Unlock the Hidden Goldmine: Why Singapore REITs Are Suddenly Outpacing Government Bonds by a Jaw-Dropping 3.8%!

Most of you might not see clearly other than the yield curve have shifted down a fair bit in one month.

The 10-year have moved down from 2.213% to 2.086% or 0.127%.

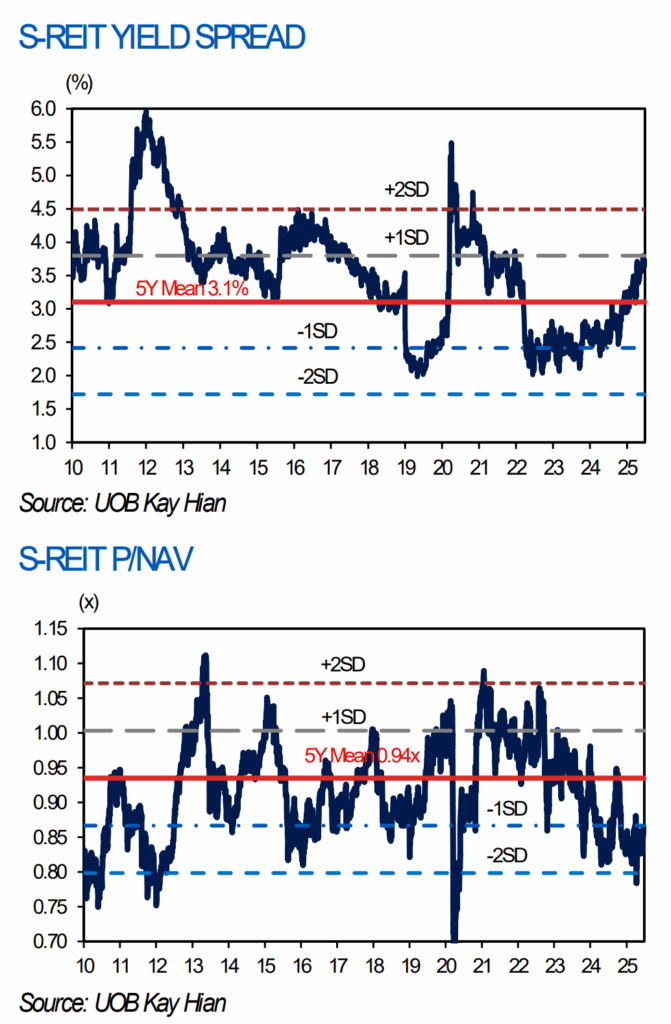

If we put everything together… the yield spread is still…. 3.8%.

Okay it might look stupid for me to see so much things to conclude that but it is what it is.

These spread would look differently if you have longer data.

And just so happen… Investment Moats used to write a fair bit about REITs so I was able to dig this out:

Post Comment