Unlock the Hidden Goldmine: Why Singapore REITs Are Suddenly Outpacing Government Bonds by a Jaw-Dropping 3.8%!

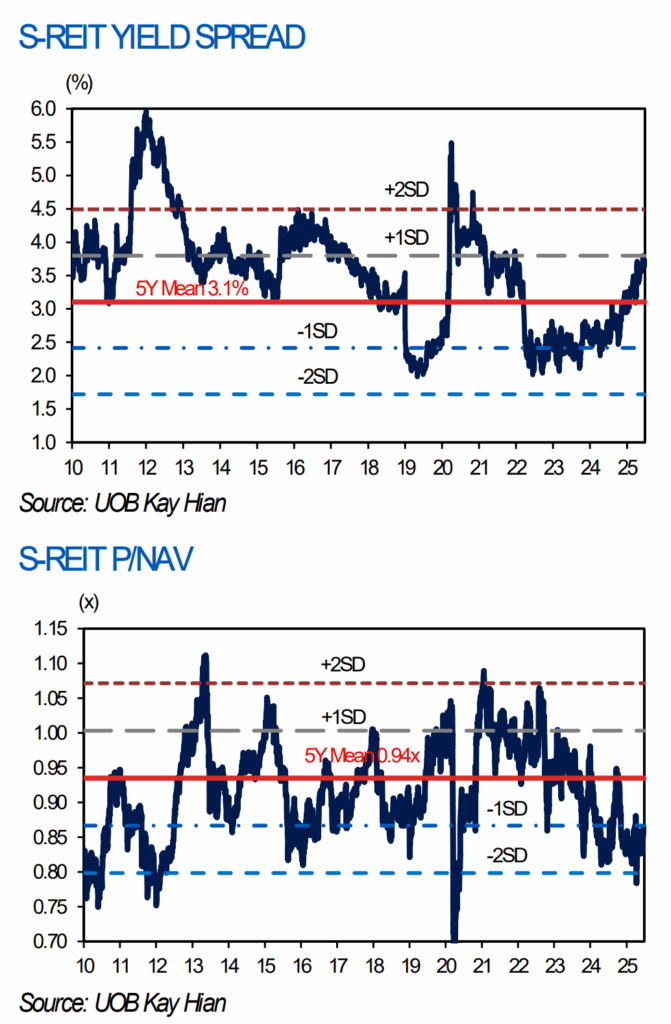

The 1SD (standard deviation) and 2SD (standard deviation) tells you if we take the whole time period, what leans towards more standard and extreme. 68% of the time, the yield spread would fall within the +1SD and -1SD. If it gets to the 2SD and -2SD that means it is kind of extreme.

The bottom chart shows the Price to (NAV) Net Asset Value, which is another valuation gauge. The lower the price to NAV the cheaper things are relatively speaking.

The REITs have not done well, due to a combination of higher expense, vacancy in the office space. To compound to that, high interest rates mean that you don’t have to take risk to get a 4-5% regular return.

Post Comment