Why Singapore’s 6-Month T-Bill Yield Drop to 1.40% Could Be the Sneaky Opportunity Savvy Investors Are Missing in 2025

Ever wondered if you could snag a piece of Singapore’s rock-solid financial fortress without breaking a sweat? Well, here’s your chance — on Thursday, 11th September 2025, a fresh batch of Singapore Treasury Bills (BS25118F) hits the auction block. Whether you’re a savvy Singaporean, a Permanent Resident, or even a curious non-resident, getting in on this is as straightforward as it gets. Just remember, the deadline to place your bets — via Internet banking or in person — is the 10th of September. Now, the big question is: will you play it safe with a non-competitive bid and settle for the cutoff yield that last clocked in at 1.44%, or will you channel your inner financial strategist and shoot for a competitive bid, aiming to secure every dollar you want? Intrigued? There’s plenty more beneath the surface, including insights from the daily dance of yields on existing T-bills and MAS bills that can clue you in on what’s coming next — because timing and knowledge, my friend, make all the difference in the game of bonds. Buckle up, and let’s dive into what these Treasury Bills mean for your portfolio and how to make the most of this auction. LEARN MORE

img#mv-trellis-img-1::before{padding-top:55.098389982111%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:117.4081237911%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:148.9666136725%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:78.776041666667%; }img#mv-trellis-img-4{display:block;}

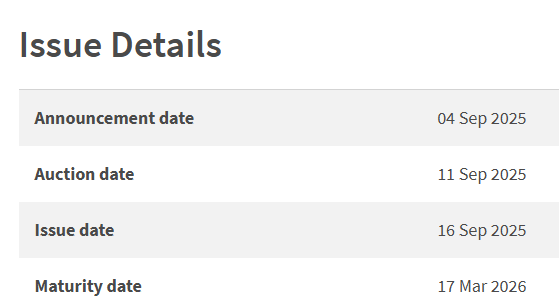

A Singapore Treasury Bill issue (BS25118F) will be auctioned on Thursday, 11th Sep 2025.

If you wish to subscribe successfully, you must place your order via Internet banking (Cash, SRS, CPF-OA, CPF-SA) or in person (CPF) by 10th Sep. Singaporeans, PR, and non-Singaporeans can all buy these Singapore Treasury Bills.

You can view the details at MAS here.

In the past, I have shared with you the virtues of the Singapore T-bills, their ideal uses, and how to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

The Tbill cut-off yield in the last auction is 1.44%.

If you select a non-competitive bid, you may be pro-rated the amount you bid and would yield 1.44%. If you would like to ensure you secured all that you bid, it will be better to select a competitive bid, but you need to get your bid right.

Some past non-competitive auctions were pro-rated. Here are some past examples:

In competitive bidding, if your bid is lower than the eventual cut-off yield (in the example below), you will get 100% of what you bid for at the cut-off yield (not the lower yield that you bid for).

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing Singapore T-bills.

The table below shows the current interest yield the six-month Singapore T-bills is trading at:

The daily yield at closing gives us a rough indication of how much the 6-month Singapore T-bill will trade at the end of the month. From the daily yield at closing, we should expect the upcoming T-bill yield to trade close to the yield of the last issue.

Currently, the 6-month Singapore T-bills are trading close to a yield of 1.44%, 20 basis points lower than the yield two weeks ago.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing MAS Bills.

Typically, the Monetary Authority of Singapore (MAS) will issue a 4-week and a 12-week MAS Bill to institutional investors.

The credit quality or risk of the MAS Bill should be very similar to that of Singapore T-bills since the Singapore government issues both. The 12-week MAS Bill (3 months) should be the closest term to the six-month Singapore T-bills.

Thus, we can gain insights into the yield of the upcoming T-bill from the daily closing yield of the 12-week MAS Bill.

The cut-off yield for the latest MAS bill auctioned on 2nd Sep (3 days ago) is 1.44%. The MAS bill is 20 basis points lower than the last issue two weeks ago.

Currently, the MAS Bill trades close to 1.45%.

Given that the MAS 12-week yield is at 1.45% and the last traded 6-month T-bill yield is at 1.41%, what will likely be the T-bill yield this time round?

What we are observing is:

- The interest at 3-month is falling at a slower pace than the 6-month.

- The interest at the 6-month is not falling at a greater pace. The more dramatic part is at the 10-year part.

Given where things are I am incline to think that yields will be at slightly lower at 1.40%.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | $20,000″ data-order=”> $20,000″>> $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | $1,000″ data-order=”> $1,000″>> $1,000 | |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | $1,000″ data-order=”> $1,000″>> $1,000 | |

| SGS 1-Year Bond | 3.72% | 12M | $1,000″ data-order=”> $1,000″>> $1,000 | |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y – 3Y | $10,000″ data-order=”> $10,000″>> $10,000 | |

| Money-Market Funds | 4.2% | 1W | $100″ data-order=”> $100″>> $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment