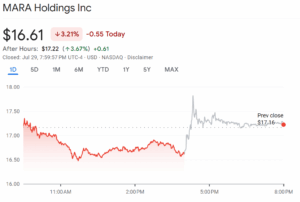

Why Betting on a Fed Rate Cut Could Be the Riskiest Play You Make This Year—Here’s the Defensive Move That Wins Every Time

Imagine you’ve got a 50-unit building in Phoenix. Occupancy’s strong at 95%, but your property taxes jump by $25,000, and utilities spike by another $10,000. Even though you raise rents a bit—say, by 2%—your net operating income still drops by around 7%. Ouch.

Hidden Cash Flow Killers You Need to Watch

Let’s talk about some sneaky ways your cash flow could get hurt, even if you’re fully leased:

- Late payments: Even a small rise in tenants paying late is like an interest-free loan you’re giving away every month.

- Slow leasing: If it’s taking longer to fill vacancies, you’re losing cash, plain and simple.

- Deferred maintenance: Those minor repairs you put off? They can become expensive emergencies before you know it.

- Legal problems: One lawsuit can wipe out months of profit instantly.

Why Protecting Your Cash Flow Matters Now

Refinancing right now isn’t cheap. Missing a single mortgage payment? That could tank your returns. Your goal right now is to keep as much cash flowing consistently as possible. The smart play is defensive: control your expenses, stay on top of collections, and keep your reserves healthy.

Post Comment