Is First Citizens BancShares ($FCNCA) Quietly Engineering a Banking Empire No One Saw Coming?

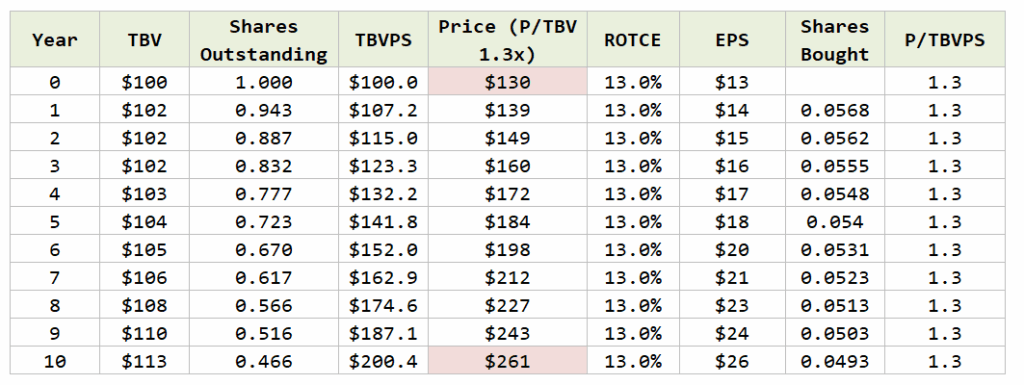

But you see the book value of your share grow by this much year after year. The above is 19.4% p.a. over 11 years.

Mr. Huber says FCNCA have compounded their book value at 13% p.a. over the past 30 years.

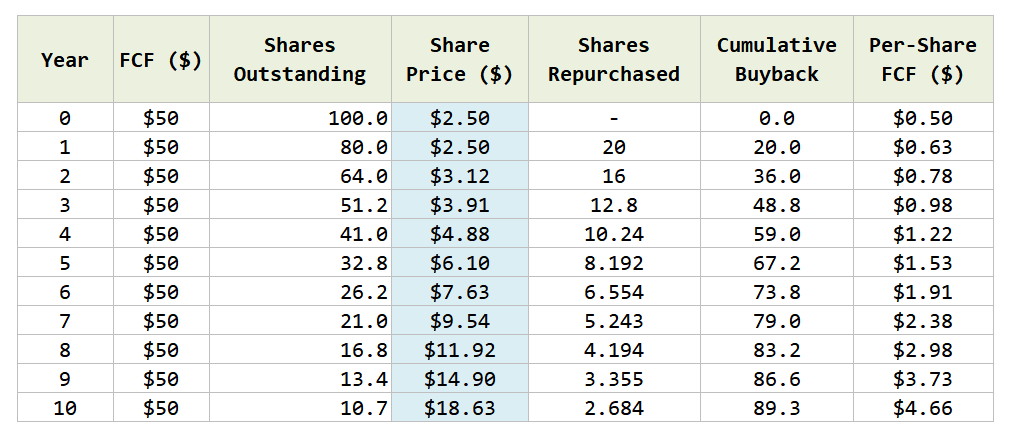

So if you pay for a PE of 12 times, or 8-9% Effective Yield, and they never paid it out to you, but compound your book value per share at 13-20% per year, would you be happy about it?

I think many would be even happy that the hurdle is just 10%.

How Impactful are Market Interest Rates to FCNCA’s Business?

Some of us might be wondering… How big is the impact of short term or long term rates?

Post Comment