Why the Aussie Dollar’s Sudden Surge Could Signal a Hidden Opportunity Amid RBA’s Cautious Inflation Warning

Ever wonder why the Australian Dollar suddenly decided to put on its running shoes against the US Dollar this Friday? It turns out the Aussie’s latest sprint is fueled by some carefully measured words from none other than RBA Governor Michele Bullock. Now, Bullock’s take wasn’t exactly a mic-drop moment—she pointed to sticky services inflation and a labor market that’s tight but flirting with balance. It’s like walking a tightrope, with inflation expectations creeping up to a 4.8% peak since June, which has central bankers tightening their grip and traders expecting a pause on interest rate moves for now. Meanwhile, the US Dollar is standing its ground—steady as a rock amid political gridlocks and whispers of rate cuts. So, while the AUD/USD pair edges upward, it’s a mix of cautious optimism and technical nudges that are sending the market into a dance, targeting key moving averages and higher price channels. Curious about how these dynamics will play out and what it means for your portfolio? Dive deeper into the evolving story here: LEARN MORE

The Australian Dollar (AUD) advances against the US Dollar (USD) on Friday, recovering its recent losses registered in the previous session. The AUD/USD pair gains ground following the cautious remarks from the Reserve Bank of Australia (RBA) Governor Michele Bullock.

RBA Governor Bullock stated on Friday that services inflation remains somewhat sticky. Bullock noted that second-quarter inflation came in slightly above expectations but is moving in the right direction. She emphasized the need for caution, given the volatility of the monthly CPI data, and added that the labor market remains somewhat tight but may be nearing balance.

Australia’s Consumer Inflation Expectations for October rose to 4.8% from 4.7% prior, marking the highest reading since June. The mounting concerns that Australia’s inflation may exceed forecasts in the third quarter support the cautious stance surrounding the Reserve Bank of Australia. Traders expect Australia’s central bank to maintain its interest rates after deciding to keep its Official Cash Rate (OCR) unchanged at 3.6% in September.

Australian Dollar gains ground despite a stable US Dollar

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is remaining steady after a four-day winning streak and trading around 99.40 at the time of writing. The US Senate remained deadlocked on legislation to end the government shutdown on Friday.

- The Federal Open Market Committee (FOMC) Minutes from the September meeting suggested policymakers are leaning toward further rate cuts this year. The majority of policymakers supported the September rate cut and signaled further reduction later this year. However, some members favored a more cautious approach, citing concerns about inflation.

- The CME FedWatch Tool suggests that markets are now pricing in a 95% chance of a Fed rate cut in October and an 82% possibility of another reduction in December.

- Federal Reserve (Fed) Board of Governors member Stephen Miran expressed his belief on Tuesday that inflation itself is simply a cause of “population increases”. Monetary policy needs to ease to get ahead of the shift down in the neutral rate, Miran added.

- Minneapolis Fed President Neel Kashkari struck a more reserved tone than some of his Fed counterparts on Tuesday, cautioning that it’s still too soon to be able to tell if tariff-led inflation will be “sticky” or not. However, Kashkari noted that he’s particularly bullish on the labor market and is expecting a return to form for American job creation, which has sputtered recently.

- Kansas City Fed President Jeffrey Schmid delivered hawkish remarks on Monday, saying that the Fed must maintain its inflation credibility and stressed that inflation is too high. Schmid added that monetary policy is appropriately calibrated.

- China’s Commerce Ministry announced on Thursday that the country will tighten rules on rare earth exports, effective December 1. Foreign businesses and individuals must obtain a dual-use items export license for rare earth exports.

- Private house approvals in Australia declined by 2.6% month-over-month (MoM) to 9,027 units in August, as expected, and reversing a 1.3% rise in the previous month. Meanwhile, the seasonally adjusted Building Permits fell by 6% MoM to 14,744 units, following a 10% decrease previously, marking the second consecutive monthly decline.

- University of Melbourne reported on Tuesday that Australia’s Westpac Consumer Confidence declined 3.5% month-over-month (MoM) to 92.1 in October, a sharper decline than the previous 3.1% fall, marking the fastest drop since April. ANZ Job Advertisements slipped 3.3% MoM in September, a much steeper drop than the previous decline of 0.3%.

- TD-MI Inflation Gauge showed a 0.4% increase month-over-month in September, rebounding from a 0.3% fall in the prior month. Meanwhile, the annual inflation gauge rose 3%, following a 2.8% increase in the previous period.

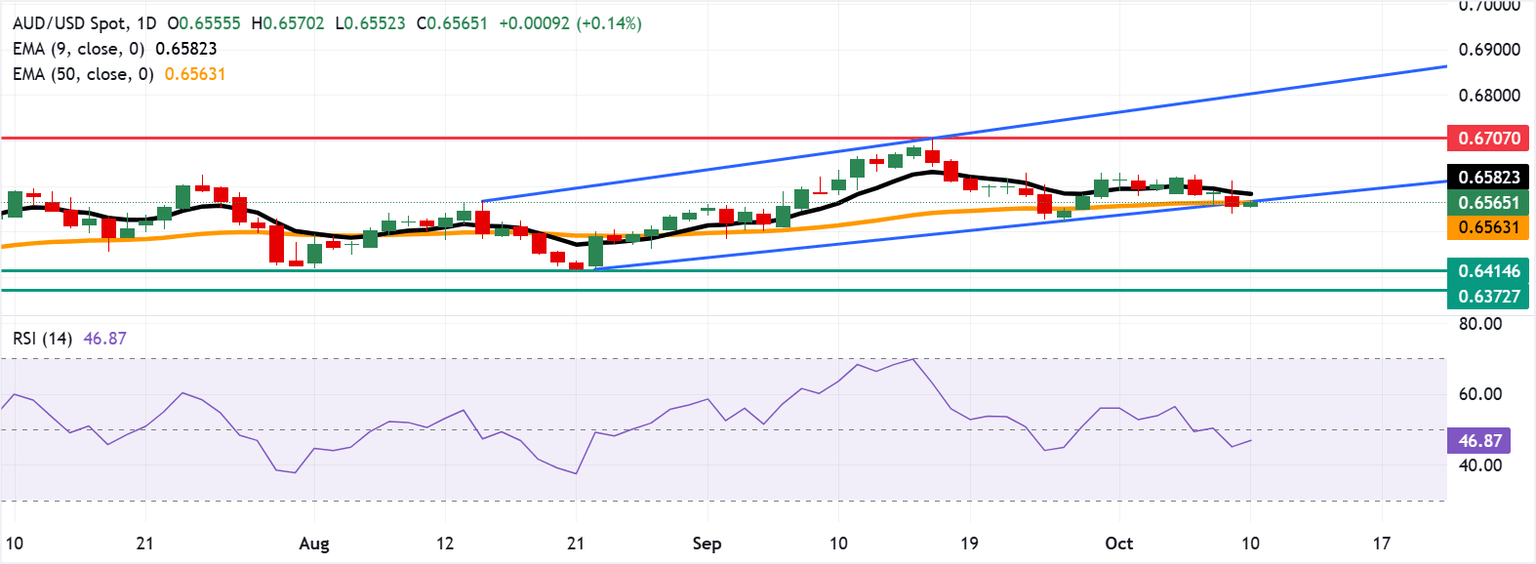

Australian Dollar rebounds toward nine-day EMA within ascending channel

The AUD/USD pair is trading around 0.6570 on Friday. Technical analysis on the daily timeframe suggests that the pair is rebounding toward the ascending channel, indicating a revival of a bullish bias. However, the 14-day Relative Strength Index (RSI) remains below the 50 level, suggesting a bearish bias is in play.

On the downside, the AUD/USD pair is testing the immediate support at the 50-day Exponential Moving Average (EMA) of 0.6563. A break below this level would dampen the medium-term price momentum, which may prompt the pair to navigate the region around the four-month low of 0.6414, recorded on August 21, followed by the five-month low of 0.6372.

A return to the ascending channel would revive the bullish bias and lead the AUD/USD pair to target the initial barrier at the nine-day EMA of 0.6582. Further advances above this level would improve the short-term price momentum and lead the AUD/USD pair to explore the region around the 12-month high of 0.6707, recorded on September 17, followed by the channel’s upper boundary around 0.6810.

AUD/USD: Daily Chart

Australian Dollar Price Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.06% | 0.08% | -0.03% | -0.18% | 0.11% | -0.06% | |

| EUR | 0.02% | 0.00% | 0.02% | -0.02% | -0.12% | -0.10% | 0.06% | |

| GBP | 0.06% | -0.00% | 0.06% | -0.06% | -0.13% | 0.11% | 0.00% | |

| JPY | -0.08% | -0.02% | -0.06% | 0.00% | -0.17% | 0.06% | -0.02% | |

| CAD | 0.03% | 0.02% | 0.06% | -0.01% | -0.20% | 0.12% | 0.06% | |

| AUD | 0.18% | 0.12% | 0.13% | 0.17% | 0.20% | 0.26% | 0.13% | |

| NZD | -0.11% | 0.10% | -0.11% | -0.06% | -0.12% | -0.26% | -0.13% | |

| CHF | 0.06% | -0.06% | -0.01% | 0.02% | -0.06% | -0.13% | 0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Post Comment