More and more, I see the high level, evergreen problem as an expectations versus reality problem.

You set unrealistic, or misinformed expectations, you will have to manage that big gap between reality when it happens.

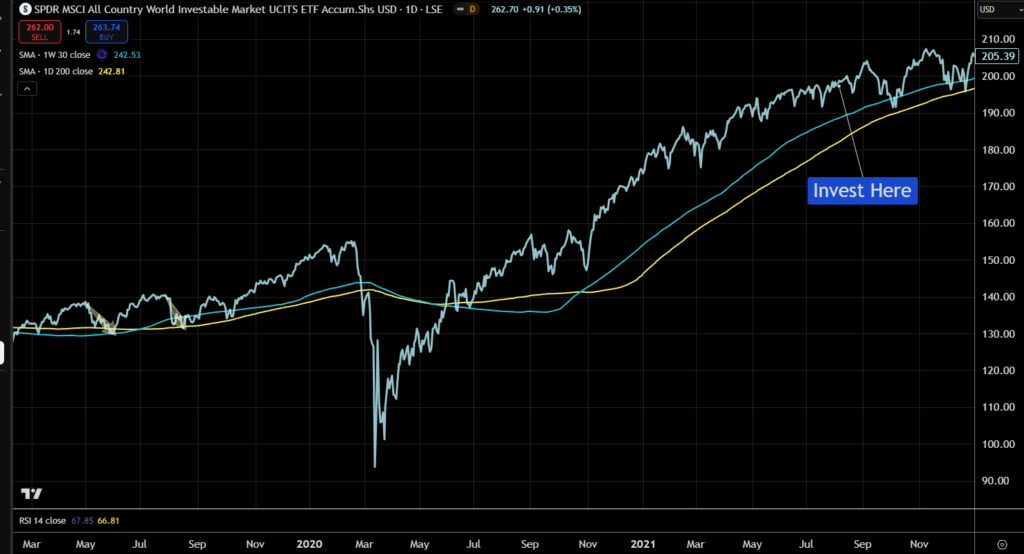

In talking with investors, I see this “the long term average return of equities is X% p.a. I want to start investing because I think that gives me a chance to hit my goal.” too much.

If they see average interest rate to be 1%, 1%, 1%, 1% every year, they will see equity return to be 7%, 7%, 7%, 7% every year.

Post Comment