Why Trump Accounts Could Completely Upset the Retirement Game—And What It Means for Your IRA Savings.

Ever wonder if a financial head start from day one could reshape the future of American saving habits? Enter Trump Accounts—the fresh new kid on the block introduced through the One Big Beautiful Bill Act (OBBBA) that’s stirring up quite the hornet’s nest among retirement sages and savings experts alike. Imagine your newborn not just coming into the world but also into a $1,000 government-funded investment account primed to grow quietly, patiently, and potentially powerfully over decades. Sounds like a win, right? But hold on—do these accounts really stack up against the tried-and-true Individual Retirement Accounts (IRAs) that have long been the bedrock of retirement planning? Let’s peel back the layers, because while Trump Accounts bring some compelling fresh features to the table, like early access and no earned income requirement, their hybrid tax status and investment restrictions add a curious twist that might not be for everyone. Are we looking at the next big game-changer in financial planning, or just another intricate piece in America’s already complex savings puzzle? Buckle up, because this romp through the nuances of Trump Accounts versus IRAs is one you won’t want to skip. LEARN MORE

Trump Accounts, recently introduced as part of the One Big Beautiful Bill Act (OBBBA), are generating a lively debate among savings and retirement experts.

Presented as a new form of birthright investment account, could these accounts really rival, or even surpass, Individual Retirement Accounts (IRAs)? A closer look is in order.

A financial boost from birth

The principle behind Trump Accounts is simple: for each child born between 2025 and 2028, the US Government automatically pays an initial deposit of $1,000, provided the child has a Social Security number.

Thereafter, parents, employers or other entities can contribute up to $5,000 per year to this account, with inflation indexation scheduled to begin in 2027.

Funds must be invested in Index funds tracking the US market, with fees limited to 0.1% to guarantee maximum returns.

Unlike traditional retirement savings accounts, Trump Accounts do not require earned income to contribute.

This means that even a newborn baby can start saving in its first year, an approach reminiscent of the “baby bonds” championed by several politicians for over a decade.

An IRA-like structure, but with nuances

Tax-wise, Trump Accounts resemble a hybrid between a Roth IRA and a Traditional IRA.

Contributions, as in a Roth IRA, are made on an after-tax basis and are not deductible.

Funds grow tax-free, but unlike a Roth, withdrawals are generally taxed like a Traditional IRA, with certain exceptions (higher education, real estate purchases, etc.).

From age 18, the account holder can make withdrawals, which then follow the usual IRA tax rules.

Before the age of 59 and a half, penalties of 10% apply on earnings in the event of non-qualified withdrawals, except in the case of use for expenses provided for in the IRA early withdrawal code.

A smart retirement tool or just another bureaucratic monster?

The main advantage of these accounts lies in their long-term nature. Placed from birth in low-cost index funds, investments can grow significantly thanks to the power of compound interest.

According to CNBC projections, an initial account of $1,000 with regular contributions of $200 a month could grow to over $250,000 in 30 years, with an average annual return of 7%.

But this promise is nuanced. On the one hand, Trump Accounts enable families to build capital for education, home purchase or even their children’s retirement.

On the other hand, they add a layer of complexity to the already cluttered landscape of American retirement savings.

Today, the US tax system has more than ten different savings vehicles, all with distinct rules: IRA, Roth IRA, 401(k), 529, HSA… and now Trump Accounts.

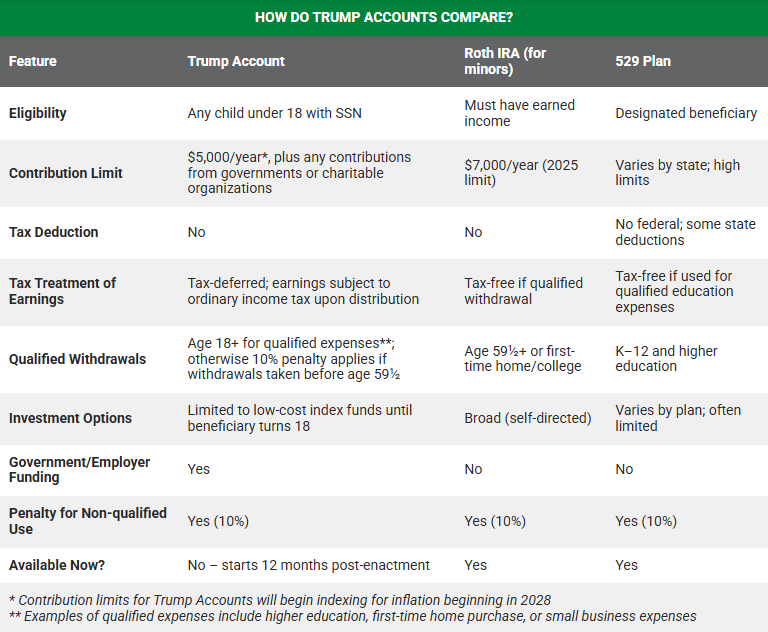

Trump Accounts vs IRAs: Key differences to be aware of

Source: BRAGG Financial

Trump Accounts are distinguished by their early accessibility. Unlike Traditional IRAs and Roth IRAs, which require earned income to contribute, Trump Accounts are open from birth.

In terms of contribution limits, Trump Accounts allow annual payments of up to $5,000, while Traditional and Roth IRAs offer a slightly higher limit, with set contribution limits at $7,000 in 2025 for people under 50.

Taxation is another major point of divergence. Deposits into a Trump Account are not tax-deductible, just as in a Roth IRA.

On the other hand, contributions to a Traditional IRA can, under certain conditions, be tax-deductible, making it an attractive instrument for taxpayers wishing to reduce their taxable income in the short term.

About withdrawals, Trump Accounts operate according to rules similar to Traditional IRAs: Gains are taxed at the time of withdrawal, with certain exceptions (education, first real estate purchase, etc.).

Conversely, the Roth IRA is distinguished by a total tax exemption on qualified withdrawals after age 59 1/2, making it the most tax-efficient option for long-term retirement planning.

Finally, the flexibility of use varies significantly. Trump Accounts allow withdrawals as early as age 18, but with restrictions. Traditional IRAs, on the other hand, impose an age limit of 59 and a half, on pain of penalty.

The Roth IRA is more flexible, allowing contributions (but not earnings) to be withdrawn tax- and penalty-free at any time, providing useful leeway in case of unforeseen need.

In short, while Individual Retirement Accounts (IRAs), and particularly the Roth IRA, retain a clear tax advantage for retirement planning, Trump Accounts are attractive for their early accessibility and apparent simplicity.

However, the taxation of exit gains remains a potential brake, limiting their competitiveness with existing retirement savings products.

An opportunity, but not a miracle solution

It would be tempting to see Trump Accounts as a universal, miraculous solution. After all, who would turn down a free $1,000 payment for their child?

Yet beyond this “gift”, experts point out that other retirement accounts may be more effective, depending on the objective pursued.

To finance education, for example, 529 plans remain unbeatable, with their targeted tax advantages. For retirement planning, Roth IRAs dominate with their total exemption on exit.

However, the management of these new accounts, their still unclear tax status, and their restricted investment framework (Index funds only) make them a tool to be used with discernment, as a complement to, not a replacement for, existing retirement savings instruments.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Post Comment