Why Savvy Interactive Brokers Singapore Investors Are Flocking to the LionGlobal Short Duration Bond ETF (SBO) — And You Should Too

Ever stumble upon something so familiar yet suddenly see it in a whole new light? That was me when a friend nudged me about a LionGlobal fund seminar. At first glance, a Short Duration Bond fund seemed ancient news—why the fuss over an oldie? Then, bam! It hit me: it’s an ETF. Suddenly, what felt like yesterday’s news became today’s treasure. This LionGlobal Short Duration Bond Active ETF isn’t about being flashy or revolutionary; it’s about being remarkably practical. If you’re the type who likes keeping your money organized—think envelope budgeting meets savvy investing—or if you’re hunting for a short-duration, high-quality fixed income option in SGD, free from estate tax hiccups and withholding tax troubles, this fund might just be your new best friend. It’s not about being better than the rest; it’s about fitting perfectly into a niche that’s often overlooked. Curious how an old fund reinvented as an ETF can revolutionize your portfolio? Let’s dive deep into the layers of risk, return, and strategy behind this intriguing option.

img#mv-trellis-img-1::before{padding-top:109.98925886144%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:97.627118644068%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:69.550173010381%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:66.89453125%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:19.820828667413%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:78.7109375%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:64.0625%; }img#mv-trellis-img-7{display:block;}img#mv-trellis-img-8::before{padding-top:73.103448275862%; }img#mv-trellis-img-8{display:block;}img#mv-trellis-img-9::before{padding-top:153.29341317365%; }img#mv-trellis-img-9{display:block;}img#mv-trellis-img-10::before{padding-top:47.0703125%; }img#mv-trellis-img-10{display:block;}img#mv-trellis-img-11::before{padding-top:45.5078125%; }img#mv-trellis-img-11{display:block;}img#mv-trellis-img-12::before{padding-top:45.60546875%; }img#mv-trellis-img-12{display:block;}img#mv-trellis-img-13::before{padding-top:49.90234375%; }img#mv-trellis-img-13{display:block;}img#mv-trellis-img-14::before{padding-top:29.166666666667%; }img#mv-trellis-img-14{display:block;}img#mv-trellis-img-15::before{padding-top:49.90234375%; }img#mv-trellis-img-15{display:block;}img#mv-trellis-img-16::before{padding-top:59.66796875%; }img#mv-trellis-img-16{display:block;}

One of my friend shared with me this LionGlobal Fund seminar.

When I saw that it was on a LionGlobal Short Duration Bond fund, I dismissed it and wonder why are they doing a road show on an old fund. Then I looked carefully and saw its an ETF.

Immediately, everything clicked in my head and I exclaimed “This LionGlobal Short Duration Bond Active ETF can be useful!”

Some readers might be wondering what is so special about a fund that has existed for so long. And why is this better than other bond funds out there.

I didn’t say it’s better, I said it is useful.

The LionGlobal Short Duration fund triangulates nicely if you are looking for the following:

- You wish to keep certain pools of money inside one main account. This is so that you can do whatever envelope budgeting or be able to do liability/goal matching. Basically, be able to easily tell “I have $XXX and this money is for YYY”

- You wish to keep some money that is cash like. Whether this is a pseudo war-chest or some more cash like allocation. This will read that you need something with very short duration in fixed income-speak.

- You want the returns to be better, but in a passive manner (that you don’t have to keep fidget around).

- You want to keep the money in SGD.

- You want the money to be invested with adequately high quality.

- If you passed away, this pool of money should not have estate tax problems.

- The distribution should not have withholding tax issues.

There is not anything that I can recall that will fit this criteria if you wish to house this in a brokerage such as Interactive Brokers. You won’t have a problem if your broker is Moomoo because you can invest in funds like the unit trust version of this LionGlobal fund, the United SGD fund.

But if you want to house everything in Interactive Brokers Singapore, this LionGlobal Short Duration Active ETF SGD fund would be ideal.

This one will not be useful if you are on Interactive Brokers LLC because it does not allow you to trade Singapore securities. Those on LLC might want to open a Interactive Brokers Singapore account and move over but that is a topic for another day.

In a way, this will not benefit Daedalus Income Portfolio since it is on IBKR LLC but should be good for Crystalys since it is on IBSG.

But its not a perfect fund per say. For one, its an actively managed fund, so there is something for you to contend with. But it is useful because of the currency, and duration limits, which is what might make this fund useful for what I mentioned above.

In this article, I will try to dump all that we can find that might be useful about the Short Duration fund. I think we will discuss about the return and risk dynamics of a fund like the short duration fund.

Main Information about the Active ETF SGD Class of the LionGlobal Short Duration Bond Fund.

LionGlobal listed a class of fund of their existing unlisted LionGlobal Short Duration Bond fund.

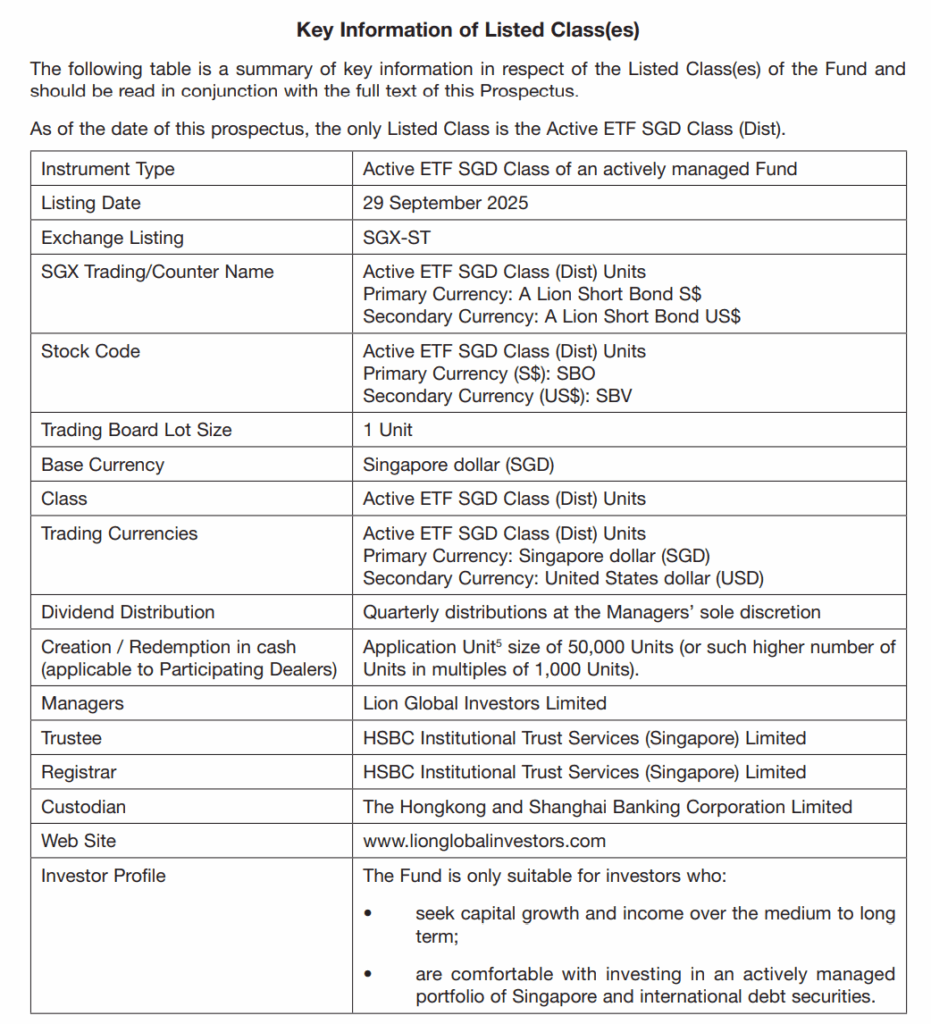

The prospectus shows the key information:

There is a SGD and also USD-hedged class and while the SGD one is what I am more interested in, some may find the USD-hedged one interesting if they like the duration. If it is USD hedged you may have more options in those London Stock Exchange (LSE) listed UCITS ETFs. They would achieve the same purpose.

This fund will make quarterly distributions. Personally I prefer the fund to be accumulating instead of paying out distributions but this is not such a biggy.

They will be listed on 29th Sep 2025 and once they are listed, you can buy them by searching up the ticker SBO or SBV, the number of units and the price you want to pay (should be close to the NAV).

You will have to pay a commission like a stock, so your one time cost will depend on the amount you transact. I have S$1500 transactions that cost me $3.43 in commissions on Interactive Brokers Singapore (0.23%) and S$2000 that cost me 0.18% and S$4400 that cost me 0.13%.

So the quantum might be a problem unlike unit trust but you won’t pay recurring platform.

We will discuss liquidity later.

The fund managers listed:

- Chu Toh Chieh

- Jessica Soon

Toh Chieh is also the listed fund manager for the existing unlisted LionGlobal Short Duration Bond Funds.

The turnover ratio, which is the buy or sell of the underlying investments as a percentage of daily average NAV for all funds is 39%. This is after all an active fund.

The main fees, which is the management fees is 0.25% listed:

I picked up the following small portion from the prospectus:

I guess that is the disappointing thing about Singapore-listed ETFs. Unlike the UCITS ones, where you can download the holdings and see in detail what it owns, you won’t be able to review with the Singapore-listed ETFs.

And people wonder why the Singapore-listed ETFs is not so well received. I always have problems finding very simple thing like average yield-to-maturity, or average maturity period on some local listed ETFs.

Some Resources if You Wish to Research Up on the LionGlobal Short Duration Bond Active ETF Fund

- Prospectus that is updated 1st September 2025

- Official site of the LionGlobal Short Duration Bond Fund (Active ETF SGD Class)

- Official site of the LionGlobal short Duration Bond Fund Class A SGD (Acc)

Current Unlisted Classes of LionGlobal Short Duration Bond Fund

In the prospectus, the new ETF is listed as a Listed Class(es) but there are a bunch of Unlisted Classes:

- Class A (SGD) (Dist) – Incepted in 22 Mar 1991 – Can invest for SRS, CPF OA, and CPF SA

- Class A (SGD) (MDist) – 08 May 2024

- Class A (USD Hedged)(Dist) – 04 Jan 2016

- Class A (SGD) (Acc) – 28 Dec 2016

- Class A (USD Hedged)(Acc) – 25 Jun 2020

- Class I (SGD) (Acc) – 28 Dec 2016

- Class I (USD Hedged) (Acc) – 09 Jul 2021

- Class I (SGD) (Dist) – 08 Jul 2014

- Class I (USD Hedged)(Dist) – 28 Apr 2016

The difference between A and I is whether the class if for institutional investors. They have different management fees charged with I being lower. MDist stands for monthly distributions while Dist stands for the class that distributes. Acc stands for the class that reinvest and does not distributes.

The longest running fund (the Class A SGD distribution) is almost 34 years old. It is also the fund where you can invest with any kind of your money.

How Diversified is the LionGlobal Short Duration Bond Fund?

I think if we are putting our important money into this, surely it is important to know how diversified is the fund right?

I have to really dig to find the information:

There will be 227 fixed income securities with mostly in Singapore. Actively managed fixed income funds are usually not the most diversified.

Current Yield and Credit Quality

The Yield-to-Maturity can be viewed as the valuation or the price of the fixed income security. It is what you can earn on a compounded basis if you hold a fixed income security to maturity. There is also variation to this call Yield-to-Worst, which is useful if the fixed income security can be called earlier and you want to find out what is the compounded return if you hold till the call period.

A 3.18% yield to maturity is the current value, and you can compare this against a government bond that has the same duration. Of course, greedy or returns seeking investors will be interested to see if the yield-to-maturity is high enough. And so far it still looks good.

This yield is as of 31st Jul 2025

The 1-year Singapore govt bond yields 1.68% and the 2-year yields 1.70% at 31st Jul 2025.

So there is roughly a 1.5% credit premium for taking on higher risk instead of government securities.

The current credit quality on average is a A-.

The prospectus did not state what kid of credit quality of fixed income is the fund limited to. The current credit quality ranks it to be safer than investment grade fixed income.

Maximum Duration is 4 but Current Duration about 2.25.

From the last updated data, the average duration of the LionGlobal Short Duration Fund is about 2.25 years.

The prospectus state that the duration will be less than 4:

How important is the average duration of a fixed income fund Kyith?

Very important. Aside from the currency, the credit rating, the duration is vital to planning and why the LionGlobal Short duration bond Active ETF is at a sweet spot.

The duration measure the sensitivity of a fixed income to a change in interest rate. If the market interest rate goes up, bond prices of a bond that has been issued goes down because the price has to go down so that the yield will be higher to match the current market interest rate.

If market interest rate goes down, bond prices of an issued bond goes up.

As a rule of thumb, if the current duration is 2.25 years, if the market interest rate goes down by 1%, the fixed income price will go up by 2.25%. If the interest rate goes down 2%, then the price will go up by 2 x 2.25% = 4.5%.

So if you are a fixed income that of duration 15, and the interest rate goes up by 2%, the price should go down by 30%!

The duration is affected by the coupon, the yield-to-maturity and most notably the maturity of the bond.

- Lower coupon: higher modified duration.

- Lower yield to maturity: higher modified duration.

We will talk more about duration and planning when we talk about LionGlobal Short Duration Bond’s past drawdowns.

The Benchmark Indexes

For SGD: 3-month Singapore Overnight Rate Average (SORA) + 0.35%

For USD-Hedged: United States 90 day Average Secured Overnight Financing Rate (SOFR90A Index) + 0.50%

Each benchmark is used as a target for the relevant Class to beat and a reference for investors to compare against the relevant Class’ performance.

The Annual Expense Ratios of the Unlisted LionGlobal Short Duration Bond Funds

The prospectus provides a good summary of the total expense ratio incur by different class of shares recently:

The footnotes is also a good read of what are the costs that is not factored into a typical expense ratio.

A lot of people imagine that the expense ratio will include everything which is not the case.

The main difference in cost is distinctly between A class and I class with the I class lower.

We don’t have the expense ratio for the Active ETF because the fund isn’t formed yet.

The annual management fee for all funds is around 0.25% p.a.

Why Not Just Keep the Cash in Interactive Brokers’ Cash Since The Cash Earns Interest?

The interest on Interactive Brokers is based on certain tiers of investment based on your Net Asset Value.

There is an interest calculator that you can use to calculate this:

I ran this as an example that If my investment is worth $300,000 in SGD and my cash balance is $30,000, the blended rate is pretty low. What I provided is a pretty reasonable scenario.

You won’t earn interest on the first $10,000 so that is why the blended rates look lower.

If you wish to earn higher interest, by taking on some risks that you are willing to take then, you got to invest.

Past Performance of the Unlisted LionGlobal Short Duration Bond Funds.

Now we might be getting to the part that will interest investors: Returns.

LionGlobal provides some returns in their prospectus.

These are the historical annualized returns for the different class of shares:

Now there are a few things that you need to know about fixed income returns: Do not assume what you see in the past is exactly going to be what you will earn!

At work we don’t know get how many clients telling us this fixed income return is so different from in the past.

And that is after we keep telling them not to assume that the historical returns is what they will get.

The historical return tells us if the fund is performing well against their benchmark indexes and also how they perform against government bonds.

The oldest fund class is 34 years old and you can see that since inception, it earned 3.49% after taking into consideration preliminary charges versus 1.82% p.a.

But in the last 3 years and 5 years, the fund was unable to beat the index performance.

Those classes which started in 2020 also failed to beat the benchmark indexes.

How do we tell the performances?

We tell you not to look at historical performances for your future returns because:

- The future performances is based on the average yield-to-maturity (YTM for short) of the portfolio of securities currently own. The yield-to-maturity can be very different from the past.

- The duration of the fund (2.2 years on average and not more than 4 years) is very short, which means the average yield-to-maturity will change a lot.

In 2021, we went through a period where the interest rate yield curve went inverted. Typically a government bond with a longer tenure will yield higher than a government bond with a shorter tenure. The yield curve is upward sloping or in contango.

However, when the curve is inverted, when the shortest tenure fixed income yields more than the longest tenure bonds, the curve is downward sloping or in backwardation.

Since the benchmark index is a 3-month SORA or SOFR90A, the tenure is shorter than what the LionGlobal Short Duration bond held at that time, naturally the future returns of the fund is going to be lower than the benchmark in the future.

We went through a period where the yield curve went from normal to inverted and now it is almost back to normal.

If you invest solely based on historical returns, your brains will be really fxxked trying to understand returns.

In past fixed income articles such as this recent one, I shared this {2 x duration – 1} Rule to estimate how much compounded return you can earn from your fixed income.

In Gabriel A Lozada’s 2016 paper title Constant-Duration Bond Portfolios’ Initial (Rolling) Yield Forecasts Return Best at Twice Duration, he introduce the { 2 x Duration -1 } Rule.

Constant-Duration Bond Portfolios’ Initial (Rolling) Yield Forecasts Return Best at Twice Duration.

It means that if you respect the duration with this { 2 x Duration -1 } formula, you will likely earn the Yield-to-Maturity (or Yield-to-Worst which is more accurate because some fixed income gets called earlier and yield to worst reflects that).

If based on Jul 2025 Factsheet info:

- Average portfolio duration: 2.25 years.

- Average YTM: 3.18%

Based on the {2 x Duration – 1} Rule, which means if you invest and hold for the next {2 x 2.25 -1 = 3.5 years}, your estimated return is 3.18% p.a. Note that this is an estimation based on research, and you should not treat it as your right that you will get that returns exactly.

If the YTM of a 2-year government bond over the same time period (next 2 years) is 1.7%, then you can see holding the LionGlobal Short Duration Bond Active ETF will do better than the government bond, assume the bonds do not default.

Learning from the 1-Year Annualized Return of the LionGlobal Short Duration Bond Class A Accumulating

The Class A accumulating was incepted in Dec 2016, this means we have 8.5 years of NAV data that we can use to help us understand some of the returns concept that we mentioned.

I plotted out the 1-year annualized return of the Class A accumulating below:

What does each point on this chart shows?

It shows if you have $20 million in 30 Apr 2020, and you dump all into the fund, you earn 5.8% for the next year. But if you dump the $20 million in 30 Nov 2021, your $20 million will be down 6.6%.

The 1-year return fluctuates pretty widely.

Many would think that if they put in fixed income they should not lose money so will be disappointed with the losses.

But that will depend on whether you respect the duration. Did you go with a fixed income fund whose average duration is shorter than your time horizon?

The average duration of the LionGlobal Short Duration fund is pretty short and going by the {2 x duration -1} Rule, if you need exactly every cent within six months, this fund might not always be ideal.

We will see more of this concept later.

Now I will usually say that I don’t know how an active fixed income manager will do. They are not the ideal for me as compared to a passive index one.

However, when I invest in a LionGlobal Short Duration bond funds:

- I am taking on more term risks, compare to the no term risk of our savings account. (you can take out your money from a savings account tomorrow and suffer no loss, but in a portfolio of fixed income, your money is locked for an average of X years)

- I am taking on more credit risks, by investing in fixed income securities that has higher risks than insured or government securities.

And therefore my returns should be higher in the longer term as I earn term premium and credit risk premium.

But these are real risks and at times the term premium and credit risk premium is negative.

In the chart below, I overlayed with the LionGlobal Short Duration bond Class A Accumulating with the return of Fullerton Cash Fund A:

The Fullerton Cash Fund is a fund holding a portfolio of fixed deposits. The holding period of fixed deposits is shorter than the LG Short Duration bond and the credit risks is lower.

So you can see that the green line tends to be lower than the blue line, which means the 1-year returns of the Fullerton Cash fund tends to be lower.

But during the most challenging period, which is what I termed the Great Depression in bonds from 14 Sep 2021 to 29 Jan 2024 (29 months), the Fullerton Cash Fund’s 1-year return is pretty positive.

Term premiums are usually positive when we invest and hold for a longer time but at times investing in longer duration fixed income instruments is risky.

The nature of returns and risk of fixed income is pretty explainable by the underlying securities.

Learning from the 3.5-Year Annualized Return of the LionGlobal Short Duration Bond Class A Accumulating

Since the average duration of the LG Short Duration Class A Accumulating is 2.2 years, we can take a look if we respect the duration and hold for 3.5 years:

Lo and behold, your $20 million will not suffer any losses (if there isn’t any big defaults). The lowest return is when you in vest in 28 Jun 2019 and invested for the next 3.5 years and you end up positive but break even.

If this $20 million is meant for something, by respecting the duration, you might not earn a high return but at least you satisfy your main objective which is not to lose money.

Let us overlay with Fullerton Cash Fund A’s return:

I can still remember the years in 2018 and 2019 when investors struggle to find good enough returns so many robos were coming up with Cash Management portfolios with higher yields. The one with only the Fullerton Cash Fund is unpopular because the YTM is just lower.

And you can see that the future 3.5 year return is a tale of two halves. Before Jun 2019 and after.

Fullerton Cash Fund’s return is much lower or you would earn more if you invest in the LG Short Duration Bond fund. But after Jun 2019, you would have done better in the Fullerton Cash Fund.

Term risk is a real risk that if you get the duration speculation wrong, you would be worse off.

But Term risk is not a risk if you understand your financial goals, what you invest in and plan correctly.

I took a look at the 2-year government bond yield on 28 Jun 2019 and it is 1.7%. It is not exactly very low and if you realize, respecting that {2 x Duration -1} Rule didn’t actually made you earn exactly 2-3% p.a. if you held for 3.5 years.

I happen to have a May 2022 LionGlobal Short Duration Fund factsheet:

Firstly notice the weighted credit rating of the portfolio is lower (now it is at investment grade), and the yield to maturity is higher, it goes to show these stuff moves around.

Unfortunately, the latest 3.5 years annualized return that I have is only Mar 2022, which is 2.85%. Not exactly 4.35% but I think investors might not be too disappointed for the low risk that they are subjected to.

8-Year Annualized Return of the LionGlobal Short Duration Bond Class A Accumulating

The term and credit risk premium will become clearer if we look at investing in these fixed income over the longer term.

The chart below is the 8-year rolling annualized return:

If you ask me is there any point in investing in short term fixed income funds and I would ask you does earning 0.5% p.a. more over time is better?

I am not sure what the answer will be because investors keep making choices based on which has a better historical returns. And if that is your lens then based on this historical returns what is your choice?

The LG Short Duration Bond fund right?

I will say… don’t bother about this so much, size up your nearer term financial goals appropriately and just fund enough and invest in higher risk higher return stuff!

Spend your time bother about the more important stuff than to worry about if a 2-year duration stuff is going to do better than a less than 1 year fixed deposit.

Learning about How Deep the Drawdowns Can Get

We say we will talk more about how important Duration is and here we will revisit it.

The chart below plots the degree of drawdown of the LionGlobal Short Duration Bond Class A Accumulating from Dec 2016 to today:

I think your eyes will zoom immediately to that “humongous” drawdown.

If you put in $20 million at the start in 14 Sep 2021, you will be down $1.5 million at the deepest.

Only to recover all 29 months later.

Given the average quality of the portfolio, the risk of massive default is low (the largest bond is 2% of the portfolio so if that bond defaults, and the fund manager gets nothing back in a liquidation process, the fund performance is down 2%).

The bond dynamics (that its an obligation to pay back the principal and the coupons) mean that the unrealized losses is temporary.

What could dramatically reduce the performance is the active fund manager. They can sell large chunks of bonds and buy them so that it will look good in the factsheets.

That humongous drawdown happen during a period where interest rate went from near 0% to 4%.

That is like a 400% increase.

Now if the average duration of the LG Short Duration bond fund is 2 years and we have a 4% increase in interest rates, the likely drawdown is 2 x 4% = 8%.

Which is roughly what we see in the depths of that period.

To give you some context the TLT, which is a 20-year maturity US government bond, is down 40% since 14 Sep 2021 and has not recovered yet!

The AGGU which is in Daedalus Income portfolio, has an average duration of 6.2 years. The deepest drawdown since 14 Sep 2021 was -15%, reached in October 2022. Today, the AGGU is up a cumulative 0.8% which means after 4 whole years it has just recovered, taking 19 more months than a 2 year duration fund.

I don’t expect every time to be like this Great Depression in fixed income.

I also showed the other drawdowns of the short duration bond fund and you realize it is pretty manageable. The drawdowns typically are not more than 1%.

Wealth Planning Around the LionGlobal Short Duration Active ETF Bond

If we add everything together, you would realize that the LG short Duration Active ETF bond rest in that sweet spot if you need some parts of your portfolio to be:

- Expose to more credit and term risks… but not as much as the Nikko ABF Bond Index Fund and the Nikko SGD Investment Grade Corporate Bond Index ETF (now they are known as Amova)

- Need it to be in SGD.

- Are okay with the occasional 1-2% drawdowns and at most 4% drawdowns because not all your money will be there.

- And you know that based on fixed income principals the money will recover.

- Even if you are selling at a loss, it is a small loss and you are reallocating to something with higher potential return.

It is an active fund but the manager has been around for a while and hopefully don’t do weird things.

Now realistically how liquid can this be.

For starters, you can only sell parts of it during trading hours which means weekday.

If you are on a margin IBSG account, you should be able to withdraw the money and it should arrive in the next few hours if you don’t sell too late. Transfers to bank by IBSG is also based on business days.

Unless you need it during a period of long official holidays, you should be looking at 3 days liquidity.

The Great Depression in Fixed Income also gives us an opportunity to see just how deep the drawdown can be. And if you want to make sure you fund more to prevent this kind of situation, you have an answer. 6-10% more funding would be pretty decent.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment