Why Trump Accounts Could Completely Upset the Retirement Game—And What It Means for Your IRA Savings.

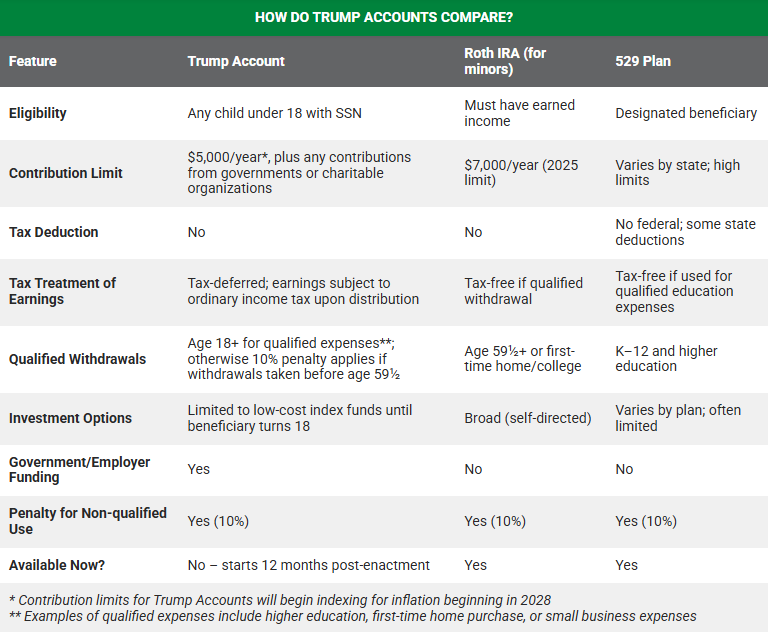

In terms of contribution limits, Trump Accounts allow annual payments of up to $5,000, while Traditional and Roth IRAs offer a slightly higher limit, with set contribution limits at $7,000 in 2025 for people under 50.

Taxation is another major point of divergence. Deposits into a Trump Account are not tax-deductible, just as in a Roth IRA.

On the other hand, contributions to a Traditional IRA can, under certain conditions, be tax-deductible, making it an attractive instrument for taxpayers wishing to reduce their taxable income in the short term.

Post Comment