Why XB Number 1 Is Shaking Up the Market—And What It Means for Your Next Big Investment Move

Ever stumbled upon a story that just punches you right in the gut — the kind that makes you rethink everything you thought you knew about investing? Well, that’s exactly what happened when my brother sent me this wild read titled “(Long Post) 1m By 31.” No, I hadn’t even cracked it open before one thought struck me like a thunderbolt: “He fxxking did it.” Imagine turning a modest $96,000 into a cool $1 million within seven years—not through the usual suspects like Tesla stocks or crypto hype—but by hacking the system with some seriously unconventional moves in the overlooked realms of Hong Kong and Singapore small caps. This post isn’t just about numbers or market jargon; it’s about redefining what it means to invest well when life throws you curveballs. It’s personal, it’s raw, and believe me, it flips the evergreen formula of earn-more, spend-less, and invest-smart right on its head. So, buckle up, because if you think wealth-building is a one-size-fits-all recipe, this tale might just make you question your playbook in the best way possible.

img#mv-trellis-img-1::before{padding-top:76.608187134503%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:122.66666666667%; }img#mv-trellis-img-2{display:block;}

This post might be slightly more personal but I think it has something to do with investing, financial independence, the usually helpful topics that I write about.

My brother forward me this post: (Long Post) 1m By 31

Even without reading it, I just thought to myself “He fxxking did it.”

I thought with how well Dreamz International went this year, my friend xb’s portfolio should do rather well. This will give him a big leg up.

I never thought it went this well.

I am truly damn happy for him. Equally happy for my friend LBS. Really brighten up what has been an emotionally difficult 6 months for me personally.

Both of them blew the market off these couple of years. Ecstatic because of how challenging life have been for them, relative to their peers. The greatest role of returns is buying a decent life to live.

Every time someone ask me: “Kyith, I just got out from university, what wealth management or wealth building advise do you have for me?”

I wrote this post for them: How to Get Rich (Realistically) and Stay Wealthy.

This post is basically based on what many distilled as the evergreen formula to eventually get wealthy:

You need to do reasonably well with 3 things in life:

- Earning more

- Optimize your expenses

- Book your rate of return over the long run for the difference of #1 and #2

Eventually, your money will compound.

I would tell people that most of us did two things very well. Most will do earn and optimize their expenses well and just let the market give you a market return. Some who don’t like to cut their expenses, they got to do the other two pretty well and most would earn damn well.

My friends XB and LBS didn’t have the best situation career wise (you got to trust me on this). It got to the point that there is so much optimization that you could do. So they got to do the only thing that they could do: Invest fxxking well.

When it comes to investing, the “base rate” is that most people cannot pick stocks and do well in the long term. Like really pick stocks and have a good rate of return they trust enough to be convicted to put in more money, to depend on for their income planning next time.

So they should do what we told our clients at Providend to do: Hold a strategic (an asset allocation that doesn’t change too much over a 10 to 60 years timeframe) and systematic portfolio. Implement that with low-cost, globally diversified, well implemented, systematic funds.

I believed in that so much (and still do after this post) that I pivoted my portfolio fully into it.

XB (and LBS as well) upended this whole fxxking equation of mine.

People would be asking me how they did it:

- Must be a decent chunk from good working income right?

- Must have some high concentration in something like Tesla or Nvidia right?

- Worked a long time in a decent company like Apple and have a lot of accumulated shares right?

- Invest in the US stocks right?

- Must have lucked out with crypto right?

They did none of those.

They did 180 degrees on whatever Wealthy Formula that Kyith came up with:

- Concentrated less than 10 securities portfolios.

- Strategic investment philosophy but a high security turnover strategy.

- A fundamental sound investment philosophy that requires high enough effort, and high enough sophistication.

- Hong Kong and Singapore stocks (I say stocks but they end up with a lot of seemingly obscure name Singapore and Hongkong small caps) which have been derided for the past decade.

- None of your Alibaba, Tencent, Meituan, DBS, UOB, OCBC, iFAST bullshit.

- Perhaps some of the dead Singapore and Hongkong stocks that you considered bullshit.

Just what I term, pure, fundamental, earnings momentum and valuations driven, concentrated investing. You may think I am bias, but through my lens, I have mad respect for people who do no-technical-charting, no what market cycles bullshit, concentrated portfolio, didn’t luck out by buying holding something, but just follow a fundamentally sound investment strategy that just keep turning the portfolio over and over and over.

Because in my opinion, it is so hard to executing and doing it well.

Fxxk the fees.

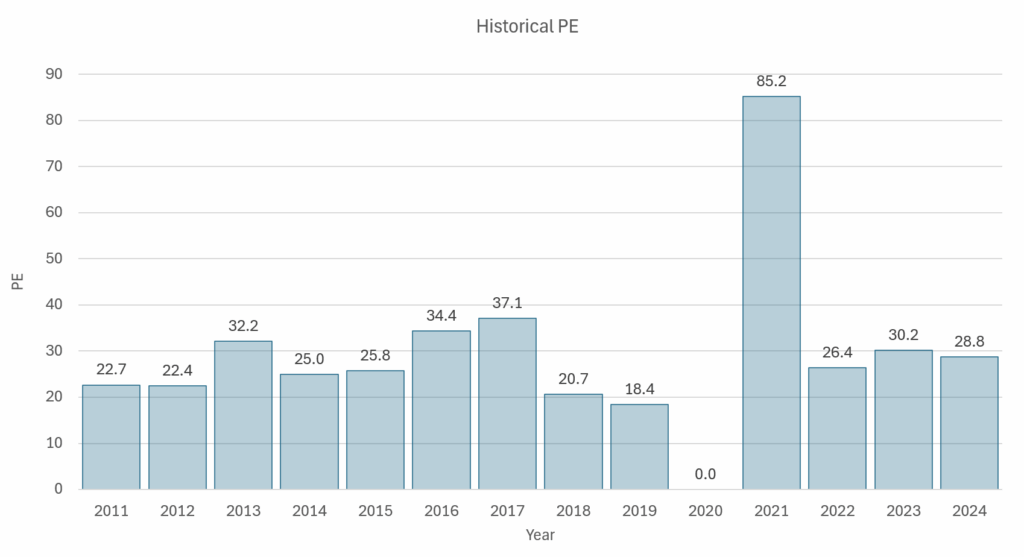

With stocks cafe, which XB use to track his portfolio, you can see his annual XIRR. What is not shown in this XIRR table is his XIRR in 2025 which is 157%. Pure filth.

The capital flow shows you how much capital that he has injected into his portfolio since 2014.

Negative means he took money out. Most likely take money out to attend his Korean K-pop concerts in Korea. Dude turn a net capital of $96k into $1 mil probably over 7-8 years in obscure HK and SG small caps. XB really have no luck at work. There were the days when he lament to me why

Whenever I was asked “Kyith, if I have $10,000 as a fresh graduate, how would you advise me to invest?”

My experience in the past, based on my individual stock investing experience would be to split them into two equal chunks:

- The first chunk to invest with Interactive Brokers in something like the IMID, VWRA or IWDA.

- The second chunk, if you have an affinity towards some investment strategy… give it a try with this!

This strategy allows you time to contrast what I think is a fundamentally sound strategy that should help most people build decent wealth (#1) with fulfilling your appetite that you could be potentially great in your own investment style (#2).

You need to feel enough pain (which means invest enough) to eventually learn the lesson.

Because deep down, whenever I had conversation with readers, clients from different walks of life I know… I always remember there is XB.

Some of them might become XB and I don’t want to kill their dream.

My colleague Sean coincidentally gave a talk to a group of young adults on Friday on Personal Finance 101: Money Hacks for Fresh Graduates.

I would hazard a guess his advise would not be something close to what XB did. And interestingly, it is not that XB, my friend LBS, don’t know these stuff. They thought that this would suit them as well. But life threw them a curve ball and they really need to depend on investing to create a path for themselves.

Sometimes, I can understand if a prospect, a client or a reader that I happen to have a conversation with question my conviction regarding the strategy that I believe would give them a high probability of success. Some of them will go on about their great investment experiences investing in individual stocks. They may question about our low planning returns and whether we can ever achieve the good returns they could have gotten by investing in the Nasdaq QQQ, S&P 500.

Most readers could sense how buy-in I am with Providend’s investment philosophy generally, but may wonder if my eyes have encounter the great personal individual stock investing and had I been an individual stock investor, would my conviction wavered.

Well, I have been an individual stock investor and perhaps that is why some reader would always lean into my content (and also a personal conversation with me), because I have seen both sides. And I have seen pure filth like my friend GG, Ser Jing (now with the compounder fund), my close investing friend Nick, LBS and of course XB.

The advise I gave is BECAUSE I know on a deep enough level how filthy returns come about. My returns are not good but that doesn’t mean I don’t have front row seats to seeing great ones.

Have you ever seen how they look like in great self-doubt? Have you ever seen them questioning if they can get income from how they currently invest long term?

I have seen them in those situations and more.

If you want to see the degree of work XB went into to get him a 900% return, this two post will probably shed light (1 and 2). It is so ironic to me that a person who just wants some decent analyst job could not get his foot through the door in funds that I greatly doubt has his long term performance.

So yes, I am asking you to do what I said, with the lens that these people I mention exists and you can turn $96k to $1 mil in 7 years.

But I think I digress.

Take a bow XB.

Thanks for fxxking up what I been telling people to do.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment