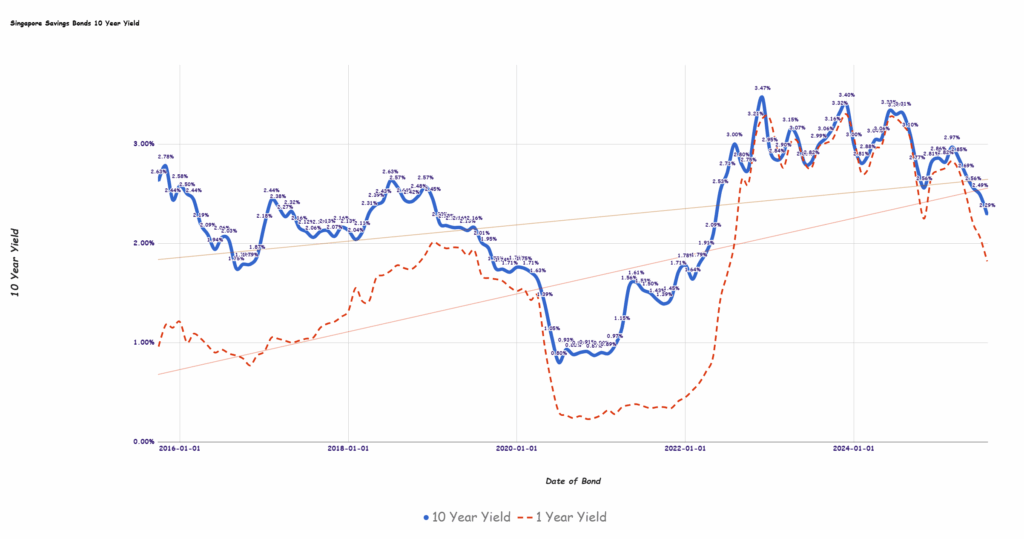

Why Singapore Savings Bonds’ September 2025 Yield Drop to 2.11% Could Be the Opportunity Investors Are Missing Right Now

How do the Singapore Savings Bonds Compare to SGS Bonds or Singapore Treasury Bills?

Singapore savings bonds are like a “unit trust” or a “fund” of SGS Bonds.

But what is the difference between buying SGS Bonds and its sister, the T-Bills, directly?

The Government also issues the SGS Bonds and T-Bills, which are AAA rated.

Here is a MAS detailed comparison of the three:

The main advantage of the 1-year SGS Bonds and Six-month Singapore Treasury Bills is that you can get a more significant allocation currently compared to the Singapore Savings Bonds. This means that if you need to earn a good interest yield of $400,000, you get a better chance to fulfil that with 1-year SGS Bonds and Six-month Treasury Bills.

Post Comment