Why Are Stablecoins Stagnant Despite Massive Minting? The Silent Alarm for Crypto Liquidity You Can’t Afford to Ignore!

Ever notice how sometimes the market throws a curveball that makes you scratch your head? That’s exactly what happened with stablecoins in July 2025. Picture this: $8 billion in fresh Tether [USDT] minted, yet a staggering $5.7 billion mysteriously pulled off the exchanges—almost like everyone’s hotboxing their cash on the sidelines instead of throwing it into the game. It’s like the market’s throwing a party, but half the guests are nowhere near the dance floor. What’s going on here? Is this overflowing supply just a mirage, or a clear sign that investors are tightening their belts, bracing for a broader risk-off mood? Bitcoin’s recent leap to $123k didn’t materialize in a bubble; it closely tracked the rotation of stablecoin liquidity. But with so much capital sitting idle, it begs the question: are we on the edge of sustained upside, or is this sidelined cash a silent dampener keeping risk appetite in check? Let’s dive deep into what these puzzling stablecoin moves mean for the market’s next steps. LEARN MORE

Key Takeaways

Stablecoins surged in supply but failed to deploy, with $8 billion in new USDT minted yet $5.7 billion yanked from exchanges. Sidelined capital stayed parked, reinforcing a broader risk-off tilt.

Tether [USDT] didn’t sit out July’s turbulence. In fact, it mirrored the market’s pulse. Its market cap jumped to $163.60 billion, tagging on nearly $8 billion in fresh supply.

That’s a 3.72% gain for the month, marking the sharpest 30-day climb since November’s 10.89% surge, when risk appetite kicked into gear. Simply put, Bitcoin’s [BTC] run to $123k didn’t happen in a vacuum.

Instead, it tracked closely with the stablecoin liquidity rotating into the system. And yet, $5.7 billion stablecoins were yanked from exchanges, creating a significant imbalance.

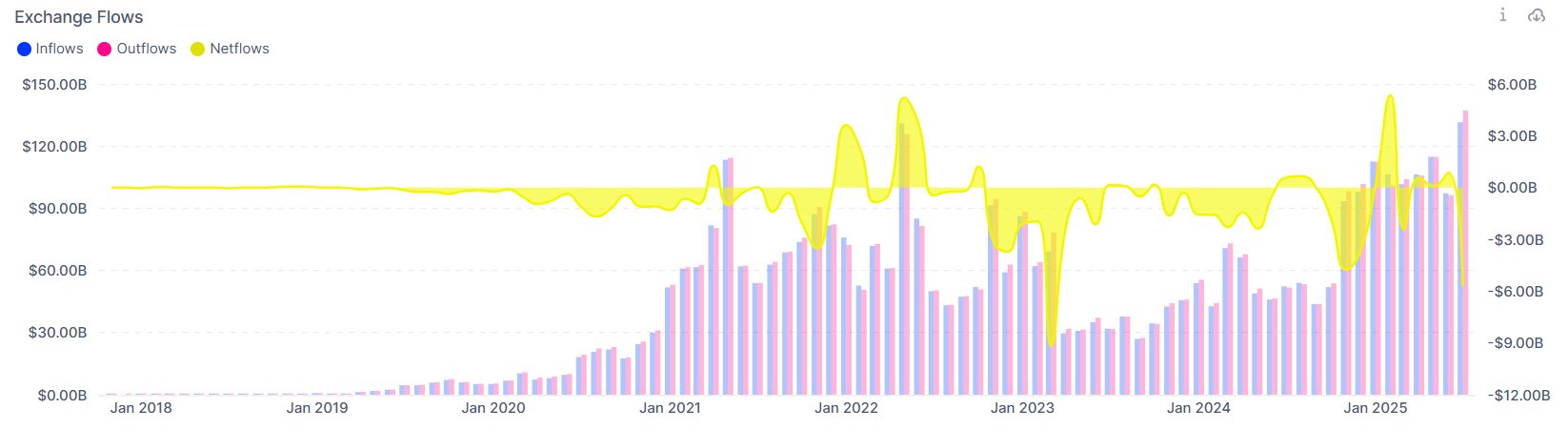

As illustrated in the chart above, in July 2025, stablecoin outflows (pink) surged, while inflows (blue) held relatively flat, marking one of the largest monthly outflow spikes since early 2022.

When you stack that against the $8 billion in fresh USDT minted, it paints a lopsided picture: Supply’s ramping, but actual risk deployment is lagging.

The result? A liquidity-deficient environment where capital might be circulating, but it’s not hitting the order books. Does this behavior point to a broader risk-off skew, capping “market-wide” upside?

Are stablecoins signaling a risk-off shift?

Notably, Bitcoin’s Stablecoin Supply Ratio (SSR) spiked from 9.39 to 10.48 by mid-July, right as BTC tagged its $123k high.

For context, a rising SSR reflects shrinking stablecoin liquidity relative to Bitcoin’s market cap, signaling that dry powder isn’t keeping pace with BTC’s upward move.

The $5.7 billion in net stablecoin outflows only reinforced this. Investors hedged instead of rotating in, adding resistance just below the highs.

Unless stablecoin liquidity returns and SSR cools off, sidelined capital stays parked, keeping risk-off pressure in play and capping BTC’s upside.

Post Comment