Is This Market Rebound Just a Dead Cat Bounce—or the Hidden Goldmine Investors Have Been Waiting For?

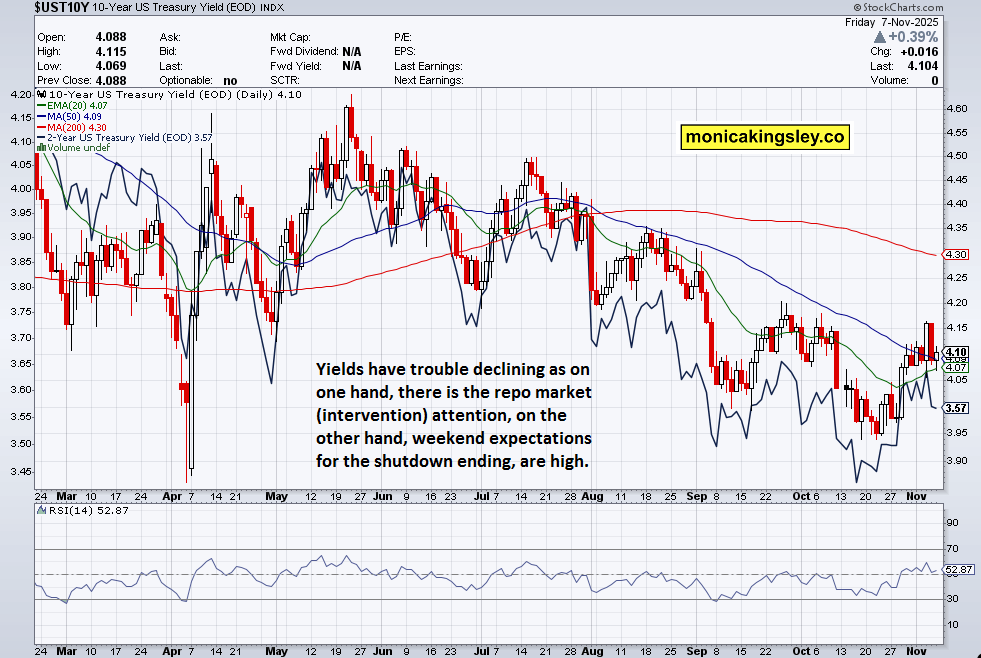

The S&P 500 did exactly what we expected — a sharp flush followed by a solid rebound that sent waves of FOMO rippling through Monday’s trading floor. Honestly, it was almost like watching a well-scripted play unfold — our clients were primed and ready, perfectly timed for the rebound and convinced a credible bottom had taken hold. Now, toss in a government shutdown resolution without any repo market hiccups, and we’re looking at an even broader stock rally stretching beyond the usual defensive sectors. Staples, real estate, healthcare—they’re all sending clear signals. Utilities are starting to bounce back, too, which could be the nudge tech needs to jump back into the party sooner than we think. But here’s the million-dollar question: just how soon can tech catch the wave? And what are the numbers whispering behind the scenes? Plus, with yields ticking and the dollar climbing, will these factors play nice to support the stock market’s momentum this coming week? Buckle up—it’s gearing up to be a fascinating ride. LEARN MORE

S&P 500 performed exactly as called – flush and then rebound – fine enough one to create FOMO in some on Monday. All clients were positioned for such an outcome – in timing the rebound, credible bottom formation. And should we get government shutdown resolution and no repo market noises, stocks would continue higher, broadening base enough beyond the current defensive one. Staples, real estate and healthcare tell the story clearly enough – and utilities rebounding pave the way for tech to notice one day as well. Just how soon can that be, what do various ratios say?

And will yields and (rising) dollar support the stock market rally in the week ahead?

Post Comment