Why One Major Bank’s $25/hr Move Could Trigger a Wage War—And Amazon’s Next Big Gamble Revealed

Ever wonder what it takes for a giant in the financial world to truly invest in its workforce beyond the usual lip service? Bank of America, sitting on a mountain of assets exceeding $2.6 billion, just flipped the script by announcing a hefty raise in minimum wage for its U.S. hourly employees — from $24 to a solid $25 an hour next month. That might sound like just a dollar bump, but it’s the final piece of a bold plan set into motion back in 2017, hiking starting pay from a modest $15 an hour all the way to a game-changing $25. To put that in perspective, full-time employees will now pull in over $50K a year — more than $20,000 extra since ’17. It’s fascinating to see how this move isn’t just about dollars; it’s about recalibrating company culture, cutting turnover in half, and even tightening the grip on customer loyalty. So, what does this mean for the future of work in big banking, especially as AI reshapes the landscape and roles? Hang tight — this wage saga is only the beginning. LEARN MORE

A major U.S. bank, with over $2.6 billion in assets, just raised its minimum wage.

Bank of America announced on Wednesday that it would raise its minimum pay for its full- and part-time U.S. hourly workers to $25 an hour. The change will take effect next month, pushing the minimum salary for full-time U.S. employees to over $50,000 annually.

This pay increase is the final phase of a plan announced in 2017 to boost the bank’s base pay from $15 an hour to $25 an hour by 2025. (Employees have been making $24 an hour since October 2024.) With the raise to $25 an hour, the starting salary for full-time U.S. workers will have increased by more than $20,000 since 2017.

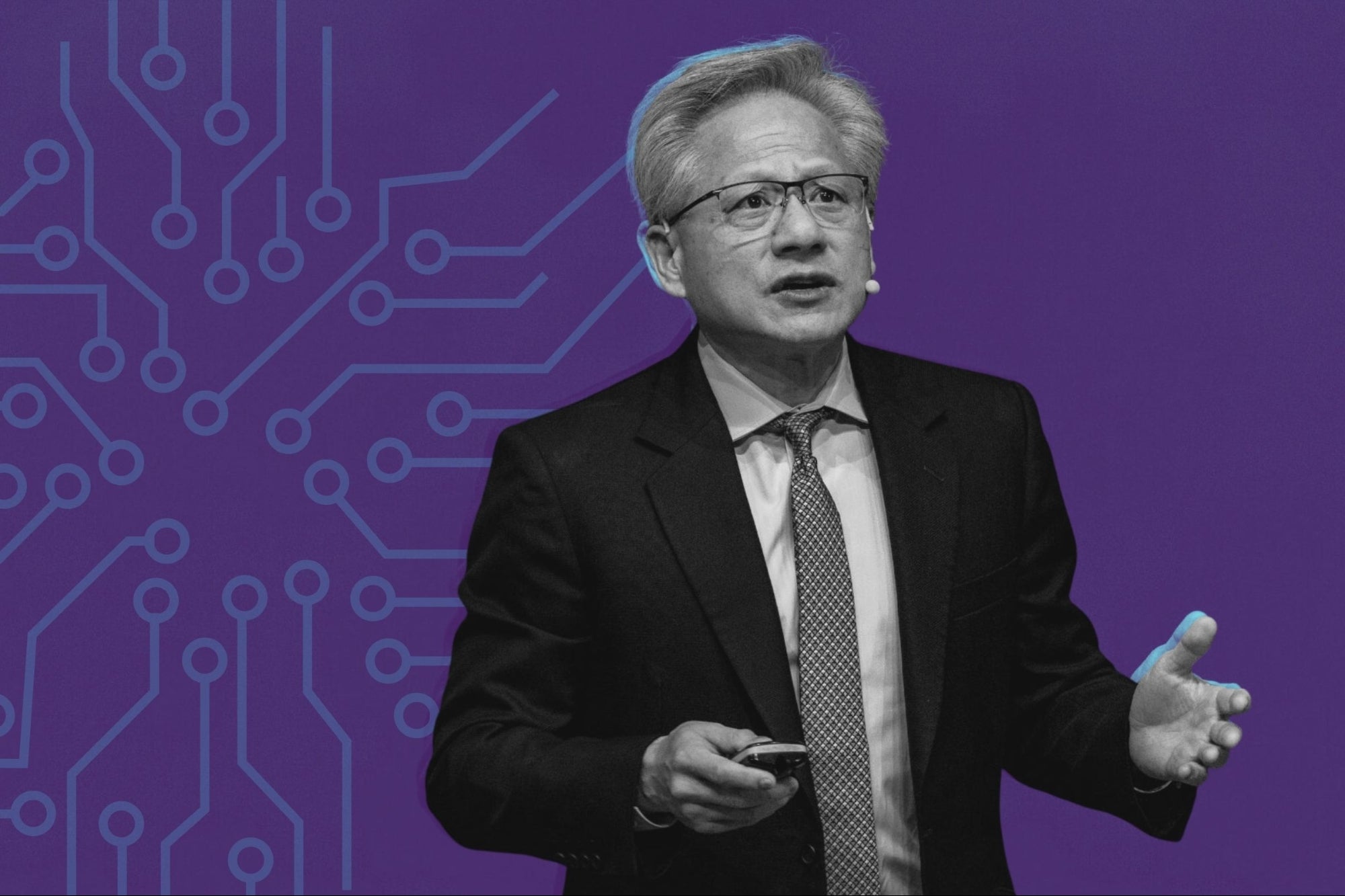

“[The raise] gives a teammate a chance to join our company, spend their whole career here, and support their families,” Bank of America CEO Brian Moynihan told Bloomberg.

Moynihan emphasized that the higher minimum wage minimized turnover, causing the rate of departing employees to drop from 20% in 2017 to around 10% this year. Customer attrition, or a loss of customers, has also dropped, he stated.

Bank of America CEO Brian Moynihan. Photographer: Betty Laura Zapata/Bloomberg via Getty Images

Bank of America CEO Brian Moynihan. Photographer: Betty Laura Zapata/Bloomberg via Getty Images

As Bank of America adopts new technologies like AI, it has reduced its number of employees across some departments, Moynihan told Bloomberg. The goal is to put more dollars in the pockets of the employees who remain and “re-skilling them,” he said.

Bank of America had about 213,000 employees as of July, according to its newsroom.

Related: Here’s What’s Considered ‘Middle Income’ in the U.S. Today, According to Bank of America Data

Amazon Is Raising Pay

Amazon also announced this week that it would increase its average hourly pay to more than $23 per hour. The retail giant is investing more than $1 billion to increase wages and decrease the cost of healthcare plans for its employees.

Full-time employees will have their pay increase by an average of $1,600 per year.

Meanwhile, Amazon’s entry-level healthcare plan will cost $5 per week and $5 for co-pays beginning next year. Amazon stated that the change is a 34% reduction in weekly contribution costs.

Amazon employed 1.55 million people globally as of the end of last year.

Related: Amazon Tells Thousands of Employees to Relocate or Resign

A major U.S. bank, with over $2.6 billion in assets, just raised its minimum wage.

Bank of America announced on Wednesday that it would raise its minimum pay for its full- and part-time U.S. hourly workers to $25 an hour. The change will take effect next month, pushing the minimum salary for full-time U.S. employees to over $50,000 annually.

This pay increase is the final phase of a plan announced in 2017 to boost the bank’s base pay from $15 an hour to $25 an hour by 2025. (Employees have been making $24 an hour since October 2024.) With the raise to $25 an hour, the starting salary for full-time U.S. workers will have increased by more than $20,000 since 2017.

The rest of this article is locked.

Join Entrepreneur+ today for access.

Post Comment