BNB’s $1K Target Just Got Supercharged: How VAPE’s $1.25B Bet Could Rewrite Crypto’s Future Overnight

So, here’s the kicker: BNB Chain just pulled off a jaw-dropping $1.25 billion PIPE raise to launch the NASDAQ-listed BNB treasury vehicle, VAPE. Now, that’s not your everyday crypto news. The question begging to be asked— is this altcoin finally stepping into the big leagues, or just flexing muscles? Sure, Binance Coin [BNB] might be playing catch-up to Ethereum’s sizzling 50%+ rally this July, but it’s far from idle. In fact, with lightning-fast transactions post-Maxwell fork and a market that’s buzzing over BNB’s infrastructure improvements, something big is brewing. Toss in the sharp pivot by CEA Industries, turning vape business into a $1.25 billion BNB-native treasury, and you’ve got a cocktail that’s shaking up the crypto landscape. Could this mark the dawn of a new era where BNB not only hits $1,000 but also upends the hierarchy of high-cap cryptos? I’ve gotta say, the market’s reaction—VAPE stock surging 550%—suggests we’re on the verge of something seismic. Ready or not, BNB is quietly gearing up to rewrite the playbook. LEARN MORE

Key Takeaways

BNB Chain is turning heads with a $1.25 billion PIPE raise to back the launch of NASDAQ-listed BNB treasury vehicle VAPE. Is the altcoin finally stepping into the big leagues?

Binance Coin [BNB] might be trailing Ethereum’s [ETH] 50%+ rally this July, but it’s not just sitting still.

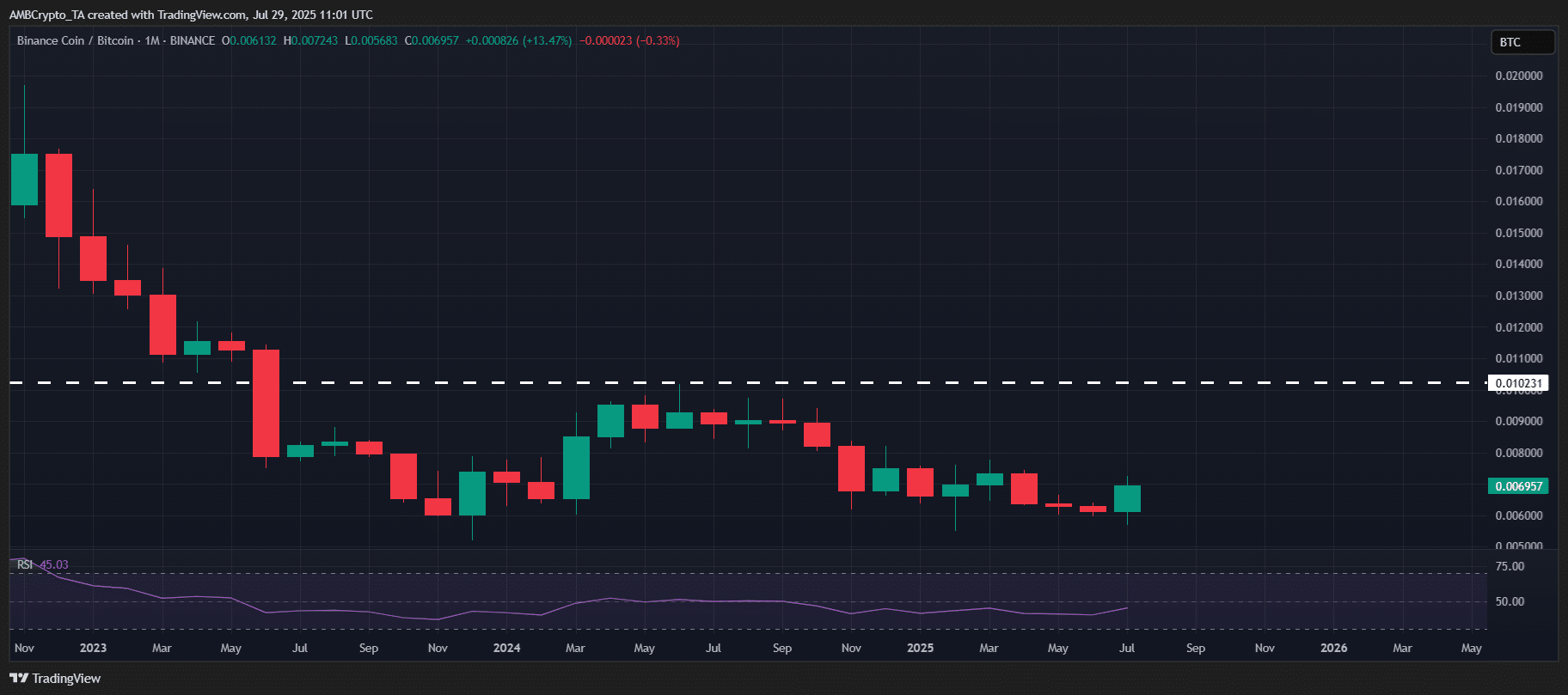

Several metrics reinforce this structural narrative.

Since the Maxwell fork, Binance Chain cut its block time from 1.5s to a snappy 0.75s. The impact’s clear: Daily transactions spiked 142.8% over the last three months, while Ethereum only saw a 24.3% lift.

With throughput scaling, latency cut in half, and user activity ramping fast, BNB looks like it’s positioning for a clean move toward $1k. But does it also raise the bar for other high-caps in the game?

VAPE launches as first public BNB treasury

CEA Industries (NASDAQ: VAPE) is making a sharp pivot. It has ditched its vape business to become a $1.25 billion BNB-native treasury vehicle.

It’s a big shift for BNB, which has long lacked the institutional wrappers that Ethereum and Bitcoin [BTC] enjoy.

The market response? Sharp and decisive. VAPE stock pumped over 550% on the news. Clearly, this could mark the beginning of a new asset class narrative for Binance Coin.

And this isn’t just a one-off headline.

With Bianance Coin hitting fresh ATHs, tightening up core infra, and maintaining solid on-chain velocity, institutions are finally clocking it as a high-yield Layer1 with real capital efficiency.

It all compounds into BNB’s clean drive toward the $1k milestone. The asset now looks poised to front-run the next cycle narrative, quietly outpacing most high-caps on structural positioning.

Post Comment