Why Trump Accounts Could Completely Upset the Retirement Game—And What It Means for Your IRA Savings.

On the other hand, they add a layer of complexity to the already cluttered landscape of American retirement savings.

Today, the US tax system has more than ten different savings vehicles, all with distinct rules: IRA, Roth IRA, 401(k), 529, HSA… and now Trump Accounts.

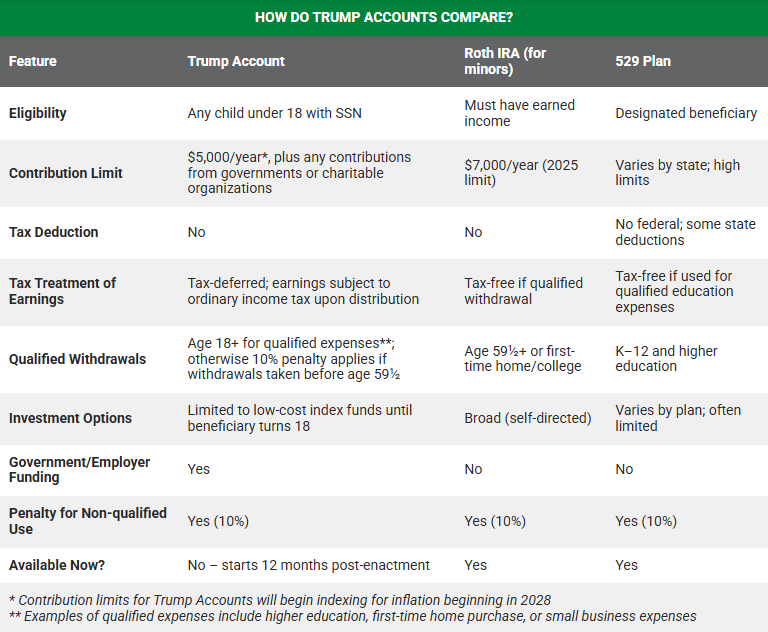

Trump Accounts vs IRAs: Key differences to be aware of

Source: BRAGG Financial

Source: BRAGG Financial

Trump Accounts are distinguished by their early accessibility. Unlike Traditional IRAs and Roth IRAs, which require earned income to contribute, Trump Accounts are open from birth.

Post Comment