AUD/USD on the Brink of a Breakout: Is the 0.7100 Mark the Gateway to Unseen Profits?

Ever wonder how two currencies can tango so gracefully amid the chaos of global economic jitters? Well, buckle up, because the AUD/USD pair is on a thrilling two-day sprint, up by 0.36%, as the mighty Greenback takes a breather. It’s almost like watching a high-stakes poker game where the US economy’s growth hiccups and inflation inching toward 3% are reshuffling the deck. Right now, the pair is flirting with 0.7086, gearing up to close out the week with gains exceeding 0.19%. For those of us who love dissecting market moves, this upward bias past the 20-day SMA at 0.7034 isn’t just a number—it’s a beacon signaling the bulls are not ready to back down just yet. Can this momentum push past 0.7100 and dare to shadow the yearly high at 0.7147? Or will a slip below 0.7000 send it tumbling toward support levels that make traders gulp? It’s a fascinating dance of numbers and nerves, and if you’re into catching the next move before it happens, you might not want to blink here. LEARN MORE

The AUD/USD advances for the second straight day, up by 0.36% as the Greenback edges lower as US economic growth takes a toll while inflation accelerates towards the 3% threshold. At the time of writing, the pair trades at 0.7086, poised to end the week with gains of over 0.19%.

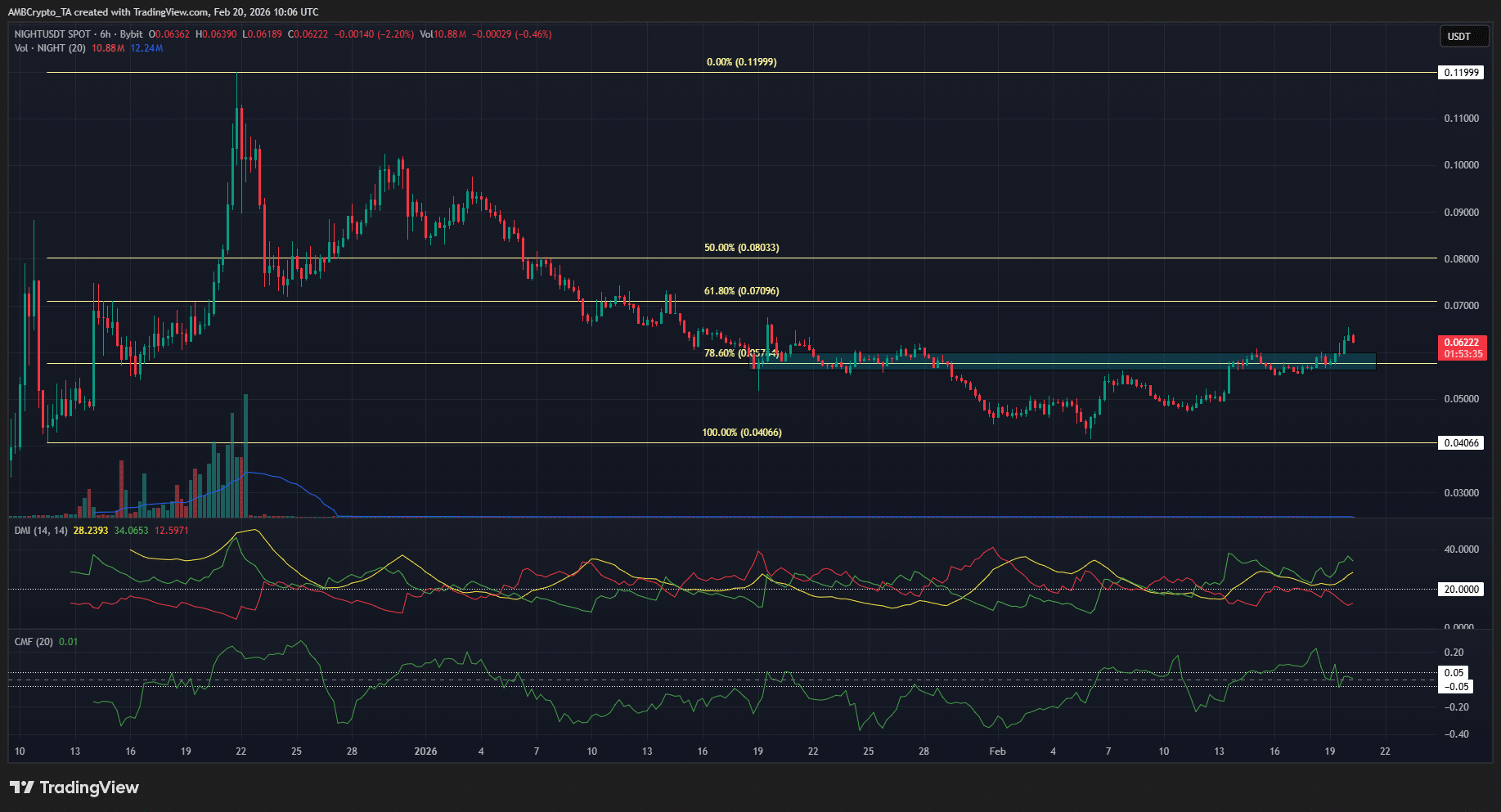

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains upward biased after buyers pushed the exchange rate past above the 20-day Simple Moving Average (SMA) of 0.7034. Following that, they cleared 0.7050 and seem poised to challenge the 0.7100 mark.

Bullish momentum remains intact, with the Relative Strength Index (RSI) aiming higher, after bottoming near 59.34. If the index surpasses 65.00, the AUD/USD could clear the next key resistance level and eye the yearly high of 0.7147.

Conversely, if AUD/USD tumbles below 0.7000 the first support would be the February 6 daily low at 0.6897, followed by the 50-day SMA at 0.6832.

AUD/USD Price Chart – Daily

Australian Dollar Price This week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.73% | 1.17% | 1.57% | 0.54% | -0.17% | 0.89% | 0.87% | |

| EUR | -0.73% | 0.44% | 0.86% | -0.20% | -0.90% | 0.16% | 0.14% | |

| GBP | -1.17% | -0.44% | 0.15% | -0.62% | -1.34% | -0.28% | -0.30% | |

| JPY | -1.57% | -0.86% | -0.15% | -1.02% | -1.70% | -0.68% | -0.66% | |

| CAD | -0.54% | 0.20% | 0.62% | 1.02% | -0.75% | 0.35% | 0.33% | |

| AUD | 0.17% | 0.90% | 1.34% | 1.70% | 0.75% | 1.08% | 1.06% | |

| NZD | -0.89% | -0.16% | 0.28% | 0.68% | -0.35% | -1.08% | -0.02% | |

| CHF | -0.87% | -0.14% | 0.30% | 0.66% | -0.33% | -1.06% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Post Comment