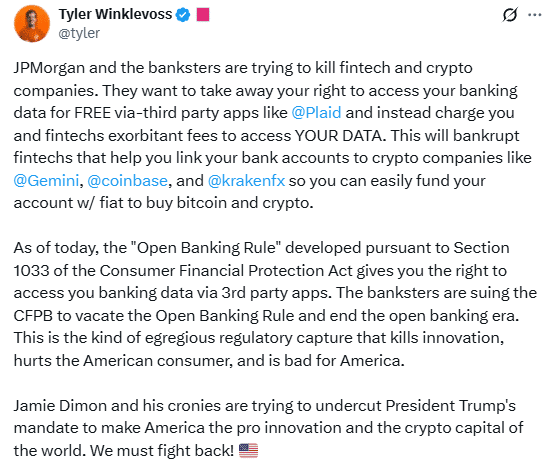

Winklevoss Drops a Bomb on JPMorgan’s Crypto Data Fees—Is This the Quiet War That Could Destroy Your Investments?

Naturally, Winklevoss condemned JPMorgan’s move as a clear case of regulatory capture and an attack on consumer rights.

JPMorgan defends itself

JPMorgan, however, defended the move, with spokesperson Pusateri stating that the new fees aim to curb the overwhelming volume of data requests made by fintech firms, most of which, the bank claims, aren’t directly tied to actual consumer activity.

In conversation with Forbes, Pusateri noted,

“We receive nearly two billion monthly requests for customer data from middlemen, and more than 90 percent of those are unrelated to a consumer using fintech services.”

Post Comment