Why Most Singapore Investors Are Quietly Winning Big with IBKR’s Tiered Pricing on LSE ETFs—And You Should Too

Ever found yourself tangled in the maze of Interactive Brokers’ pricing plans, wondering whether Tiered or Fixed fees actually save you money — or just your sanity? As a Singapore-based investor diving into the world of USD-denominated ETFs listed on the London Stock Exchange, I’ve been there, scratching my head over complicated commission structures and hidden fees. After a less-than-stellar initial comparison left me more confused than enlightened, I rolled up my sleeves and crafted a detailed Google Spreadsheet designed to demystify the true cost for you. This isn’t just another dry breakdown—it’s tailored specifically for investors like us, factoring in Singapore GST, various trade sizes, and the quirks of IBKR Pro’s pricing. Spoiler alert: while Tiered Pricing often comes out ahead, there are exceptions, and this guide will help you uncover which path is best for your unique investment journey. Curious to see where your trade fits into this puzzle? Let’s crack the code together. LEARN MORE

img#mv-trellis-img-1::before{padding-top:45.975744211687%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:14.855875831486%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:40.779220779221%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:92.28515625%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:49.31640625%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:222.12581344902%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:222.12581344902%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:222.12581344902%; }img#mv-trellis-img-8{display:block;}img#mv-trellis-img-9::before{padding-top:222.12581344902%; }img#mv-trellis-img-9{display:block;}img#mv-trellis-img-10::before{padding-top:222.12581344902%; }img#mv-trellis-img-10{display:block;}

I was not too happy with my shoddy comparison which is cheaper if you choose Tiered Pricing or Fixed Pricing if you are on Interactive Brokers Pro plan. (IBKR Lite is Now Available to Interactive Brokers Singapore Investors.)

There were so many things not factored in and Singaporean investors like yourself must be left wondering how it would be if we factor in all the costs.

So I decided to write a Google Spreadsheet to help you figure out once and for all.

To caveat, my comparison of the total cost is strictly for the people investing in the following way:

- You are a Singapore-based investor.

- Invest in Exchange Traded Funds (ETF) Listed on the London Stock Exchange (LSE for short).

- Invested in USD Denominated ETFs.

- You are on IBKR Pro with different trade sizes.

- You are subjected to Singapore GST.

This is a niche group of investors but they would be the investors that invest mainly like me. If not, you can actually copy my spreadsheet and make the necessary adjustments. My spreadsheet is a pretty good template.

Long story short, if you invest in LSE-listed, Irish or Luxembourg domiciled, USD denominated ETFs, usually Tiered Pricing is better for you. I said usually because you might be different, and hope this article would help you see why.

Interactive Brokers (IBKR) Pro Fixed Pricing and Tiered Pricing

IBKR Pro has two different kind of pricing.

By default, you are set to Fixed Pricing when you first set up. So if you want to change you have to go to Settings to change. You can change anytime but it will be in effect only after 24 hours of the next business day.

The difference between Tiered and Fixed pricing mainly comes down to how commissions are charged and whether exchange/clearing/rebate costs are passed through to you.

1. IBKR Fixed Pricing

- Simple “all-in” rate: IBKR charges you a single flat commission per share (for stocks) or per contract (for options), regardless of the exchange/venue used.

- Exchange & clearing fees included: The flat rate already covers IBKR’s commission plus most exchange and clearing fees.

- No exchange rebates: If your order provides liquidity and the exchange would normally pay a rebate, IBKR keeps it — you don’t see it.

2. IBKR Tiered Pricing

- Pass-through of actual exchange/clearing fees/rebates: You pay IBKR’s low base commission plus any actual exchange or clearing costs, and you receive any liquidity rebates.

Interactive Brokers give you the flexibility to choose and their rates will look complex to you because your final total cost depends on:

- Your total trade value.

- Which exchange you are on.

- Which currency your trade is on.

- Fractional or non-fractional shares.

- Whether there are other fees.

Fixed pricing is like an all in very clean fee. But in exchange for a clean fee, you gain less flexibility.

My FREE Google Spreadsheet to Help Singapore-based Investors See if Tiered or Fixed IBKR Pro Pricing is Cheaper For You

I crafted this free spreadsheet that you can put in your trade value and show an estimated cost, based on the resources provided by Interactive Brokers.

I have linked the Interactive Brokers resources in the spreadsheet as well so that you can check the work.

You can make a copy of the spreadsheet through this link: Make a Copy of My Google Spreadsheet >>

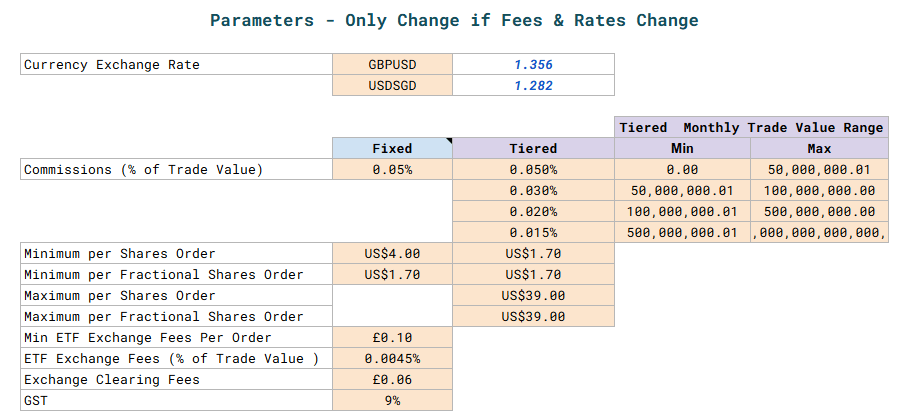

This section is the IBKR parameters taken from their website or some default currency conversion. The currency conversion is pulled from Google Finance. You don’t have to change this section unless IBKR changes their pricing, or GST changes.

This is where you put in your trade value. If you are looking to trade US$100, then put this in. I showed you the corresponding value in SGD next. You can also choose if you are trading fractional shares.

This is all the inputs you need.

The results below will be calculated for you.

This section shows the estimated total cost on both Fixed and Tiered Pricing. So the commission percentage for tiered is based on your monthly trade value but since most of us is US$50,000,000 and below it is usually 0.05%! (unless I have some ultra ultra high net wealth readers).

There will be Exchange and Clearing Fees for Tiered Pricing. But in this case of US$5,000 even after that Tiered pricing is cheaper. I will also show you the total cost as a percentage of your trade value to see if you have kept cost low.

I think any cost below 0.20% is okay lah but that is me speaking.

Some reasons:

- If you are a longer term investor, this is a one-time, or two-time entry cost and not a recurring custodian, wrap or advisory fee. This cost will be diluted over time.

- If you convert currency before buying stocks, you will pay 0.002% with a minimum of 2 USD. This is a one time cost. (Refer to resource here). Note is 0.00002 if you compare 0.1% is 0.001. If you use AutoFX to convert it is 0.03% instead. As long as your currency conversion is reasonable, your cost is rather low.

This calculator will help you figure out.

Where is the Range of Trade Value Where Fixed Pricing is Better for Singapore-based Investors?

In my free Google Spreadsheet, I also provide a look up table:

This is only for normal shares not fractional shares.

You can see specific to LSE-listed, Irish or Luxembourg domiciled, USD denominated ETFs, fixed pricing is cheaper from US$7,260 to US$85,180. Beyond that, Tiered pricing is cheaper.

I recommend keeping to Tier Pricing because even if you look at that range… the percentage cost relative to your trade value is 0.055% vs 0.06%. There is not a lot of difference.

Both are just cheap enough!

If cheap cost is around 0.20%, then your minimum investment size should be around US$1,000 or SG$1,282 if you use tiered pricing. Your minimum will be higher at US$2,000 if you are on Fixed Pricing.

If You Invest in Fractional Shares, it Might be Different

My calculator allows you to compare the cost if you are trading factional shares:

The fixed minimum for fractional shares is US$1.7 instead of US4.0. Thus, in the same US$5,000 example, Fixed pricing end up slightly cheaper than tiered.

So this is why I would use the word usually.

How to Switch Your Pricing from Fixed to Tiered Pricing in Your Interactive Brokers App

To change your IBKR Plan from Pro Tier or Fixed to IBKR Lite you can do the following.

Since most of you are likely to be on the mobile I am going to give mobile-based instructions. You should be both on Interactive Brokers Mobile or Interactive Brokers Global Trader.

If you are logged in on both platform, then lets started.

If you click on :

- The three slashes on the top left corner of the Mobile app

- The human silhouette on the top left corner of the Global Trader app

It will bring you to the more admin panel. You will see either of the following:

Click on the Settings on whichever platform you are in.

You will see the following panel in both:

Click on Account Settings.

If you are on Interactive Brokers Mobile, you will see another sub-panel.

In that panel, click All Account Settings. (You won’t see this in Global Trader)

In All Account Settings:

You be presented with the following screen:

You can toggle and choose between the two plans. Changes will take effect after 24 hours or the next business day.

Interactive Brokers Remains the Best Broker for Long Term, Passive, Strategic, and Systematic Portfolios for Singapore-based Investors.

I think indirectly, this article shows that if you are a more passive investor who would like to form a portfolio based on a strategic, long-term buy and hold strategy using low-cost, tax efficient UCITS ETFs listed on the London stock exchange, Interactive Brokers remain the most cost competitive option.

- There are no recurring access, advisory, wrap fees.

- There are no platform fees.

- Currency conversion is near spot with very, very low cost relative to the 0.25-0.30% charged by the next broker that allows you to trade on LSE.

- Allows you to trade in other European exchanges if you wish to access UCITS ETF that is not listed in LSE such as Swiss, German, Dutch exchanges.

- With Tiered pricing even investing US$500 gives you a one time cost of 0.41%. This is very good.

- A custodian who has a long operating history.

- A custodian majority own by an owner where the company makes up a significant chunk of his net worth.

- A custodian that thrived during the GFC instead of suffer.

So if you have not give them a try, you can do so today.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers

Post Comment