecoin be the underdog story that actually sticks around and surprises us all this Q4? Let’s dive deep and find out. LEARN MORE

Key Takeaways

Why is Litecoin showing strength this cycle?

Litecoin is decoupling from the altcoin pack with +11.83% vs. BTC, boosted by whale accumulation and risk-off hedging.

Is the rally backed by real on-chain activity?

LTC’s DeFi TVL jumped 12%, daily on-chain volume hit $15.1 billion, and 6% more 100k+ wallets signal long-term locking.

Litecoin [LTC] is breaking away from the broader altcoin pack.

After a 4.8% rally so far in November, LTC is one of the few coins kicking off the month on a bullish note. To put that into perspective, Ethereum [ETH] is down 10%, so there hasn’t really been any alt rotation this cycle.

Against this backdrop, LTC’s relative strength stands out. In fact, it’s also showing strong momentum vs. Bitcoin [BTC], up 11.83%, which gives it an edge as traders look to hedge in a risk-off environment.

But does this resilience actually show up on-chain?

Notably, on the DeFi side, Litecoin is seeing a solid 12% jump in its Total Value Locked (TVL), hitting $2.1 million. That’s $240k flowing into LTC’s DeFi stack, boosting liquidity and showing growing on-chain activity.

Why does this matter? Rising TVL signals that more capital is being deployed into the network, creating a divergence. In other words, LTC isn’t just seeing rapid moves. Instead, there’s real long-term locking of funds.

Against this setup, LTC is carving out solid resistance at $108, which looks more like a cooldown than a full-on sell-off. So, if it breaks through (even in a risk-off market) could Litecoin be flexing as a real Q4 contender?

Litecoin tops $102 as whales and record volume drive the run

Litecoin is showing real conviction at key resistance.

On-chain metrics from Santiment highlight why the bullish momentum could continue. Over the past three months, the number of 100k+ LTC wallets has grown by 6%, signaling that big players are steadily stacking.

Meanwhile, daily on-chain volume has hit an all-time high of $15.1 billion, showing heavy network activity. Together, these signals show LTC’s gains are grounded in real network participation rather than hype-driven pumps.

The result? Litecoin has kept Q4 losses to just 7.5%.

By contrast, ETH is down 17%, highlighting how whale accumulation and network growth have fueled LTC’s relative strength in the market. If this trend sticks, breaking past the $102 resistance wall could be just the start.

From here, Litecoin has a real shot at stacking momentum. With LTC already leading the top-cap altcoins, a continued push could put it among the biggest gainers of Q4, making it a must-watch asset.

Post Comment