Is First Citizens BancShares ($FCNCA) Quietly Engineering a Banking Empire No One Saw Coming?

As pat of the deal, the FDIC also moved cash equivalents of deposits worth up to $56B (because loans happen due to deposits) as liabilities part of the deal.

FCNCA paid zero cash upfront. Okay, technically they paid $500 million for that loan book.

This is because the deal is structured as a “purchase and assumption” transaction. This is a kind of deal the FDIC likes to structure for failed banks quickly to minimize disruption to depositors and financial markets.

Why this deal is great is because:

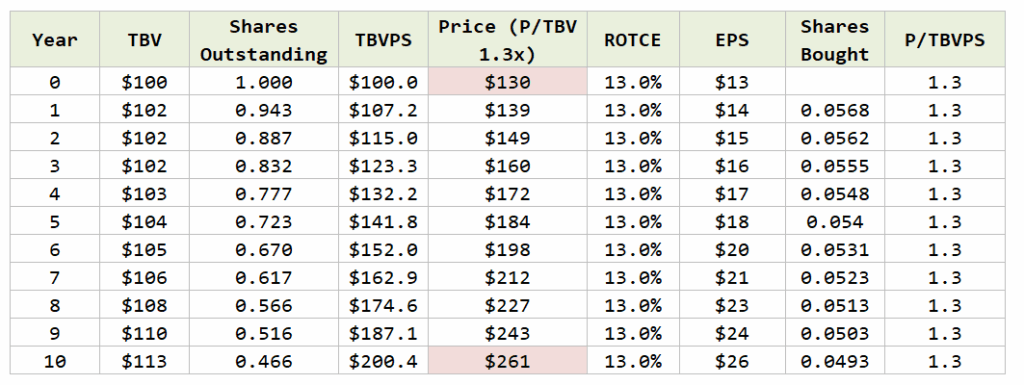

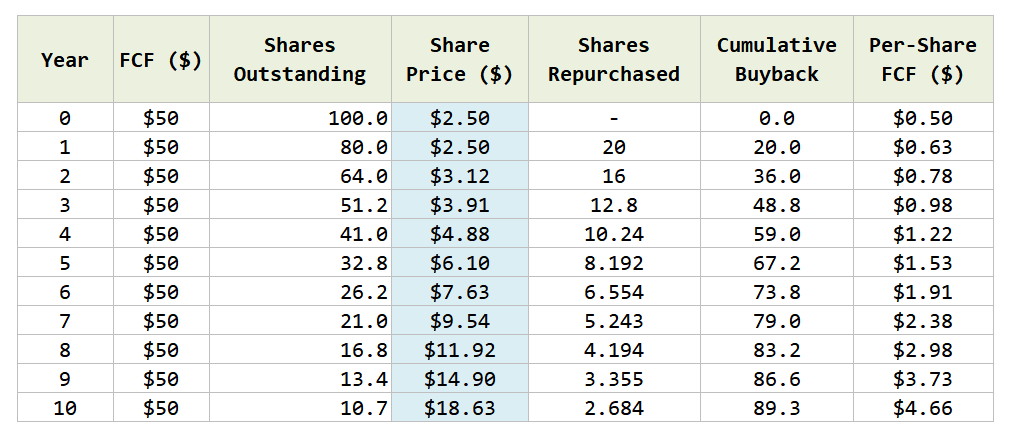

- If you understand some parts above if FCNCA has a 12-14% ROTCE, 3.2% NIM, what this deal basically does is double their loan book.

- They can improve their efficiency ratio.

- The FDIC insurance protects them from downside for this SVB portion.

- They get important tech clients and relationships.

- They get fee income.

- And existing shareholders did not get diluted!

SVB has been a bank that for decades earn solid ROE and had a very valuable relationship with Silicon Valley startups and technology companies. Mr. Huber spoke to a few SVB customers and also the ones who left in a panic last March.

Post Comment