Gold Hits a Crucial Crossroad: Will the EU-US Trade Stalemate Ignite a Bull Run or Trigger a Collapse?

Daily digest market movers: Gold reacts to renewed trade tensions

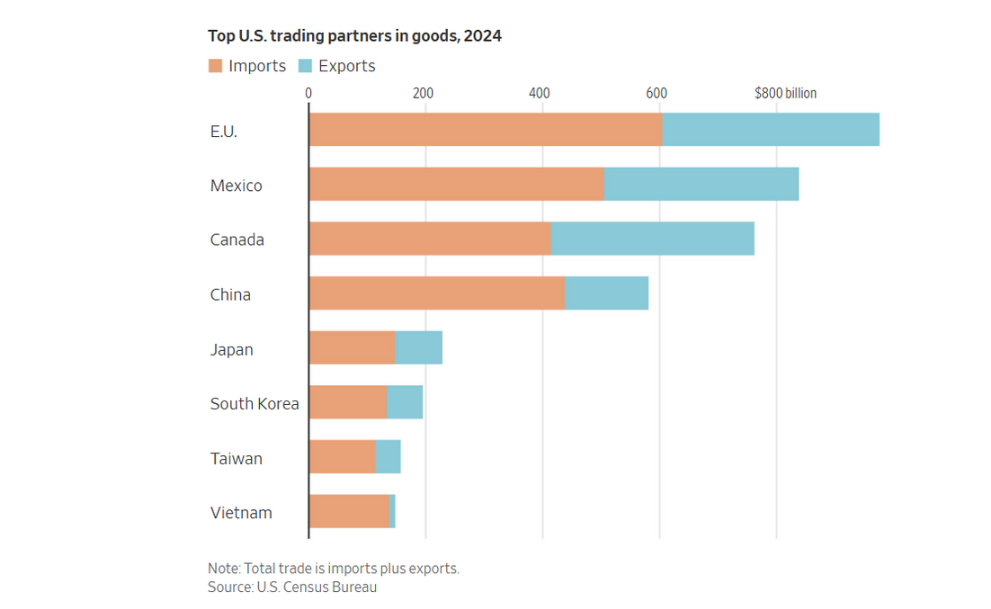

- Brussels is working to secure a trade agreement while simultaneously preparing a fresh set of retaliatory tariffs. These measures are aimed at targeting up to €72 billion worth of US exports, which would cover products such as cars, aircraft, bourbon whiskey, digital services, and other key sectors.

- Sector-specific tariffs are also set to remain in place. This includes the 50% tariff on steel and aluminium, with the same rate applying to copper imports to the US beginning next month.

- Auto parts imported to the US are currently subject to a 25% levy. Trump has also indicated that tariffs on pharmaceuticals and semiconductors may be implemented soon.

- According to Bloomberg, estimates from the EU indicate that duties are already impacting roughly 70% of imports to the US. This amounts to approximately $442 billion worth of trade.

- Economic data from the US has recently revealed that the economy remains resilient despite the fundamental risks associated with increased import costs.

- Michigan Sentiment data released on Friday showed that US consumers remain optimistic. Meanwhile, the University of Michigan (UoM) also published its preliminary inflation expectation figures. The survey revealed that both the 1-year and 5-year inflation expectations have decreased.

- US Retail Sales data on Thursday also surpassed analyst predictions, indicating robust consumer spending.

- As the Federal Reserve (Fed) remains reluctant to cut interest rates, citing concerns that tariffs may still lead to price increases, markets are currently pricing in a 56.1% probability of a rate cut in September. Meanwhile, the CME FedWatch Tool indicates that the likelihood of rates remaining unchanged at the same meeting stands at 41.3%. Any shifts in these expectations will impact the demand for US yields. Rising yields do not bode well for non-yielding assets, such as Gold.

Gold technical analysis: XAU/USD breaks above symmetrical triangle resistance, as bulls retest $3,400

The daily chart of spot Gold shows a breakout from the symmetrical triangle pattern, which has pushed XAU/USD above the 23.6% Fibonacci retracement level of the April low-high move near $3,372. As this level now steps in as support, the price is currently flirting with the critical $3,400 psychological resistance level. A surge in bullish momentum above this zone would bring the June 16 high of $3,452 back into play, opening the door for a potential retest of the $3,500 all-time high.

Post Comment