Why the So-Called Housing Crash Is Just Another Myth – What Every Investor Needs to Know Now

Alright, let’s cut through the noise: the buyer’s market is officially here. Yep, those red-hot housing markets that had everyone talking are finally coolin’ off, but don’t mistake that for a free-for-all fire sale. Instead, we’re seeing a “mild” correction shaking up the status quo — a change that’s giving buyers more negotiating muscle and bringing real estate investors some much-needed opportunities after years of scarcity. Now, if you’re wondering—will this lull spiral into a full-blown crash? That’s the million-dollar question on everyone’s lips. With mortgage delinquencies ticking up in certain pockets and some markets flirting with oversupply, it’s tempting to sound the alarm. But here’s the kicker: sellers are starting to step back, the frenzy is easing, and that could be the very thing that averts disaster. So, what’s really going on beneath the surface, and how should savvy investors position themselves right now? Buckle up, because in this September 2025 housing market update, I’m unpacking the facts, data, and no-fluff insights you need to navigate this evolving landscape. Ready to see where the smart money’s headed? LEARN MORE.

We can definitively say it now: the buyer’s market is here.

The housing market is cooling down, but the deals are heating up as a “mild” correction slows down hot markets and gives buyers even more power in cold ones. With it comes buying opportunities—ones that real estate investors have been starved of over the past few years. You can negotiate for more, offer less, and lock in a lower mortgage rate than last year.

The question is: will this correction turn into a full-blown housing crash? Dave’s giving you his honest (and data-backed) opinion in this September 2025 housing market update!

Mortgage delinquencies are rising rapidly in one subset of the market, the crash-bro clickbaiters say it’s a sign of a coming housing apocalypse—are they finally right about something? One thing is certain: a few housing markets across the US are in danger of slipping into an even more oversupplied market. But, with new data showing that sellers are quitting and walking away, will this reverse the worrying trend?

Stick around, we’ve got your housing market update without the hype.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Dave:

The buyer’s market is here, deals are getting better, but there is risk in the market too. So the key is to understand exactly what’s happening right now, so you know a good deal when you see it and you can avoid costly mistakes. Are home prices likely to go up or down? Could the correction turn into a crash? Today we’re breaking down the most recent housing market data to help you understand how to find and execute on the increasing opportunities in the housing market. Today on the show, we’re going to be looking at the data as we do every single month. And today we have a lot to cover. The market is moving into a correction, as I’ve been saying, was likely all year. And this creates interesting dynamics for investors, both good and bad. So today we’ll start with what’s happening with both prices nationally and regionally.

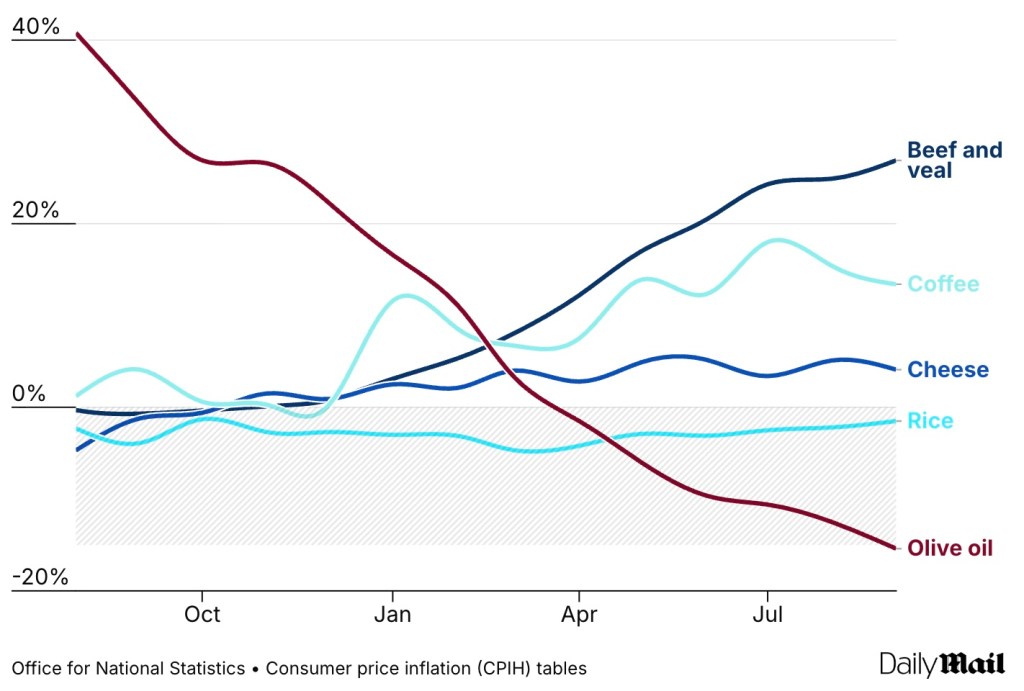

We’ll talk a little bit about what’s likely to happen with price growth and appreciation in the next year. We’ll even get into how rents are trending a little bit, inventory, trends, housing market health because we got to monitor if the correction’s going to turn into a crash. And then of course at the end we’ll talk about what this all means. Let’s do it. Let’s talk about price growth first. This is an important one. Of course, everyone wants to know this one and it’s the one that really is changing. I think according to the data. We are in a correction at this point. It really depends on who you ask, what the exact number is, but most reliable sources have price appreciation somewhere between positive 1% and negative 1%, so pretty darn close to even. But that is on a nominal level and that is really important to remember.

We’ll talk about that a couple times throughout the show, but when I’m saying they’re up or flat, I am not talking about inflation adjusted prices. So on the high end, they might be up 1% year over year. When you just look on paper, yeah, they’re up a little bit. But when you compare that to inflation, which is up about 3%, you’re actually losing a little bit of ground. And as a real estate investor, I want to know that difference. That difference matters a lot to me. The difference between nominal and real, real just means inflation adjusted pricing. And I think for most of the year at this point, we’ve seen that we are in negative real price appreciation even though we’re kind of flat on nominal home prices. So personally I would categorize that as a very mild correction. This isn’t a crash yet, and we’ll talk more about whether or not that is likely and it is certainly not happening in every region of the country.

We’re seeing very different performance depending on where you are, what state you are, even different cities in the same state are seeing really different performance. But I think on a national level, this kind of lull that we’re feeling, I think at this point we can qualify it as a correction and a buyer’s market. And as I said at the top, and we’ll get into a lot today, that means there’s both risk and opportunity. But before we talk about how you should go about playing this new market dynamic that we’re in, just wanted to drill into some of those regional differences that we’re seeing quickly. Not much has changed in terms of patterns, just the scale has changed a little bit. So if you’re living in the Midwest or you’re living in the northeast right now, you’re probably not sensing that correction that I’m talking about because even if you look at the numbers seasonally adjusted and inflation adjusted, you’re probably seeing positive home price growth year over year.

Almost all of the markets in the northeast are still positive. The Midwest is starting to see more of a mixed bag, but like I said, the scale is changing. So even those markets that were really positive, take Milwaukee at the beginning of the year, Milwaukee was like 8% year over year growth. Cleveland was really hot. We saw Indianapolis really hot. They’re still positive, they’re just less positive. So now they’re 3% year over year. Now they’re 4% year over year. And so that’s why I am saying that we are in a buyer’s market and we’re probably heading into more of a buyer’s market is because even the markets that are doing well are doing less well. Now that is certainly not an emergency, but you see the same trend of slowing appreciation in pretty much every market in the country at this point. The markets that have actually turned negative in terms of sales price are mostly concentrated in the west.

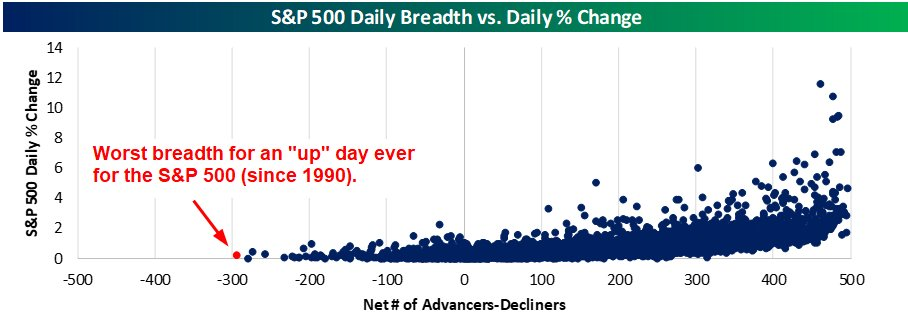

We see markets in California and Washington, Oregon, Arizona, Denver for sure, and then in the southeast and in Texas with the biggest declines still being in Florida and along the Gulf Coast. So overall mixed bag. But the reason I’m saying that we’re a buyer’s market is there’s just a lot of evidence. There’s data that buyers now have a lot more leverage in the market, and this can be a very good thing for investors as we’ll talk about, but there’s this metric I want to share. It’s called these sale to list percentage. It’s basically a ratio of what percentage of the asking price does it ultimately wind up selling for. So if you were in a perfectly balanced market, which pretty much never happens, it would be at a hundred percent. That means every seller gets exactly the price that they list it for. If it is above a hundred percent, that usually means that you’re in a seller’s market because people are bidding over asking in order to lock down deals or like we are seeing right now.

When that number falls below 100, that usually means that you’re in a buyer’s market and buyers have regained power right now, according to Redfin, the average sale to list percentage or ratio has dropped to below 99%. So it’s not like we are seeing a huge difference, but it means on average sellers are not getting their list price and this is across the entire country. And so we’ll talk about this more at the end, but one key takeaway that every investor should be thinking about when they hear this news is that they should be offering below list price because they probably, according to the average, are going to be able to get that. And of course, 1% not crazy, but that’s the average. And so for investors who want to buy below current comps, who want to get the best possible deal that they can, not only should you be offering below list price, but the chances that you’ll get a below list offer accepted are going up.

So that’s what we see so far in terms of sales prices across the country. Of course, I’m sure everyone wants to know now where do we go from here and actually pull together forecasts from a couple of the top most reliable data providers out there to share with you. And then I’ll give you my reaction in just a second. Zillow, which I know people knock on Zillow data, but I really appreciate one thing about Zillow’s data. They revise their forecast every single month and what they are saying right now is that they think through the end of 2025 that will wind up with home prices at negative 1% nominally so similar to where we’re at, but a modest correction. Now that is a change from where we started the year Zillow was forecasting modestly positive prices, but they haven’t changed that much. They’ve just pulled it down a little bit over the course of the year.

Now we have the case Schiller lens, which comes from Reuters. They actually updated their forecast in September and they are still forecasting a positive increase in appreciation of 2.1%. They say that they think home prices will grow next year, 1.3%. Core logic says 1.4% year over year. Goldman Sachs, they haven’t updated since April, so I don’t take that one as seriously, but they were saying 3.2% and realtor.com hasn’t updated there since December. So take that one with a grain of salt, but they’re saying 3.7% year over year. So that is what some of the more notable names in the industry think is going to happen. And I’m going to share with you what I think is going to happen, but first I need to share with you what’s going on with inventory and new listings because I’m going to base all of my predictions and forecasts about pricing for the rest of the year and into 2026 based on inventory data and demand data. That is what is sort of the lead indicator for prices in the housing market. So let’s dive into that, but first we got to take a quick break. We’ll be right back.

Welcome back. I’m here giving you my September housing market update So far we talked about that housing prices are pretty flat on a national basis and we are still seeing some of those regional trends and I shared with you what many the big forecasters in the industry think are going to happen. Now I want to share with you my projection for the rest of the year and just some early thoughts about 2026, but first I need to tell you what’s going on with inventory new listings. We need to dive into some of this other data because that is what informs us where prices are going to go inventory. That word is basically just a measure of how many homes are for sale at any given point. And what we saw in August was actually really surprising the pattern over the last several years, basically since 2022 when rates started to go up is that inventory has been climbing and that makes sense if you have been paying attention to these housing market updates.

But basically what’s been going on is more and more people are starting to sell their home and even though there is some demand, there is still stable demand. We are seeing homes sit on the market longer and that means inventory is going up just for some reference from 2012 to 2017 ish, the average number of homes for sale at any given point in the United States was about 2 million for the years leading up to the pandemic from 2017 to about 2020, it was 1.7, 1.8 million ish. Then during the pandemic it dropped all the way down to about 1.1 million. That was during peak craziness and it has been slowly climbing back up and we are now back above 1.5 million for the first time since 2019. So that’s pretty significant and that is worth noting and you’re going to see a lot of headlines saying that inventory is climbing like crazy, but remember that even though it has been going up and we’re about 1.5 million, we’re still about 16% below pre pandemic levels.

And I think the most interesting statistic I saw while I was researching and pulling the data for this episode is that inventory actually fell from July to August according to Redfin. And that should make you pause because the narrative in the media and the truth has been that inventory has been going up like crazy. And I reference this media narrative because I think I hear this a lot from people who are saying that the market is going to crash and they point to inventory going up over the last several years as evidence of that. And if inventory were to go up indefinitely at the pace that it is going up for the last couple of years, sure, yeah, the market would crash, but there is no guarantee or no reason to even believe that inventory would go up forever. So seeing inventory fall from July to August, which is the last month we have data for is really notable.

It is showing that inventory is starting to level off and it is only one month of data, so we’re going to have to look at this for a few months, but just even seeing it level off for one month is really notable and there are reasons to believe that this pattern, the shift in pattern could be sustainable and that is because we have this other lead indicator that we need to look at, which is new listings. Now I know it’s a little bit confusing, but new listings and inventory are actually different metrics, inventory measures, how many homes are for sale at a given point in time? The new listings actually measures how many people put their home for sale on the market in that month. So we’re talking about August and the difference is that you could have a lot of new listings and inventory can actually go down because there’s a lot of demand and those homes are selling quickly, but actually what we’re seeing is inventory go down because new listings are actually going down as well.

And this is another super important dynamic. We’ve actually seen this in the data for the last month or two that counter to the crash narrative that are saying more and more people are selling their homes, they’re desperate, they’re going to do anything to sell their homes. No, that is not what is happening. What’s happening is that people are recognizing that this might not be a great time to sell your home. They are also noticing sellers also notice that there is a correction going on and they’re probably thinking, you know what? I don’t really want to sell right now and so I’m going to not list my home for sale. And I think that is what’s going on. That mindset is what’s happening throughout the market. People are just choosing not to sell and that is one reason and I’ll share some other data with you.

I believe we are in a correction, but we are not likely heading for a crash because for as long as people have the option not to sell, it is very unlikely that you get crash dynamics that really just hasn’t happened before and so it remains very unlikely. Now this is going to be one that we’re going to watch really closely. As you probably know, we do these housing market updates every single month. And so when we report back in October for September data, I will share with you what’s going on with inventory new listings because I’m personally very curious if we see this fall, and for those of you who are astute observers of the housing market, you’re probably saying, oh, maybe they fell because of seasonality. They always fall this time of year and that is true, but the data I’ve been sharing with you is seasonally adjusted, which is how we want to look at this kind of stuff.

There are all sorts of ways that analysts seasonally adjust this data and we’re seeing it fall on a seasonally adjusted basis, which is why it’s so significant. Now, of course there are still markets that are seeing huge increases in inventory. Lakeland, Florida is the biggest example. I actually pulled some data that shows the change in inventory from pre pandemic levels because I think that’s still the metric we want to use here because sure, it might not ever go back to pre pandemic levels, but looking at inventory year over year, which is how you would want to look at it, it just doesn’t really make sense because coming up from a artificial low we’ve been in the last few years doesn’t really tell us all that much. And so if you look at inventory changes from 2019 to the same month in this year, that’s what really tells you a lot.

And what we see is in certain markets like Lakeland, Florida, that’s the number one, it’s up 60% over pre pandemic levels, which is huge. Austin is up above 30%, San Antonio above 30% Denver sitting at about 27%. We see Tampa pretty high, new Orleans pretty high above pre pandemic levels. That’s why these markets are likely going to see price declines. Meanwhile, you look at places like Providence, Rhode Island and Hartford, Connecticut, they’re still like 60% below pre pandemic levels, so the chances of them seeing corrections are relatively small, but it’s still absolutely possible. So given all of that, my forecast for the remainder of the year is that we were going to remain relatively flat. I’m sticking with the prediction I made in November of last year is that we were going to be plus or minus two or three percentage points on a national basis, but the general vibe of the housing market is going to be pretty much flat, and I think that’s what we were seeing and my hypothesis about that is that affordability in the housing market just wasn’t going to change that much.

I know that in the beginning of the year, a lot of people were saying mortgage rates were going to be in the fives. I never bought that. I have been saying that they were going to stay in the sixes somewhere between 6.25, 6.75, somewhere in that range for most of the year. And that has been accurate and I think that’s where mortgage rates are staying for the remainder of this year. I know that the Fed has said that they are going to cut rates two more times this year. I don’t think it’s going to move mortgage rates that much, maybe a little bit, but I would be pretty surprised if it goes below 6% by the end of this year just because of what is going on with inflation, what is going on with the risk of recession. I just don’t think mortgage rates are going to move and I think inventory is starting to level off. So if you look at those two things combined, I think we’re going to get more of the same, at least for the remainder of 2025, which it’s crazy to say is really only three more months. So as we look forward to 2026 to understand if we’re going to get into a crash or if the housing market will cover or if we’ll have more of the same, we really need to understand the state of the American homeowner and we’re going to do that right after this break.

We’ve talked about prices, we’ve talked about inventory, and I want to turn our attention to a third bucket of data that I think is super important going forward. This is homeowner health. Just generally, how is the average American homeowner doing with their properties that they own? Because to me, this is another lead indicator, maybe the main lead indicator that we need to look at going into 2026 about whether the correction that we’re in is going to turn into a crash. Like I mentioned, inventory is super important to that, but if we want to understand why inventory is leveling off and whether that’s going to change and it’s going to start accelerating again, to me it really comes down to homeowner health. As I said earlier, people right now, the reason inventory is leveling off is because they’re choosing not to sell. They don’t have to sell.

In other words, they’re not being forced to sell, which is the term that we use in the housing market to describe when people no longer can pay their mortgage and are forced to sell their property on the market. This dynamic can really push up inventory and can flood the market in the right circumstances to create crash scenarios. So we need to know if this is going to happen, and luckily we have tons of data that help us understand whether or not this is likely. The first thing that I like to look at is just delinquencies, right? This is how many people are behind on their mortgage payment because I know people look at price declines and think, oh my God, they’re going to get foreclosed on. That is not actually how this works. This is a common misconception about the housing market. You cannot be foreclosed on just because the value of your property goes down.

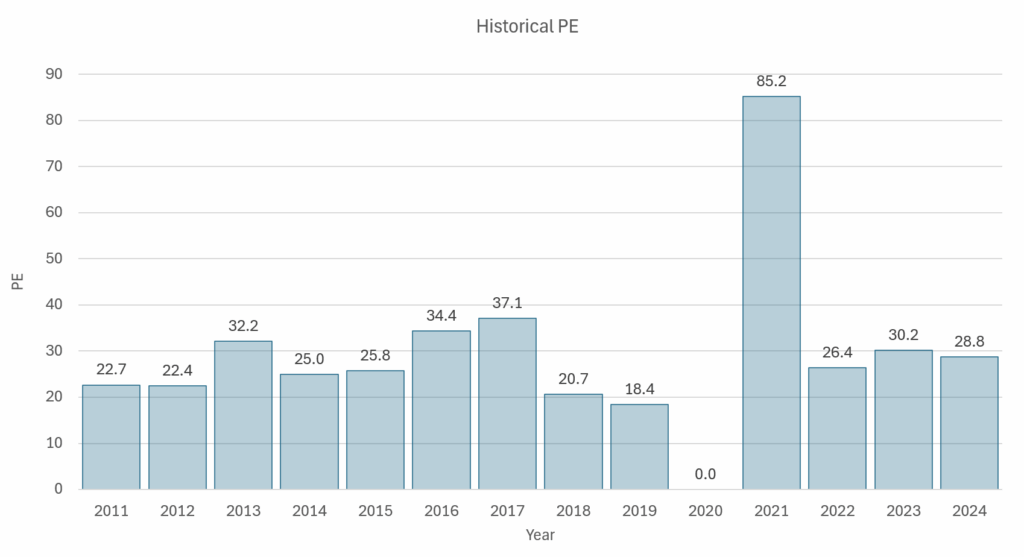

If you are underwater, that does not mean that the bank can foreclose on you. The only way that foreclosures start to happen is if people start to default on their mortgages. Basically they stop making their payments. And as of now, that is not happening. What we saw in 2008 in that time, we saw delinquencies go up above 10%. They were above 5% from about 2006 to, I don’t know, 2014. So for eight years we saw a delinquencies rate above 5%. As of right now, they were at 3.5%. Before the pandemic, they were about 4%. So even in 2019 when the housing market felt relatively normal, the delinquency rate was higher than it was today. And this actually makes sense, right? Think about how many people refinanced their mortgages during 20 20, 20 21, 20 22. The ability for people to pay their mortgages has only gone up over the last couple of years.

Now, there are certain kinds of mortgages that are seeing increases of delinquencies and we’ll get into that, but I really want to just emphasize this. Foreclosures really are still below pre pandemic levels and delinquency still below pre pandemic levels. Now, there are some pockets of mortgages that are seeing increases in delinquencies. Those mostly come from FHA loans. We have seen those go up to about 10 11%, which are above pre pandemic levels. So that is notable. They’re about at 2015 levels, but they’re not like skyrocketing and they’ve started to level off a little bit and the fact that they’ve risen in recent months actually makes a lot of sense because there was a moratorium on foreclosures in the FHA loans for a while that ended I think in April. And so seeing them spike up in April makes sense, but we really haven’t seen them keep going up from there.

Same sort of thing is happening with VA loans as well. We’re seeing modest increases in delinquencies. They are above pre pandemic levels. So these are things that we do need to keep an eye on, but keep in mind that these types of mortgages make up about 15% of the overall mortgage market. So that’s why when I say the aggregate delinquency rate is still low, that’s true. It’s because FHA and VA loans only make up a small portion of the mortgage market. So that’s one side of the homeowner health equation. Basically we’re seeing very low delinquencies. We’re seeing very low foreclosure rates. Of course, that can change. If we saw just a huge break in the labor market, unemployment skyrocketed, that could change, but as of right now, there is no evidence that that is happening. So that would have to be a total change in the pattern going forward.

Obviously we’ll update you on that. The other piece of homeowner health that I want to share with you I don’t think we’ve talked about on these market updates over the last couple months is just how much equity US homeowners have right now. The number is actually about $17 trillion in terms of equity in the United States. I just want to say that again. The aggregate amount of equity that the US homeowners have is $17 trillion, which is an all time high. And the number of mortgages that are underwater is tiny. It’s like 1%. But what’s kind of crazy about this is just how healthy the average American homeowner is still right now with that $17 trillion of equity built in of that $17 trillion. This is crazy. The tapable equity, which is basically if everyone in the United States who has a home and has positive equity, they all went out and did their maximum cash out refi.

They could pull out 11.5 trillion in equity, which is remarkable. And it’s going up. It was up 4% quarter over quarter, it was up 9% year over year. And this just shows how much money the average American homeowner has right now. So again, this is another reason why we probably are not going to see a crash because there’s just so much wealth for the average American homeowner and they’re not having problems paying their mortgages. So if things get bad in the broader economy, they’re just going to choose not to sell, and that provides a bottom for a housing market, and that is what happens during a normal housing correction. And I think that’s what we’re seeing here. So in summary, average American homeowner still doing pretty well. We are not anywhere near where we were in 2008 where all of these red flags were flashing warning signs.

We saw delinquency rates going up before 2008. Homeowner equity was declining for years. That is not happening right now, and of course things could change in the future, but the data suggests we are in a regular correction and we are not on the precipice of a crash. So remember that. So what do we make of all this data as investors for the rest of 2025 and heading into next year? My main point to investors right now and has been for the last couple months, and I think is going to remain that way for the foreseeable future is that being in a buyer’s market is an interesting time. It creates risk in the market for sure because prices could be going down and we don’t know when they’re going to pick back up. At the same time, it also creates opportunity. I see this almost every day.

The average deal that I’m seeing come across my desk is better than it has been probably since 2021 or 2022. And I think that is going to stay that way for a while because even though the market is not in a free fall, I do think we’re going to see more motivated sellers and I think we’re going to see a lot of the social media investors, people who are sort of a little bit interested in real estate investing but not really committed to it. I think they’re going to kind of go away for a while at least because the benefits of investing in a correction market like we’re in are not that obvious, right? The average person is going to see, oh, prices went down 1% year over year on Zillow, and they’re going to say, you know what? I don’t want to buy that.

But for an investor who has a long-term buy and hold perspective, they could be thinking now is the time to buy great assets at a slight discount. And to me, that is an attractive option. Now, you have to be very disciplined and patient to not buy junk on the market because there’s going to be plenty of that. But if you find the opportunity to buy great assets during a less competitive market like we’re in right now, that is a good opportunity for buy and hold investors. The other piece of this that I haven’t really gotten into much today, maybe I’ll do another episode on this soon, is that I believe that cashflow prospects are going to improve starting in 2026. We are getting through a lot of the glut of supply in the multifamily market, and it’s still going to take a little bit of time, but I do think we’re going to start seeing rent prices increase gradually next year, and with prices staying stagnant, that means the opportunity for cashflow is going to improve and that should get every buy and hold long-term investor excited.

But the key again to investing in this market is one, having that long-term perspective because if you’re buying a property to sell it in a year or two years, I think it’s a little bit risky right now. Now, I’m not saying you can’t do it, but if you’re going to do a burr, just run the numbers and make sure if you can’t refinance that it’s still worth holding onto. I think that is the prudent conservative way to approaching this kind of market. If you’re going to hold for five to 10 years and you can five great assets and they pencil at current interest rates, I would do those deals. I’m personally looking at those deals, and I think that is a perfectly good approach to investing in this market. But remember, be patient and negotiate because you can. We are seeing buyers, Regan the power in the housing market for the first time in a long time, and you as investors, it’s on you to go out and use that newfound leverage that you have in the market.

To me, that’s an exciting opportunity, and hopefully you’re feeling the same way that you’re going to be able to go out and buy great assets at below current market comps. That is real estate investing 1 0 1, and I think it’s going to be achievable for a lot more people in the coming year or so. That’s our housing market update for September, 2025. Thank you guys so much for listening. I’m Dave Meyer, and by the way, if you have any questions about this, always hit me up on BiggerPockets or on Instagram where I’m at the data deli. Happy to answer any questions you have there. Thanks again. We’ll see you next time.

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover

- The “mild” housing market correction: what it means and whether it’ll become a crash

- Updated home price predictions and how much prices will rise/fall by the end of the year

- Signs that you can start confidently bidding under asking price (but by how much?)

- Why inventory is beginning to reverse (have sellers finally had enough?)

- Mortgage delinquencies are rising: who’s affected and could it lead to foreclosures?

- What investors should do now to prepare to buy discounted deals (be patient!)

- And So Much More!

Links from the Show

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Post Comment