Why Metaplanet’s $61.4M Bitcoin Bet Could Trigger the Next Massive Crypto Surge—Are You Ready to Ride the Wave?

Ever wonder what it takes to play in the big leagues of Bitcoin accumulation? Tokyo-based Metaplanet Inc. just answered that question loud and clear—by stacking up a whopping 18,113 BTC, pushing their commitment to a “Bitcoin standard” treasury strategy to new heights. Since turning Bitcoin into their core business hit in December 2024, they’ve been on a relentless buying spree, adding another 518 BTC on August 12th alone, tipping the scales at a staggering $1.85 billion in reserves. But here’s the kicker—while the market’s mood swings like a rollercoaster, Metaplanet’s bold moves mirror the fierce appetite of giants like Strategy (formerly MicroStrategy). It’s a chase for dominance that begs the question: Is Metaplanet carving out a seat at the top of the global Bitcoin throne, or just fueling the next market shakeup? Let’s dive into the numbers and strategies behind this high-stakes game. LEARN MORE

Key Takeaways

Tokyo-based Metaplanet significantly increased its Bitcoin holdings to 18,113 BTC, reflecting a strong commitment to a “Bitcoin standard” treasury strategy.

Tokyo-based Metaplanet Inc. has further strengthened its position among the world’s largest publicly traded Bitcoin [BTC] holders, adding 518 BTC on the 12th of August.

The move raised its reserves to 18,113 BTC, valued at roughly $1.85 billion at press time.

Since making Bitcoin a core business in December 2024, the firm has pursued an aggressive accumulation strategy.

Metaplanet adds more Bitcoin

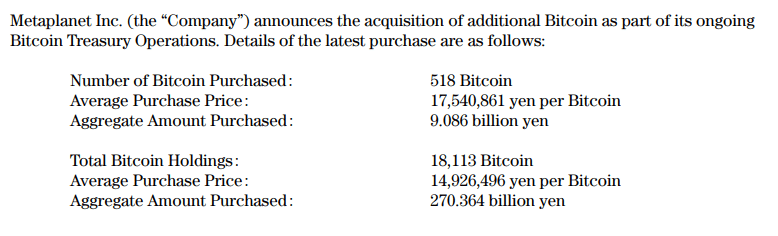

The Tokyo Stock Exchange filing showed a 9.086 billion yen spend, or $61.4 million, at 17,540,861 yen (~$118,519) per BTC.

Naturally, this pushed its total Bitcoin spend to 270.364 billion yen, reflecting a deepening commitment to the asset.

In late July, it bought 463 BTC for $53.7 million at an average $115,895, lifting holdings to 17,595 BTC.

That prior purchase helped achieve a 459.2% year-to-date BTC Yield, according to the company’s performance indicators.

For context, AMBCrypto earlier reported this July buy as part of a rapid accumulation streak, keeping it in the global top tier.

Keeping pace with the whales

That being said, Metaplanet’s pace of accumulation mirrors the aggressive strategies of other Bitcoin-centric firms.

U.S.-based Strategy (previously MicroStrategy), for example, recently revealed the purchase of 155 BTC for about $18 million at an average cost of $116,401.

This latest buy raised Strategy’s total to 628,946 BTC, worth an estimated $46.09 billion, solidifying its position as the world’s largest corporate Bitcoin holder.

According to BitcoinTreasuries data, Metaplanet now ranks sixth globally among public companies holding Bitcoin, trailing only Strategy, MARA, XXI, Bitcoin Standard Treasury Company, and Riot.

Analysts suggested that such concentrated corporate purchases reflect growing institutional conviction in Bitcoin, particularly from firms embracing a “Bitcoin standard” as a core treasury management philosophy.

Market reaction tells another story

Of course, markets remained unpredictable.

Following the announcement, Metaplanet’s stock saw a short-lived 1% rise from 985 yen to 997 yen, before slipping to 980 yen and eventually settling 2.69% lower at 975 yen by press time.

The decline came alongside a broader market pullback, with Bitcoin itself dropping 2.44% over the past 24 hours to $119,092.10, according to CoinMarketCap.

Post Comment