I kind of know this better than a lot of people.

But the problem is like many, we have too much things to think about and it just didn’t occur to me that what affected financial independence income planning can affect the business side of the work we do in wealth advisory.

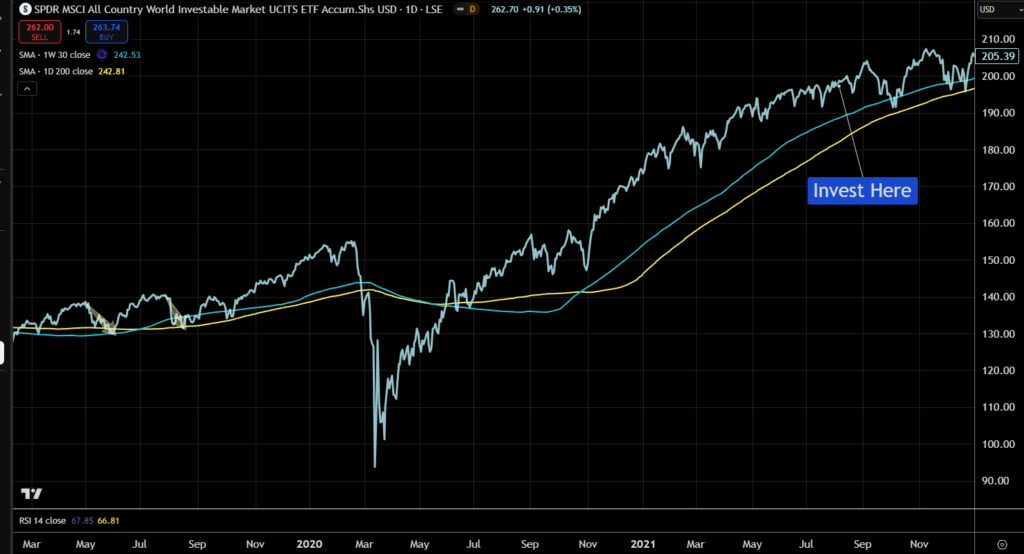

And so that batch of clients endure one year of 26% drawdown in the market.

Then if we revisit this in year 2 anniversary, the returns is a cumulative 5.7%. That is an annualize 2.8% p.a.

Some clients struggle to understand this. In some of their minds, equity does at least 7% if not 12% p.a. in the long run. So to see this after two long years, they would start wonder if they make the wrong decisions, especially if they have trusted us and invested the majority of their net wealth.

Post Comment