AI Mentions Explode in Q4—Here’s the ONE Trigger That Could Rocket Bitcoin to a Record High Overnight!

Artificial Intelligence is no longer just sci-fi fodder or a buzzword tossed around in tech meetups—it’s reshaping our financial landscape in real time. But here’s the kicker: as AI engineers breakthroughs and powers tech stocks to soaring heights, it’s also stirring up a storm beneath the surface—especially if you’re watching how crypto and traditional tech play the long game. Ever wonder why Bitcoin has been wobbling while Nvidia charts relentless upward? That divergence isn’t just a market quirk; it’s a flashing neon sign pointing right at the tricky dance between innovation and economic risk. So, what’s an investor to do when AI’s promise comes entangled with looming disruption? Let’s unpack this tangled web, and yeah—there might be some surprising hedges in play you didn’t see coming. LEARN MORE

It’s becoming increasingly difficult for investors to ignore the long-term risks of Artificial Intelligence (AI), especially as it integrates more deeply across sectors. Consequently, effective risk management is essential.

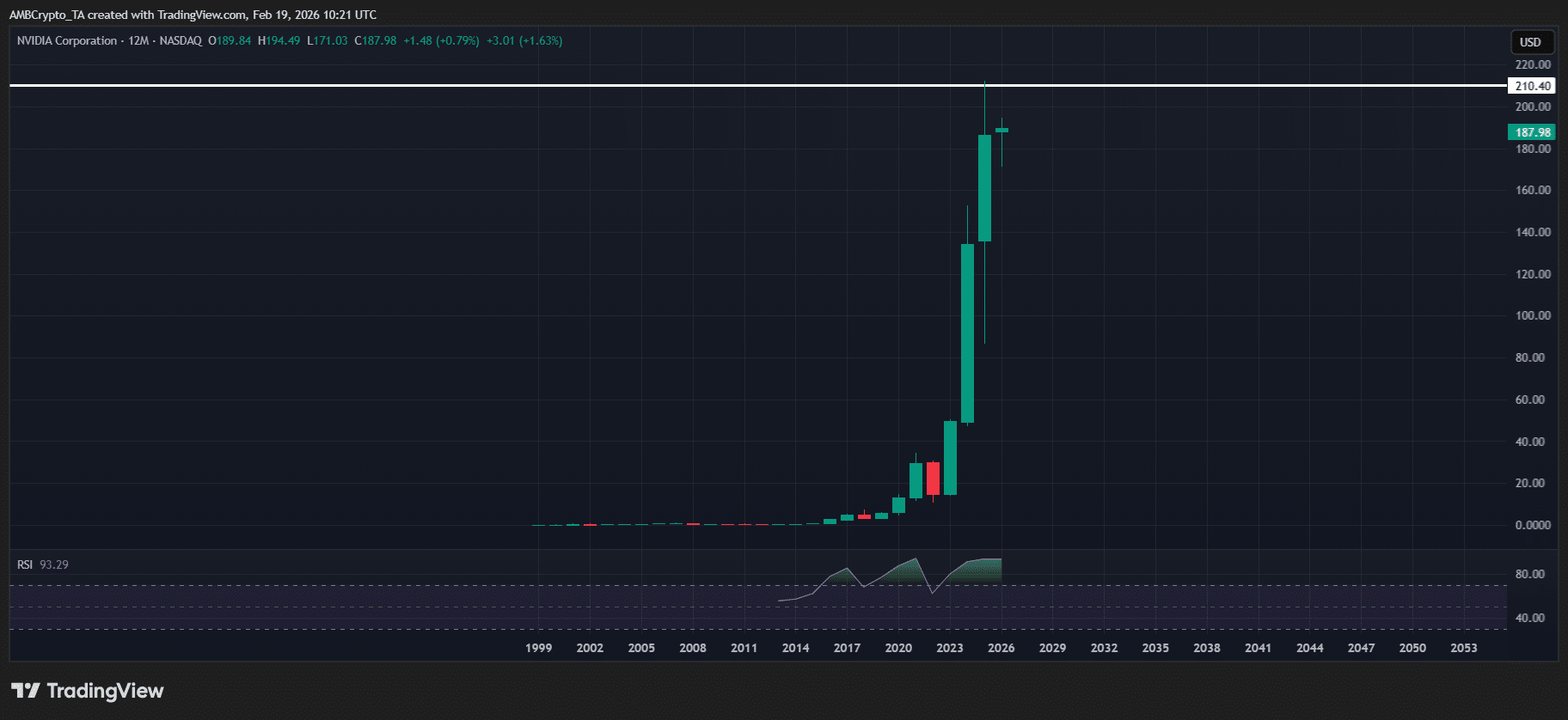

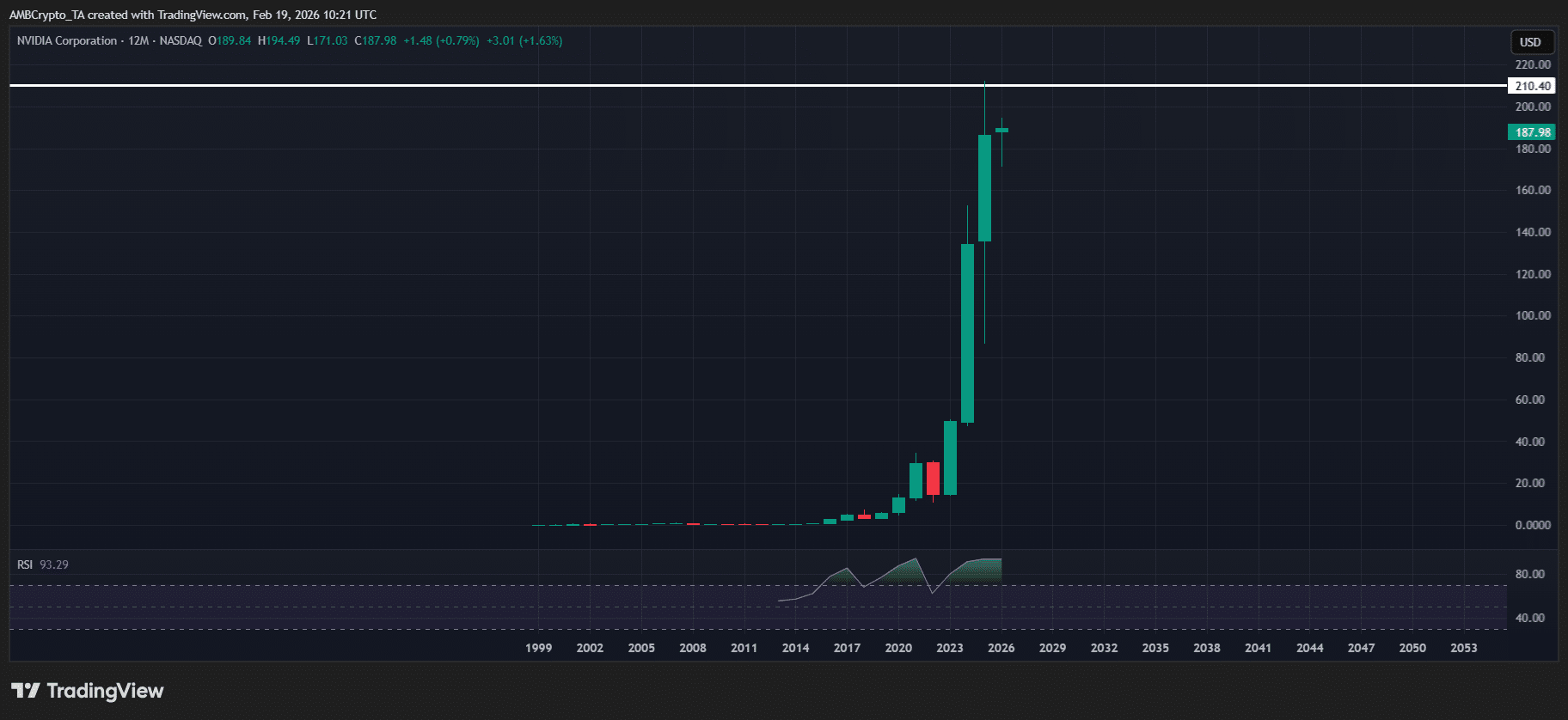

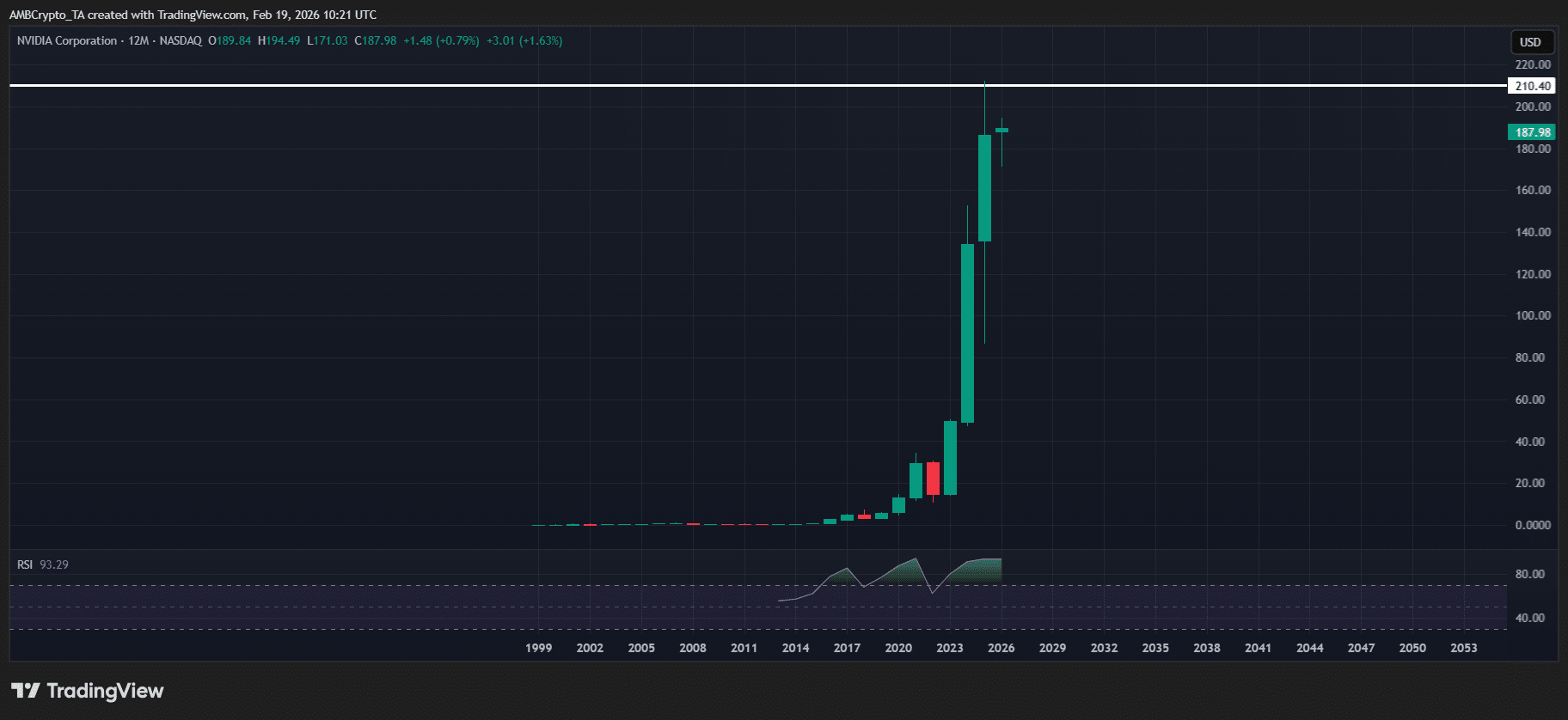

You can really see it in tech stocks, hitting new highs and pulling in big capital as investors bet on AI as the next big thing. The result? Tech stocks and the crypto market are moving in completely different directions.

On the charts, Bitcoin [BTC] is down 24%, while Nvidia [NVDA] keeps extending its gains from a 39% jump in 2025. Back then, BTC closed the year down 6.3%, showing just how much tech stocks rode the AI wave.

Still, the fear of AI disruption has been hard to ignore.

According to the Kobeissi Letter, mentions of “AI disruption” during Q4 2025 earnings calls hit 126, 2x the previous quarter and 3x the level seen a year ago, highlighting just how volatile the market outlook has become.

Building on this, Arthur Hayes, the co-founder of BitMEX, has called the AI narrative the true catalyst for Bitcoin and the broader crypto market, predicting digital assets could reach all-time highs in the near future. The big question: Is an AI-driven rotation the next major trend?

As AI shakes markets, Bitcoin could stand out as a hedge

Arthur Hayes’s thesis is grounded in the economic impact of AI.

Analysts identify the credit markets as the area of greatest risk. As AI automates jobs and boosts productivity, it could trigger deflation, potentially forcing banks to print more money to stabilize the economy.

In this context, analysts see the growing divergence between Bitcoin and tech stocks as an early signal of AI-driven “financial risk.” The idea is simple: the more capital investors park in tech, the higher the potential risk of an economic slowdown.

That’s why tracking this divergence has become a key metric for investors.

Meanwhile, as the chart above shows, confidence in the U.S. dollar has been hitting extreme bearish levels since “Liberation Day” in April last year. In turn, pushing it to multi-month lows and testing its overall strength.

Looking ahead, this fading confidence could intensify as the AI disruption narrative takes center stage. In this context, financial risk becomes a key theme, positioning Bitcoin as a long-term hedge while investors rotate out of an oversaturated AI market and into risk assets.

Final Summary

- Growing divergence between Bitcoin and tech stocks signals a potential economic slowdown, making this divergence a key metric for investors.

- Falling confidence in the U.S. dollar and oversaturated AI markets could position Bitcoin as a long-term safe haven for rotating capital.

Post Comment