Why USDT’s Rising Dominance Could Ignite an Altcoin Surge No One Saw Coming—Are You Ready to Profit?

Ever wonder what happens when the market’s favorite stablecoin, USDT, starts flexing its dominance muscles again? Well, it looks like we might be heading for a déjà vu moment reminiscent of April 2025—a short-term altcoin correction that sent quite a few investors scrambling. I mean, who doesn’t get a little jittery when liquidity pulls away from the riskier altcoins, right? But here’s the twist that keeps this rollercoaster ride so intriguing: stablecoins aren’t just about playing it safe—they’re quietly gathering strength with new players like Ethena’s USDe pumping billions into the game. Could this sidelined cash soon dance its way back into altcoins, sparking a robust comeback? It’s a classic tale of caution meeting opportunity, and honestly, I can’t wait to see which way the tide turns. Ready to dive into the details and figure out if this dip is a sign to hold tight or a secret signal to jump back in? LEARN MORE

Key takeaways

USDT dominance is expected to climb, potentially triggering a short-term altcoin correction similar to April 2025. However, rising stablecoin demand and support could cause strong altcoin rebound.

The market could face some turbulence in the coming weeks, as analysts expect Tether [USDT] dominance to rise to a level that last triggered a sharp altcoin correction in April 2025.

This move is often seen as a flight to safety, draining liquidity from riskier assets like altcoins.

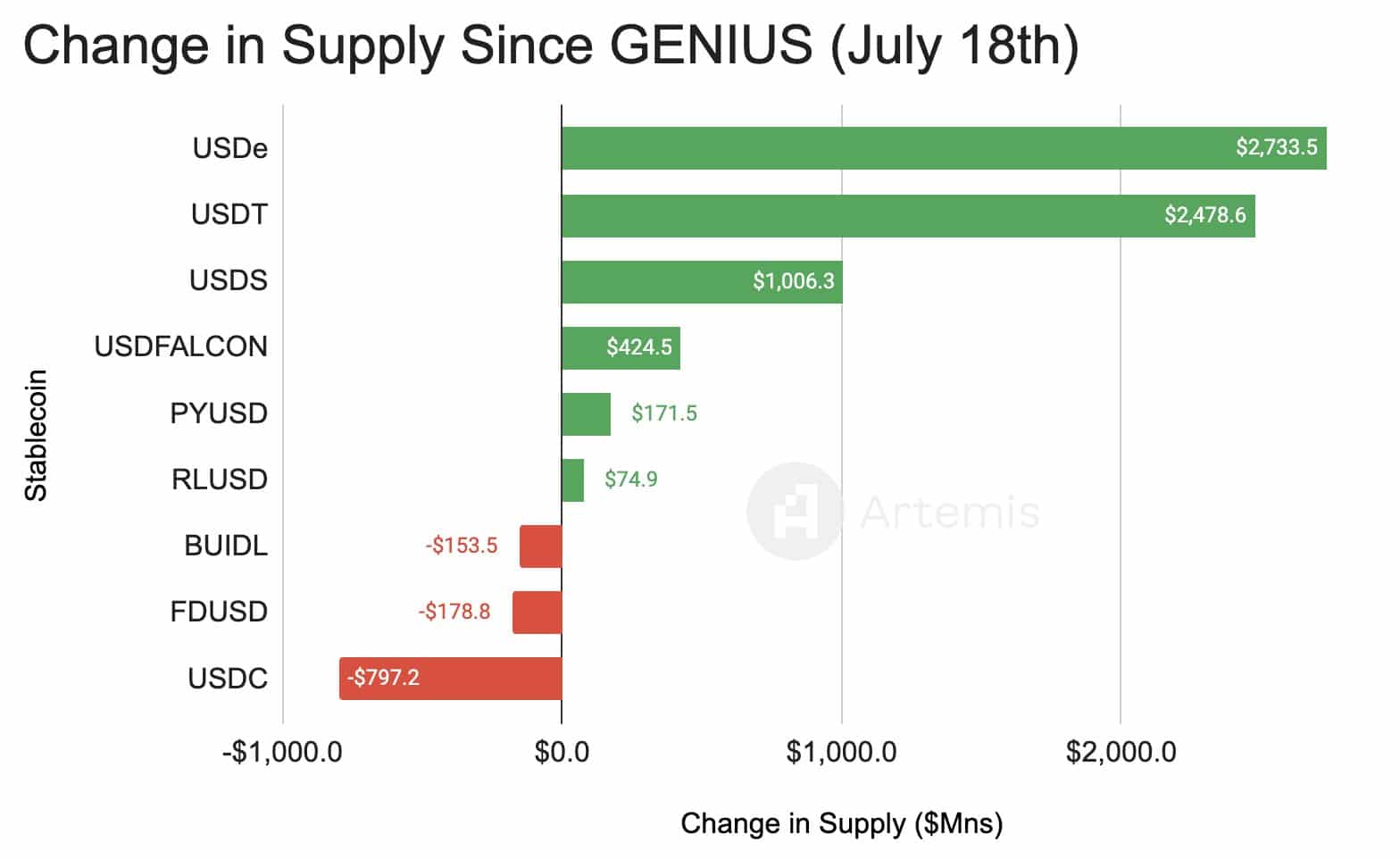

However, the stablecoin story isn’t just about caution. Ethena’s [ENA] USDe has added $2.7 billion in supply, amid heavy support for the sector.

Once USDT dominance peaks, that sidelined liquidity could rotate back into altcoins, opening the door for a strong rebound.

Analyst warns of sharp correction

Global momentum builds

As USDT dominance temporarily drains risk-on appetite, the broader stablecoin narrative continues to gain strength.

JPMorgan CEO Jamie Dimon recently acknowledged that stablecoins — unlike Bitcoin — serve real customer demand.

His remarks came alongside the firm’s partnership with Coinbase, allowing Chase users to convert reward points into crypto.

“I’m a believer in stablecoin, a believer in blockchain, not personally a believer in Bitcoin itself, but you’re the customer – I don’t like to tell customers what they can and can’t do with their money.”

Meanwhile, the U.S. House’s passage of the GENIUS Act has catalyzed similar regulatory efforts across Asia.

Countries like South Korea, Thailand, and the Philippines are advancing frameworks for fiat-pegged tokens. Regional giants like JD.com and Ant Group are also exploring stablecoin issuance.

Post Comment