Why T Rex’s 2x BitMine ETF’s $32M Debut Is Turning Heads—and What It Means for Your Portfolio in 2025

Ever wondered what it takes for a new ETF to make a blockbuster entrance in the bustling crypto market? T-Rex’s 2X BitMine ETF (BMNU) just threw its hat in the ring, raking in a jaw-dropping $32 million on its very first day—securing the crown as the third-best ETF launch of 2025. It’s like watching a sprinter leap ahead in a crowded race, fueled by the growing enthusiasm for leveraged crypto investments and BitMine’s ambitious Ethereum strategy. This ETF doesn’t just offer a ticket to crypto exposure; it doubles down with 2X daily leveraged returns tied to BitMine’s stock, making it a tempting catch for investors hungry for amplified gains. But what’s really driving this surge, and can BitMine’s mission to hoard 5% of the Ethereum supply rewrite the rules of crypto investing? Let’s peel back the layers of this exciting debut. LEARN MORE.

Rising institutional demand accelerates leveraged crypto ETF popularity as BitMine’s Ethereum strategy fuels investor enthusiasm.

Photo: PJ McDonnell

Key Takeaways

- T-Rex’s 2X BitMine ETF (BMNU) recorded $32 million in trading volume on its first day, making it the third-best ETF launch of 2025.

- BMNU offers investors 2X leveraged daily exposure to BitMine’s stock performance, appealing to those seeking amplified returns tied to cryptocurrency-related firms.

Share this article

T-Rex launched its 2X BitMine ETF (BMNU) today, generating $32 million in first-day trading volume and ranking as the third-best ETF debut of 2025, according to Bloomberg ETF analyst Eric Balchunas.

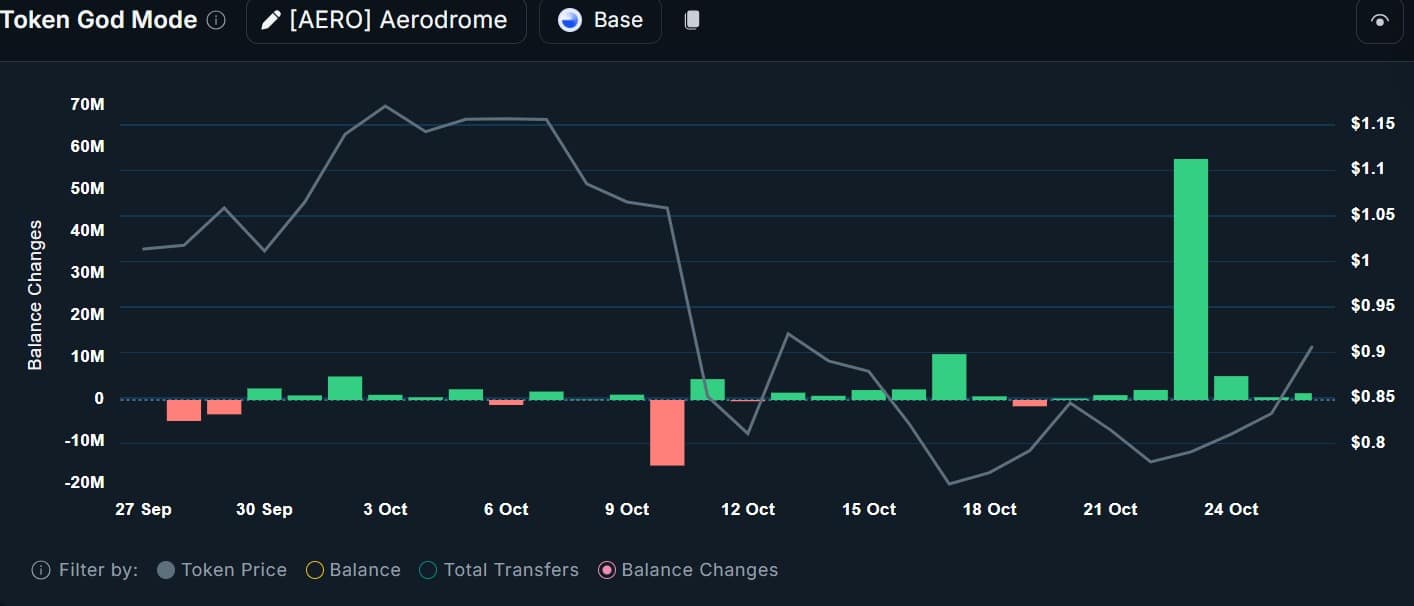

The fund provides 2x daily leveraged exposure to BitMine Immersion Technologies (BMNR), which holds 2.4 million ETH valued at $9.6 billion. The product capitalizes on growing investor interest in companies with substantial crypto treasury holdings, particularly those focused on Ethereum accumulation.

BMNU’s debut volume trails only the XRP ETF and Dan Ives ETF among approximately 650 ETFs launched in 2025. The strong opening reflects a robust appetite for leveraged crypto exposure products amid rising institutional adoption of digital assets.

BitMine has positioned itself as a leading Ethereum accumulator. The company has signaled ambitions to reach a 5% Ethereum supply target.

Share this article

Post Comment