Why This Bitcoin Crash Could Be the Golden Ticket for Long-Term Investors—Are You Ready to Seize It?

Is Bitcoin really caught in a storm of fear, or is this just another classic case of market jitters disguising opportunity? Lately, the crypto giant’s social sentiment has dived into one of its most bearish zones in half a year—raising eyebrows and anxieties across investor circles. But here’s the kicker: despite the gloomy chatter, Bitcoin’s fundamentals have stayed rock solid, subtly hinting this dip might just be the setup savvy investors dream of. With BTC hovering near historic lows compared to tech titans like Apple and NVIDIA, and experts nodding at the 20% drop as a potential ‘buy-the-dip’ signal, it feels like the market is wrestling with a classic paradox—fear peaking while buy orders pile up. Could this be the calm before Bitcoin’s next big surge? Or is the old crypto rollercoaster gearing for another twist? Buckle up—this isn’t your average market déjà vu. LEARN MORE

Key Takeaways

Why are investors worried about Bitcoin right now?

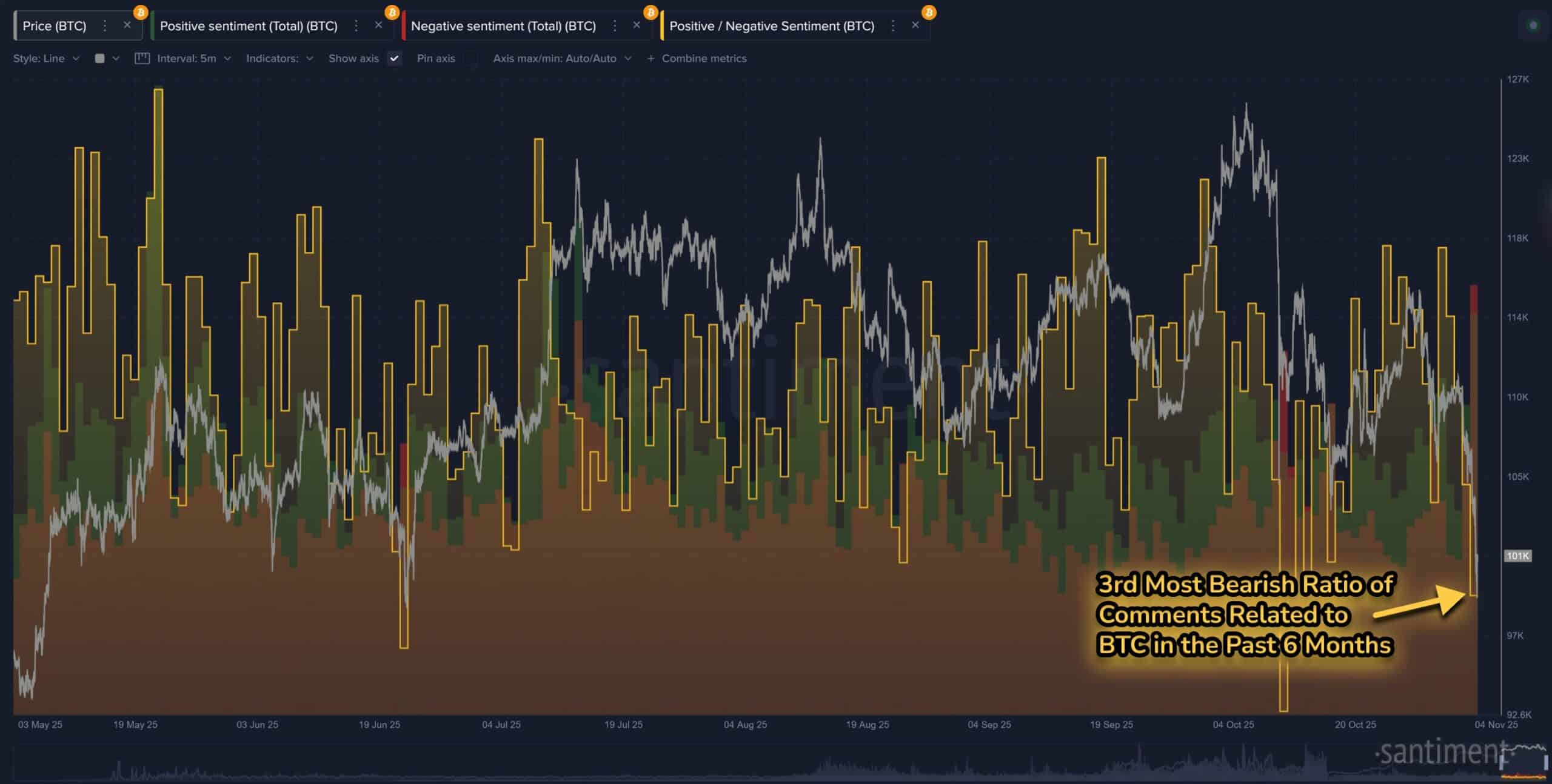

BTC’s Social Sentiment hit its third most bearish reading in six months, signaling rising fear despite steady fundamentals.

Is Bitcoin’s drop below $100,000 a bad sign?

Not necessarily. Experts say the 20% dip could be a buying opportunity.

Bitcoin’s [BTC] mood turned darker than its data.

Social Sentiment just hit its third most bearish reading in six months, at a moment when the fundamentals aren’t actually breaking. Instead, BTC remained near historic relative lows against Apple [AAPL] and NVIDIA [NVDA], and the on-chain base case still looks firm.

It feels like sentiment pricing in stress that the network itself isn’t showing yet.

Crypto Analyst Nic Puckrin, Co-Founder of The Coin Bureau, told AMBCrypto,

“Bitcoin under $100,000 tends to fill crypto investors with an almost biblical level of dread. It’s worth remembering that despite the recent sell-off, BTC is currently only around 20% below its all-time high. This is crypto, not the bond market, so a 20% drop is often just a buying signal.”

Fear peaks even as traders buy the dip

Bitcoin’s drop coincided with one of the most bearish comment ratios in six months, yet crowd behavior revealed a twist.

Santiment data showed the highest level of Negative Words in eight months, even as “buy” mentions stayed elevated. Similar setups, like in late October, preceded short-term recoveries.

The latest data showed extreme negativity paired with active buy mentions. BTC may be near another local sentiment-driven inflection point.

The flush that reset the market

The crypto market’s $1 trillion drawdown since January was a massive leverage reset. Open interest collapsed over 40% after peaking near record highs, as hundreds of thousands of traders were liquidated daily.

But adoption never slowed.

User counts jumped to 560 million, stablecoins now handle 30% of transactions, and institutional participation via ETFs and reserves keeps expanding.

While prices fell from $3.66 trillion peak to $2.65 trillion, fundamentals strengthened. The market is rebuilding from forced liquidation.

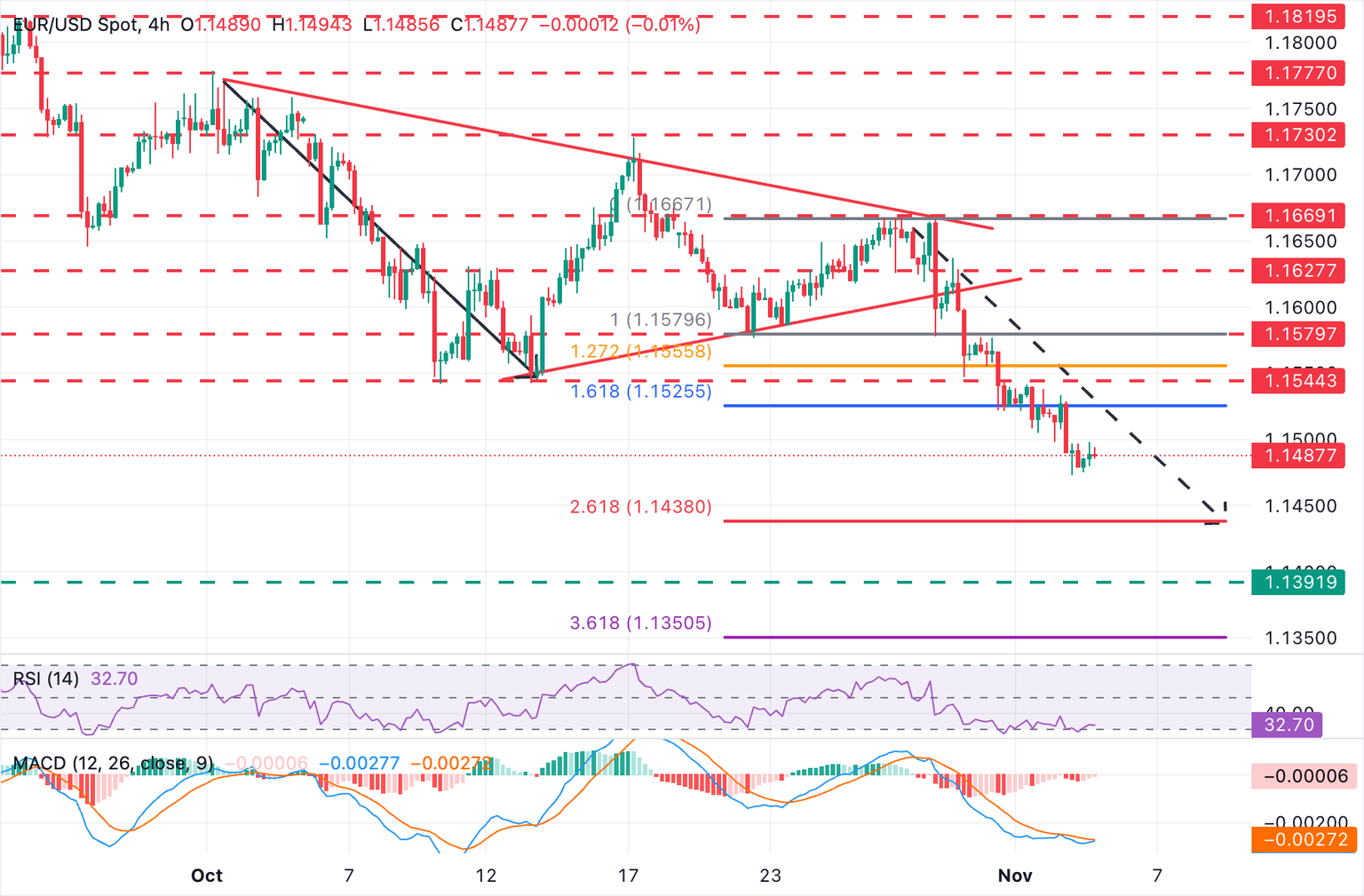

That disconnect between fear and fundamentals is also showing up beyond crypto charts, too.

Post Comment