The evidence of a weaker emerging markets, of value shows that it is uncertain to always expect the markets to always do 10%, 10%, 10%, 10%, 10%.

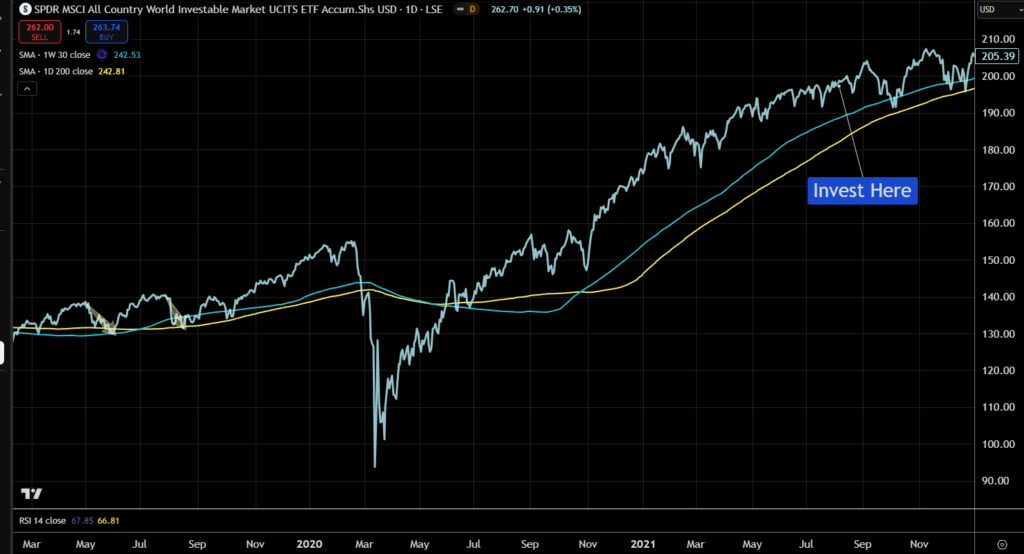

What is also more underrated is whether developed, emerging, value, growth, small caps, fixed income investment grade, the critical part is whether you invest in any stuff at all. If you have you would be better than 15 years ago in aggregate.

You will only know in hindsight returns are this bad not when you live through it.

The advisory challenge is to shape the client’s perception to be closer to the reality. But if it is closer to reality it means another big challenge: Helping them to manage the emotional part when the market throws enough uncertainty shit at them.

Post Comment