Why Singapore Savings Bonds’ September 2025 Yield Drop to 2.11% Could Be the Opportunity Investors Are Missing Right Now

Here we go again—a brand-new issue of Singapore Savings Bonds has just hit the market, and if you’re like me, tracking these monthly sneak peeks has become something of a habit (since October 2015, no less!). But here’s a little brain teaser: in a world buzzing with investment options, how does locking your money in a ten-year government-backed bond yielding 2.11% stack up against the allure (or dare I say, the boredom) of short-term yields dipping to 1.71% if cashed out after just one year? Imagine watching your $10,000 quietly morph into $12,134 over a decade—slow and steady or just steady? And hey, this isn’t just any bond. It’s backed by Singapore’s government and open to a broad ambit of investors, including Permanent Residents and even savvy foreigners with CDP or SRS accounts. So, are these bonds your financial safe harbor or just the polite adult in the room of investments? Let’s unravel the numbers, the nuances, and the nitty-gritty so you can decide if the Singapore Savings Bonds deserve a slice of your portfolio now. LEARN MORE

img#mv-trellis-img-1::before{padding-top:52.63671875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:25%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:34.5703125%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:77.83203125%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:38.825214899713%; }img#mv-trellis-img-5{display:block;}

There is a new issue of Singapore Savings Bonds.

I have tracked almost every issue of Singapore Savings Bond since its issue in Oct 2015.

The September 2025 SSB bonds (SBSEP25 GX25090A) yield an interest rate of 2.11%/yr for the next ten years. You can apply through ATM or Internet Banking via the three banks (UOB, OCBC, DBS)

However, if you only hold the SSB bonds for one year, with two semi-annual payments, your interest rate is 1.71%/yr.

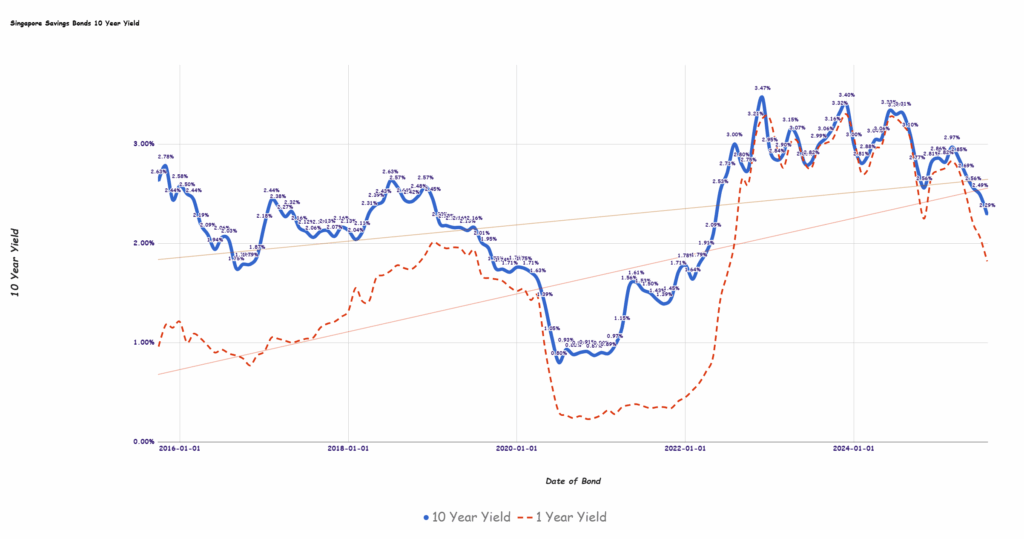

The one-year SSB yield seems to be heading down, showing a less flat curve.

$10,000 will grow to $12,134 in 10 years.

The Singapore Government backs this bond, which you can invest in if you have a CDP or SRS account (this includes Singapore Permanent Residents and Foreigners).

A single person can own not more than SG$200,000 worth of Singapore Savings Bonds. You can also use your Supplementary Retirement Scheme (SRS) account to make a purchase.

You can find out more information about the SSB here.

Note that every month, there will be a new issue you can subscribe to via ATM. The 1 to 10-year yield you will get will differ from this month’s ladder, as shown above.

Last month’s bond yields 2.29%/yr for ten years and 1.82%/yr for one year.

Here is the current historical SSB 10-Year Yield Curve with the 1-Year Yield Curve since Oct 2015, when SSB was started (Click on the chart, and move over the line to see the actual yield for that month):

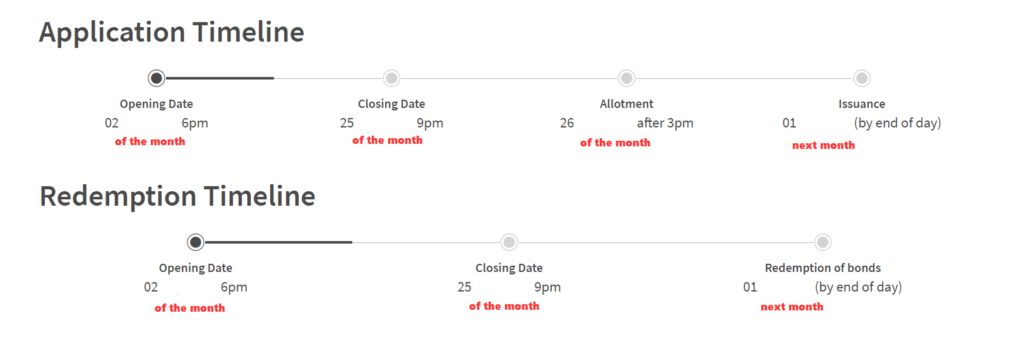

How to Apply for the Singapore Savings Bond – Application and Redemption Schedule

You will apply for the bonds throughout the month. At the end of the month, you will know how many of the bonds you applied were successful.

Here is the schedule for application and redemption if you wish to sell:

You have from the second day of the month to about the 25th of the month (technically the 4th day from the last working day) to apply or decide to redeem the SSB you wish to redeem.

Your bond will be in your CDP on the 1st of the following month. You will see your cash in your bank account linked to your CDP account on the 1st of next month.

You May Not Get All the Singapore Savings Bonds That You Apply For

Do note that when you apply for the Singapore Savings Bonds, you may not get all that you apply for. Think of this as you are bidding for an amount which is determined by the demand and supply of Singapore Savings Bonds.

When the interest rate is low, the demand tends to be lower relative to history, and you can get a more significant amount. Still, if the interest rate is very high, demand can be so overwhelming that you may get a small portion you apply for.

For example, in the August 2022 issue, you can apply for $100,000, but the maximum allotted amount per person was $9,000 only. If you applied for $8,000, you would get your total $8,000 allocation.

To review the past allotment trend, you can take a look at SSB Allotment Results here.

How do the Singapore Savings Bonds Compare to SGS Bonds or Singapore Treasury Bills?

Singapore savings bonds are like a “unit trust” or a “fund” of SGS Bonds.

But what is the difference between buying SGS Bonds and its sister, the T-Bills, directly?

The Government also issues the SGS Bonds and T-Bills, which are AAA rated.

Here is a MAS detailed comparison of the three:

The main advantage of the 1-year SGS Bonds and Six-month Singapore Treasury Bills is that you can get a more significant allocation currently compared to the Singapore Savings Bonds. This means that if you need to earn a good interest yield of $400,000, you get a better chance to fulfil that with 1-year SGS Bonds and Six-month Treasury Bills.

The short-term interest rates are getting rather exciting, and short-term SGS bonds and treasury bills may be applicable to supplement your Singapore Savings Bonds allocation.

I wrote a guide to show how you can easily buy the Singapore Treasury Bill and SGS Bonds here. You can read How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

My Past Value Add Articles Regarding the Singapore Savings Bonds

Read my past write-ups:

- This Singapore Savings Bonds: Liquidity, Higher Returns and Government Backing. Dream?

- More details of the Singapore Savings Bond. Looks like my Emergency Funds now

- Singapore Savings Bonds Max Holding Limit is $200,000 for now. Apply via DBS, OCBC, UOB ATM

- Singapore Savings Bonds’ Inflation Protection Abilities

- Some instructions on how to apply for the Singapore Savings Bonds

Past Issues of SSB and their Rates:

- 2015 Oct, Nov, Dec

- 2016 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2017 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov

- 2018 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2019 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2020 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Oct, Nov, Dec

- 2021 Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2022 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2023 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2024 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec

- 2025 Jan, Feb, Mar, Apr, May, Jun, Jul, Aug

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | $20,000″ data-order=”> $20,000″>> $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | $1,000″ data-order=”> $1,000″>> $1,000 | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | $1,000″ data-order=”> $1,000″>> $1,000 | |

| SGS 1-Year Bond | 3.72% | 12M | $1,000″ data-order=”> $1,000″>> $1,000 | |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y – 3Y | $10,000″ data-order=”> $10,000″>> $10,000 | |

| Money-Market Funds | 4.2% | 1W | $100″ data-order=”> $100″>> $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment