Why Owning Just 3–7% of Bitcoin Could Be the Ultimate Power Move According to Michael Saylor—Are You Ready to Seize It?

So, here’s a curveball for your Monday read: Michael Saylor and his firm Strategy are setting their sights on snagging up to 1.5 million Bitcoin—that’s roughly 7% of the entire BTC supply. Sounds bold? You bet! After weathering a streak of tough red quarters, Strategy just reported a whopping $10 billion in net income for Q2—their first profitable quarter in quite some time. Now, Saylor’s not sweating the skepticism over their aggressive Bitcoin hoarding, brushing it off by pointing out that BlackRock holds even more. But here’s the real kicker—Strategy has been funding this huge Bitcoin appetite through stock issuances and debt, which has caused some share dilution. To keep things in check, they’re only selling shares when their modified net asset value (mNAV) hits above 2.5x, a move applauded by industry insiders. As they pivot toward preferred perpetual stocks like Stretch [STRC] to fuel further buys, you might wonder—Is Strategy just buying Bitcoin, or reshaping the corporate treasury playbook entirely? Dive in and let’s unpack how this maverick company is not only stacking sats but possibly engineering the future of Bitcoin-denominated returns.

Key Takeaways

Saylor implied that there was nothing wrong with his firm eyeing 1.5 million BTC, or about 7% of the BTC total supply. The firm saw a profitable Q2, the first time following several red quarters.

Michael Saylor, chairman of Strategy (MicroStrategy), has downplayed concerns about the firm’s aggressive Bitcoin [BTC] buys, which now control 3% of the overall BTC supply.

In a recent CNBC interview, Saylor stated,

“I don’t think owning 3% to 7% of Bitcoin supply is too much. BlackRock has more than that.”

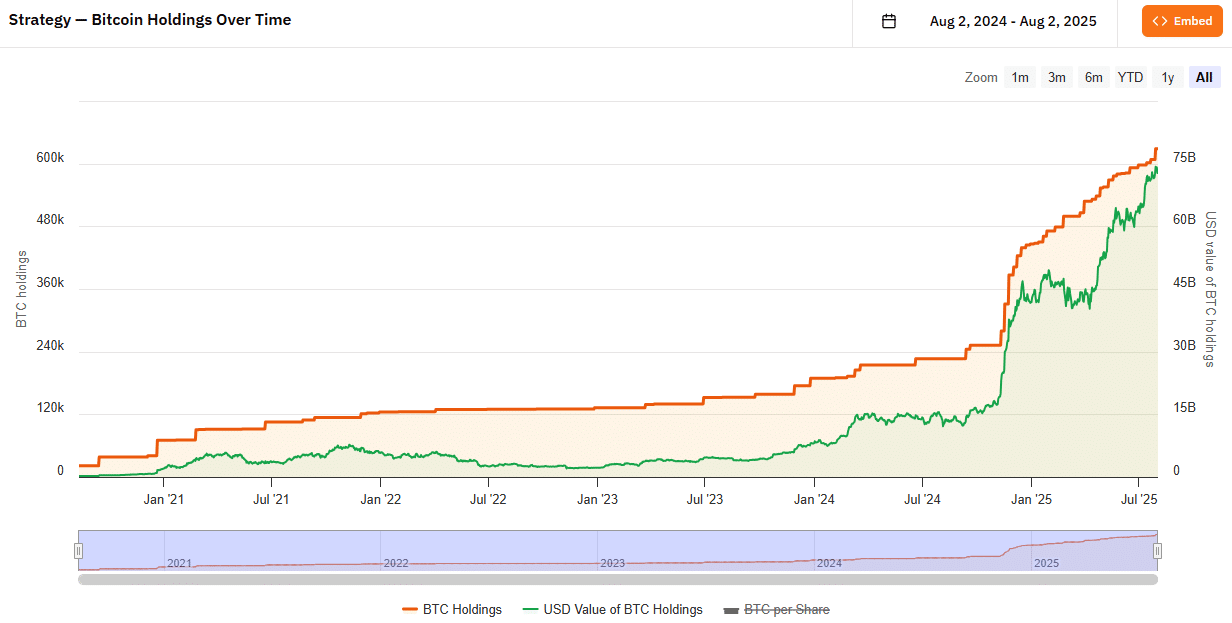

Strategy currently holds 628,791 BTC, about 3% of the overall BTC supply. A 7% target would imply owning 1,470,000 BTC or about 1.5 million coins.

Record Q2 profit and BTC plans

The firm also revealed a profitable Q2 during the latest earnings call held on the 31st of July. It made $10 billion in net income in Q2, marking the first profitable quarter after a series of losses.

Additionally, its BTC holding gain hit $13.2 billion on a YTD (year-to-date) basis. The aggressive BTC acquisition has been funded through stock issuance and debt.

However, the ongoing sale of stocks to raise capital has led to share dilution amid a drop in mNAV (modified net asset value), an indicator that tracks the market value of a firm relative to its BTC holdings.

To prevent further dilution, Strategy said that it will only sell MSTR shares when the mNAV is above 2.5x. VanEck’s Matthew Sigel hailed the move as ‘best in class’ for MSTR treasury management.

At press time, the mNAV was at 1.62x, down from the record level of 3.89x hit last November.

Now, the firm will focus on the yield-bearing preferred perpetual stocks to raise the capital for BTC buys. They include Stretch [STRC], Strike [STRK], Stride [STRD], and Strife [STRF].

But Stretch [STRC] appeared to be the most favorable perpetual preferred stock, going by the largest $2.5 billion raise that was finalized recently to buy over 21K BTC.

It has a variable yield based on market performance, and Saylor billed it as a ‘treasury BTC,’ more like a money market fund.

In contrast, he presented the common stock MSTR as ‘amplified BTC’ for those seeking a 2x BTC exposure.

In fact, Saylor viewed MSTR as undervalued at current levels, citing its $24B estimated net income and shared the firm’s post that stated,

“Strategy is misunderstood and undervalued $MSTR”

In a note to clients, Wall Street analysts at Benchmark echoed the same and placed a buy rating for MSTR with a price target of $705, adding that,

“The upshot is that MSTR is not just buying bitcoin anymore, but instead engineering a corporate treasury machine designed to generate Bitcoin-denominated returns, manage its capital raises with precision, and scale faster.”

At press time, MSTR was valued at $366.63, down 8.7% during the intra-day trading session on the 1st of August.

BTC was down only 2% over the same period.

Post Comment