Why “One More Time” Could Be the Game-Changer Your Weekend Strategy Desperately Needs—Ignore at Your Own Risk.

When I first dipped my toes into writing about investing back in 2007 on Monevator, I had this sneaky suspicion: “How long before I run outta steam and stories?” After all, the essentials of personal finance? You could slap ’em on a Post-It note and call it a day. At the time, index funds were gobbling up retail money like some gigantic whales at an endless buffet . And Gordon Brown, then UK chancellor, was crowing about ending boom and bust. Seriously, what more was there to say? Turns out, quite a lot — especially after the Great Financial Crisis tore through that comfy complacency, and when The Accumulator showed up, bringing his razor-sharp eye on the sneaky fees and mental traps in passive investing. Fast forward, and surprise! The tools and tricks for private investing kept spinning faster and faster — from ETFs and all-in-one funds to zero-commission trading and yes, Bitcoin’s wild ride. Lately, I’ve been eyeballing some fresh, jaw-dropping moves: tokenized stocks that let you bet on OpenAI’s future via blockchain, stablecoin laws aiming to reshape the backbone of finance, and the FCA softening to let everyday investors get their hands on crypto exchange-traded notes. Is this dizzying innovation a blessing or a gamble headed for trouble? Maybe more than we expect. But hey, as Paul Volcker pointed out, sometimes the simplest innovations pack the biggest punch — who thought the humble ATM would top the charts? Still, a part of me wonders: Are we all gearing up for a future where buying crypto-exposure to Elon Musk’s rocket ventures is just another weekday habit? Or are we inching toward the next financial crisis, as some warn? Buckle up, folks, ’cause the ride’s just getting interesting. LEARN MORE

What caught my eye this week.

When I first began writing about investing on Monevator in 2007, I wondered when I’d run out of things to say.

The basics of good personal finance can famously be written on a Post It note.

At the same time, index funds were already mopping up retail investors’ money like baleen whales feasting at an all-you-can-eat plankton buffet.

As for the economy, the UK chancellor Gordon Brown boasted he’d put an end to boom and bust.

What would there be left to talk about?

Of course the Great Financial Crisis soon kicked such complacency into touch.

And shortly afterwards The Accumulator started writing for Monevator. His beady forensic eye for the hidden costs and frictions to avoid in passive investing – and his awareness of the psychological landmines that abound – proved this blog could be a writing project to take us into old age, if you guys will keep having us…

(AI notwithstanding!)

Harder, better, faster, stronger

What I didn’t see coming in 2007 though was that the mechanics and tools of private investing would continue to evolve…

…or devolve, depending on your perspective.

We already had index funds, ETFs, cheap share trading for those who wanted it – though not zero commissions yet – and innovations like all-in-one and target-date funds that wrapped best investing practice into products that enabled you to buy good investing habits off the shelf.

There was still a wealth of venerable investment trusts for old nostalgics like me to kick the tyres on should we want to do something different, too.

Were we crying out for free share trading, levered and short ETFs, and Bitcoin?

Probably not, but they came our way anyway – and there’s no end in sight.

In just the past few weeks I’ve been reading about:

- Mirror notes from the investing platform Republic (formerly Seedrs) to enable UK investors to get exposure to the performance of unlisted SpaceX.

- The new stablecoin legislation in the US. Boosters say it lays the groundwork for moving the financial rails wholesale onto the blockchain.

- RobinHood’s tokenised stocks – now available in Europe – which combine both these ideas to purportedly enable you to bet on the future of OpenAI, say, again via the blockchain.

- The UK’s FCA relenting to allow everyday investors to buy exchange-traded notes tracking Bitcoin and potentially other crypto assets from 8 October.

Is such innovation a good thing?

Well… perhaps more than seems likely right now.

Get lucky

Paul Volcker, the inflation-beating chairman of the Federal Reserve, notoriously remarked that the ATM was the only useful financial innovation of the past 30 years – at least as of the time of his quipping.

But even as he spoke, the seeds were being laid for the very welcome private investing revolution that I outlined at the start of this piece.

So maybe we should be humble about where these latest developments might lead?

It’s easy to be cynical about whether the average person has any need to buy crypto-based exposure to Elon’s rocket ships.

But perhaps we will all be doing something similar a couple of decades hence – and maybe not even realising it?

On the other hand, I have some sympathy with Bill McBride, who won a bit of renown in the blogosphere nearly 20 years ago by predicting the financial crisis.

And his view of these latest innovations is sobering:

The key to preventing a financial crisis is to keep the non-regulated (or poorly regulated) areas of finance out of the financial system.

A good example is the Tulip Bubble in the 1600s. Some people got rich, others were wiped out, but it had no impact on the financial system.

Unfortunately the current administration has embraced crypto. They are allowing it to creep into the financial system, and allowing 401K plans to hold crypto (aka future bagholders).

There has been some discussion of allowing financial institutions to lend against crypto holdings – like for a mortgage.

This is mistake and increases the possibility that crypto will be the source of the next financial crisis.

Time will tell. But hopefully we’ll be here to report on the unfolding drama again should the worst happen…

Please share your thoughts in the comments below, and have a great weekend.

From Monevator

Sticking to a financial plan when the honeymoon is over [Members] – Monevator

From the archive-ator: Seven unusual ideas for a better value wedding – Monevator

News

UK GDP slows as economy feels effect of higher business costs – Sky

Employers hire virtual staff and contractors to combat the N.I. hike – This Is Money

House prices are falling, but it’s a mixed picture across Britain – This Is Money

Over 3.6m investors pay dividend tax [Twice as many as in 2021] – Yahoo Finance

Average mortgage rates below 5% for the first time since Truss budget – BBC

Oasis tour injected £1.1 billion into the UK economy – This Is Money

London developer must pay ex-wife £15m after hiding assets in ‘sham’ trust – Standard

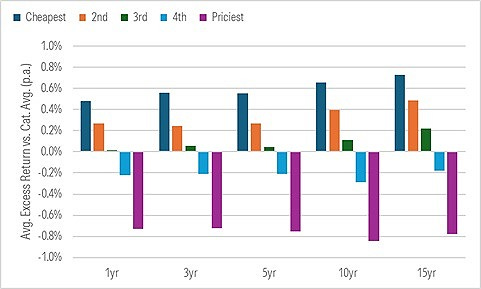

Fees predict performance – Basis Pointing

Inheritance tax speculation mini-special

Treasury looking at IHT again to plug deficit [No Brexit cited, as usual] – Guardian

Gifting and the seven-year rule are apparently in the spotlight – Morningstar

How does IHT work today and what might be changing? – Guardian

Yet another take – This Is Money

How onshore bonds can help beat inheritance tax – MoneyWeek

The already-planned changes largely protect family farms, study finds – CenTax

Products and services

Celebrate your birthday with 35 freebies and discounts – Which

Beat the base rate for three months with Prosper’s 4.5% fixed-rate savings – T.I.M.

What’s happening to car insurance premiums? – Which

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

The pros and cons of an immediate needs annuity – This Is Money

Savings will be taxed directly from pay packets from 2027 – Standard via Yahoo

How to avoid getting stung for hidden hotel charges – Be Clever With Your Cash

Try health service Thriva via my affiliate link and we both get £30 in credit – Thriva

How to complain to the Financial Ombudsman Service – Be Clever With Your Cash

Homes for sale near golf courses, in pictures – Guardian

Comment and opinion

Un-exceptional US stock market earnings? – Elm Funds

How the top rate of income tax became a middle-class problem – The Times

Retirement is only halfway up the mountain – A Teachable Moment

Everything is disruptable – Abnormal Returns

More meetings means less thinking – Behavioural Investment

How to use Bitcoin in your portfolio – Morningstar

The first $10,000 is the most important – Of Dollars and Data

Is London’s financial future evolving or eroding? – CNBC

Why the first years of retirement matter most – Retirement Researcher

Wealthy people buy more insurance than theory predicts – Alpha Architect

Investing and longevity mini-special

How likely is it that an investor will outlast their savings? – Maths Investor

Investing in the inevitable tides of demographic change – Polymath Investor

What are your chances of ending up in a care home? [Paywall] – FT

Naughty corner: Active antics

Three big ideas for understanding how stocks work – Fortunes & Frictions

Retail traders are driving crazy post-earnings volatility – Sherwood

How much cash should companies hold? [Research, PDF] – Morgan Stanley

The damage done by MiFID II – Klement on Investing

Shorting is hard – Inside the Mind of Mojo

A Novo Nordisk deep dive – Quartr

Super-long Japanese government debt: the new widow-maker – FT

Kindle book bargains

What They Don’t Teach You About Money by Claer Barrett – £0.99 on Kindle

Too Big to Fail by Andrew Ross Sorkin – £0.99 on Kindle

50 Economics Ideas by Edmund Conway – £0.99 on Kindle

Mastering the Business Cycle by Howard Marks – £0.99 on Kindle

Environmental factors

Europe bakes and burns, turning holiday hotspots into infernos – Guardian

Government inexplicably tells citizens to delete old emails to save water – Tom’s Hardware

Squid and chips? UK’s warming waters could change what we eat – Independent

What might happen to cities as sea levels rise? – Klement on Investing

Why ‘best time to visit’ no longer applies – BBC

Plight of the bumblebees – Biographic

Our wasteful culture has led us to Wet Wipe Island – Standard

Study finds whales and dolphins regularly hang out togother – The Conversation

Robot overlord roundup: ChatGPT-5 edition

OpenAI moves fast and breaks ChatGPT – Spyglass

GPT-5 – “a legitimate expert in anything” – can’t spell – Sherwood

An AI nerd rounds-up all the other takes on GPT-5 – Don’t Worry About The Vase

GPT-5 and other LLMs are not human brains. They never will be – Gary Marcus

Not at the dinner table

The permanent stain – Andrew Sullivan

Trump administration asks NASA to draw up plans to destroy its own climate-monitoring satellites – NPR

How big are Trump’s tariff revenues, really? – NPR

Mimicking China isn’t how the US should race against China – Faster, Please

Why a Leeds teenager woke up with a Chinese bounty on her head – Guardian

Is America about to solve its housing problem? [Podcast] – The New Bazaar

Off our beat

China’s unemployed young adults who pay to pretend to have jobs – BBC

Meta (Facebook/Instagram) makes at least $25 a month per US user – Sherwood

As thousands of teenagers scramble for university places…why? – Guardian

The rise and fall of musical ringtones – Stat Significant

Dining across the divide – Guardian

Wandering in Woolwich – Propegator

No printers or PCs says Starbucks Korea to its customers – BBC

And finally…

“Have some humility – plenty of clever people get spanked regularly by the markets.”

– Tim Hale, Smarter Investing

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment