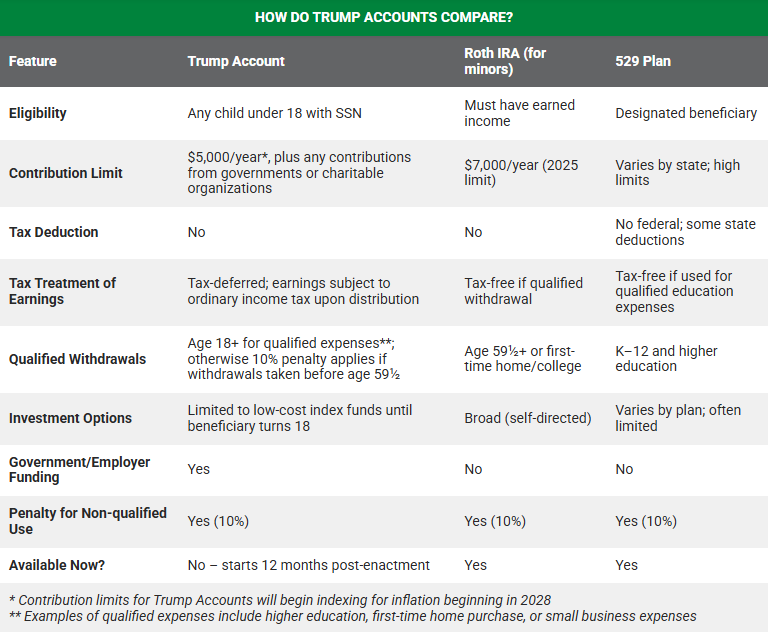

Why Trump Accounts Could Completely Upset the Retirement Game—And What It Means for Your IRA Savings.

The Roth IRA is more flexible, allowing contributions (but not earnings) to be withdrawn tax- and penalty-free at any time, providing useful leeway in case of unforeseen need.

In short, while Individual Retirement Accounts (IRAs), and particularly the Roth IRA, retain a clear tax advantage for retirement planning, Trump Accounts are attractive for their early accessibility and apparent simplicity.

However, the taxation of exit gains remains a potential brake, limiting their competitiveness with existing retirement savings products.

Post Comment