Unlock the Hidden Goldmine: Why Singapore REITs Are Suddenly Outpacing Government Bonds by a Jaw-Dropping 3.8%!

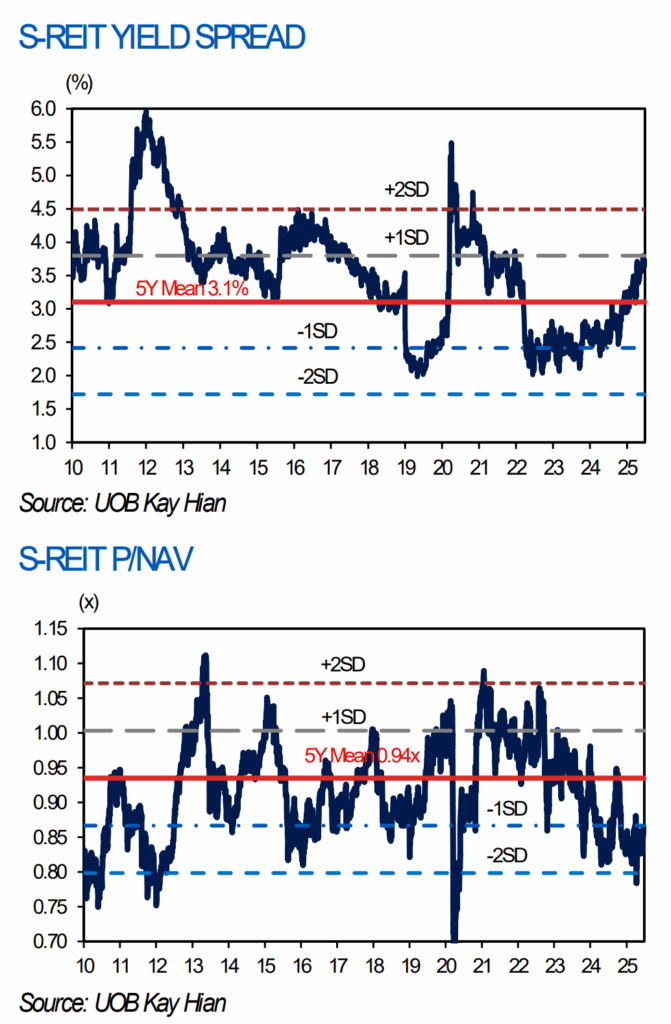

The following S-REIT (Singapore REITs) yield spread and price to NAV is taken from a UOB Kay Hian report published on 27 Jun 2025:

The yield spread shows the cap-weighted dividend yield for the listed REITs minus the risk-free rate which is typically the 10-Year Singapore Government Bond Rates.

REITs is a asset class that is more risky than government bonds and naturally, they should command a premium over government bonds. The top chart allows us to see that premiums change over time. If the spread is narrow (small number like in 2019 and recently), then that means you are not rewarded much for investing in the riskier REITs then just government bonds.

Post Comment