Is First Citizens BancShares ($FCNCA) Quietly Engineering a Banking Empire No One Saw Coming?

It makes sense to review ROE and ROTCE together.

Here is FCNCA’s numbers:

FCNCA made a few acquisitions over the past 11 years but very little goodwill and intangibles were added. The ROE and ROTCE is added.

FCNCA ROTCE was around the 8% region. Then with acquisition and scale, it became 10%. Then 12-14% region.

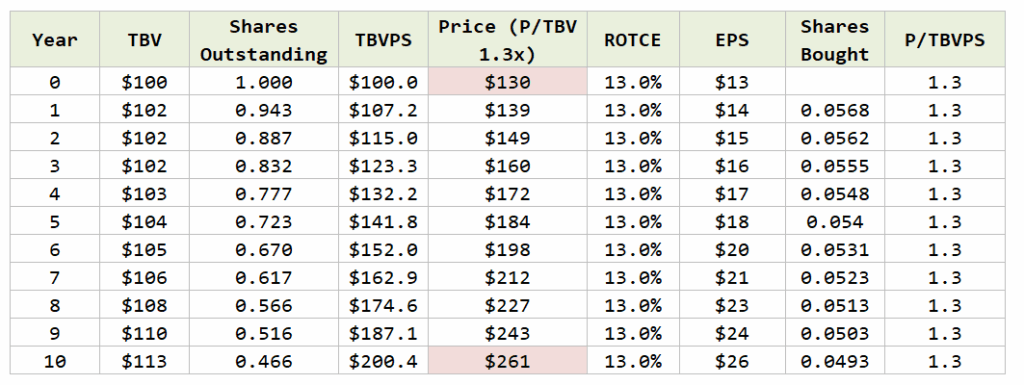

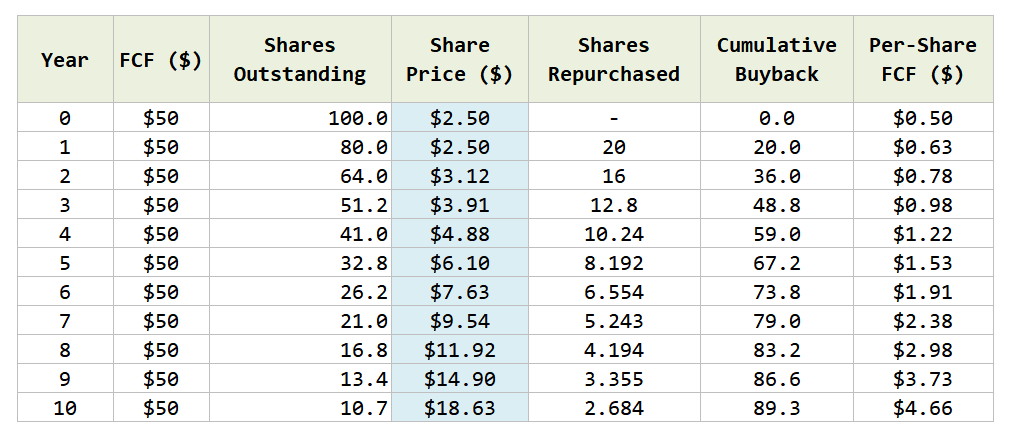

Now this means that if FCNCA were to trade at 1 times tangible book value, your $1 earned from FCNCA that they use to buy back their stock is put into:

- A business that is growing in scale.

- Scaling up in efficiency.

- Earning a consistent 12-14% a year.

- That have this kind of ROTCE for a while already.

Now where are you going to buy a business like that?

Post Comment