MARA Holdings’ 2026 Bitcoin Sales Plan: A Bold Move That Could Redefine Financial Flexibility—Here’s What Investors Need to Know

Ever wonder what it takes for a Bitcoin miner to keep the lights on while…

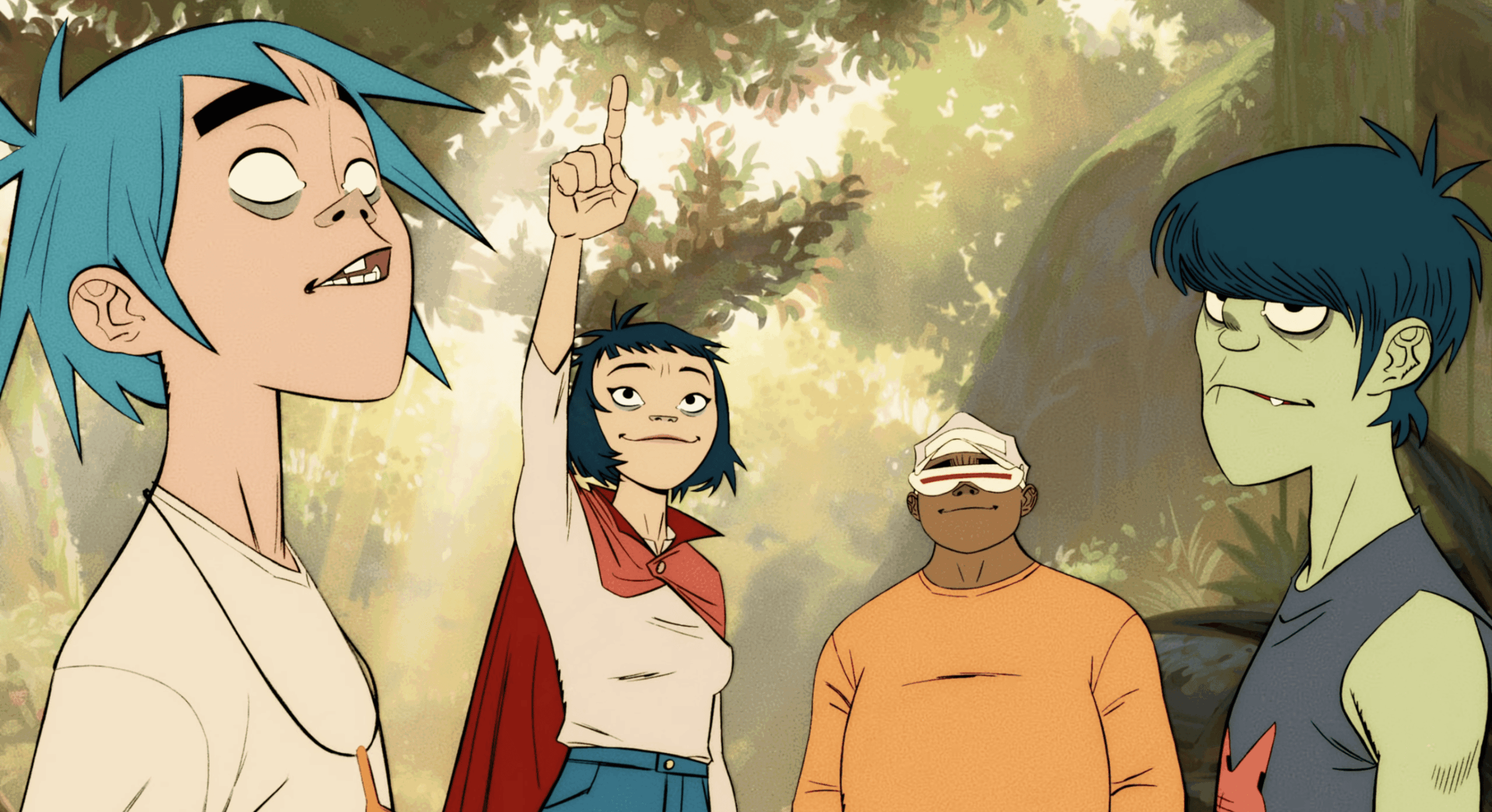

Unlock the Soundtrack of 2026: The 5 Albums Shaking Up the Industry You Can’t Afford to Miss

Ever wonder what it takes for legendary artists to shake off the dust of almost…

Oil Prices Surge: The Unexpected Roadblock Crushing Rate Cut Dreams – What Every Investor Must Know Now!

So, here we are again—just when you thought the relief of falling interest rates was…

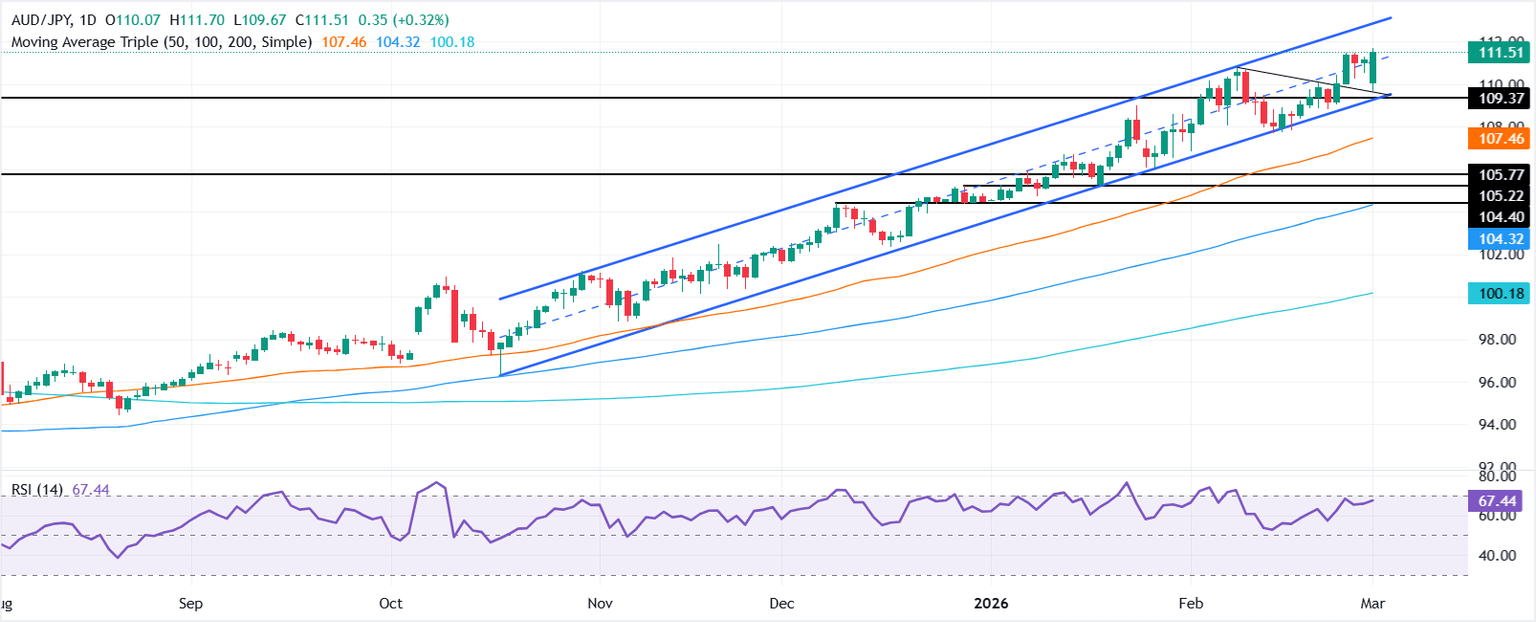

Why Smart Investors Are Racing Back to the USD as Global War Threats Ignite Market Chaos

Ever notice how the US Dollar sometimes plays the role of the undeserved underdog, then…

Why the $28 Demand Zone for Decred [DCR] Could Be the Hidden Sweet Spot Investors Are Missing Right Now

Ever wonder why some altcoins seem to bounce back just when you think the floor’s…

Why Is Peter Thiel Quietly Unloading $280 Million in Palantir Shares Right Now?

So, here’s a wild thought—what does it say about the future when Peter Thiel, the…

Unseen Moments Revealed: 30 Jaw-Dropping Polaroids That Captured the True Drama of the 2026 Actor Awards

Ever wonder what happens when Hollywood’s brightest lights collide under one roof, cameras flash, and…

Unlock the Denim Secrets of 2026: Trends That Will Transform Your Style and Confidence Instantly

Denim — the stubborn classic that refuses to fade away. But here’s the million-dollar question:…

Unlock the Secret Sanctuaries: 5 Southeast Asian Luxury Hotels Where Vegan Indulgence Meets Unforgettable Wellness Retreats

Isn’t it curious how, once upon a time, vegan dining in luxury hotels was often…

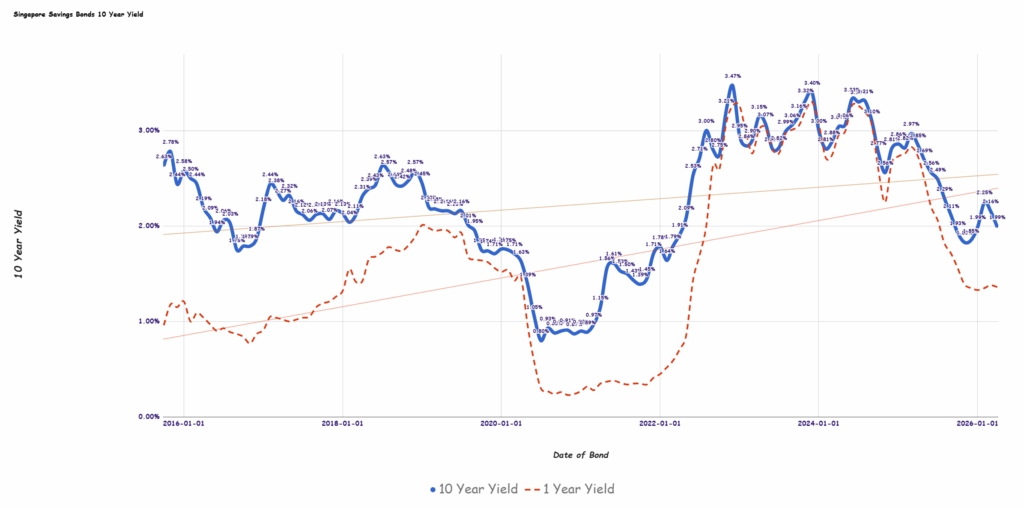

Is the 1.99% Yield on Singapore Savings Bonds April 2026 Signaling a Hidden Opportunity or a Red Flag?

Every month, like clockwork, the latest issue of Singapore Savings Bonds (SSB) arrives—offering yet another…

![Why the $28 Demand Zone for Decred [DCR] Could Be the Hidden Sweet Spot Investors Are Missing Right Now](https://wealthhealthself.com/wp-content/uploads/2026/03/why-the-28-demand-zone-for-decred-dcr-could-be-the-hidden-sweet-spot-investors-are-missing-right-now-150x150.png)

![Why the $28 Demand Zone for Decred [DCR] Could Be the Hidden Sweet Spot Investors Are Missing Right Now](https://wealthhealthself.com/wp-content/uploads/2026/03/why-the-28-demand-zone-for-decred-dcr-could-be-the-hidden-sweet-spot-investors-are-missing-right-now.png)